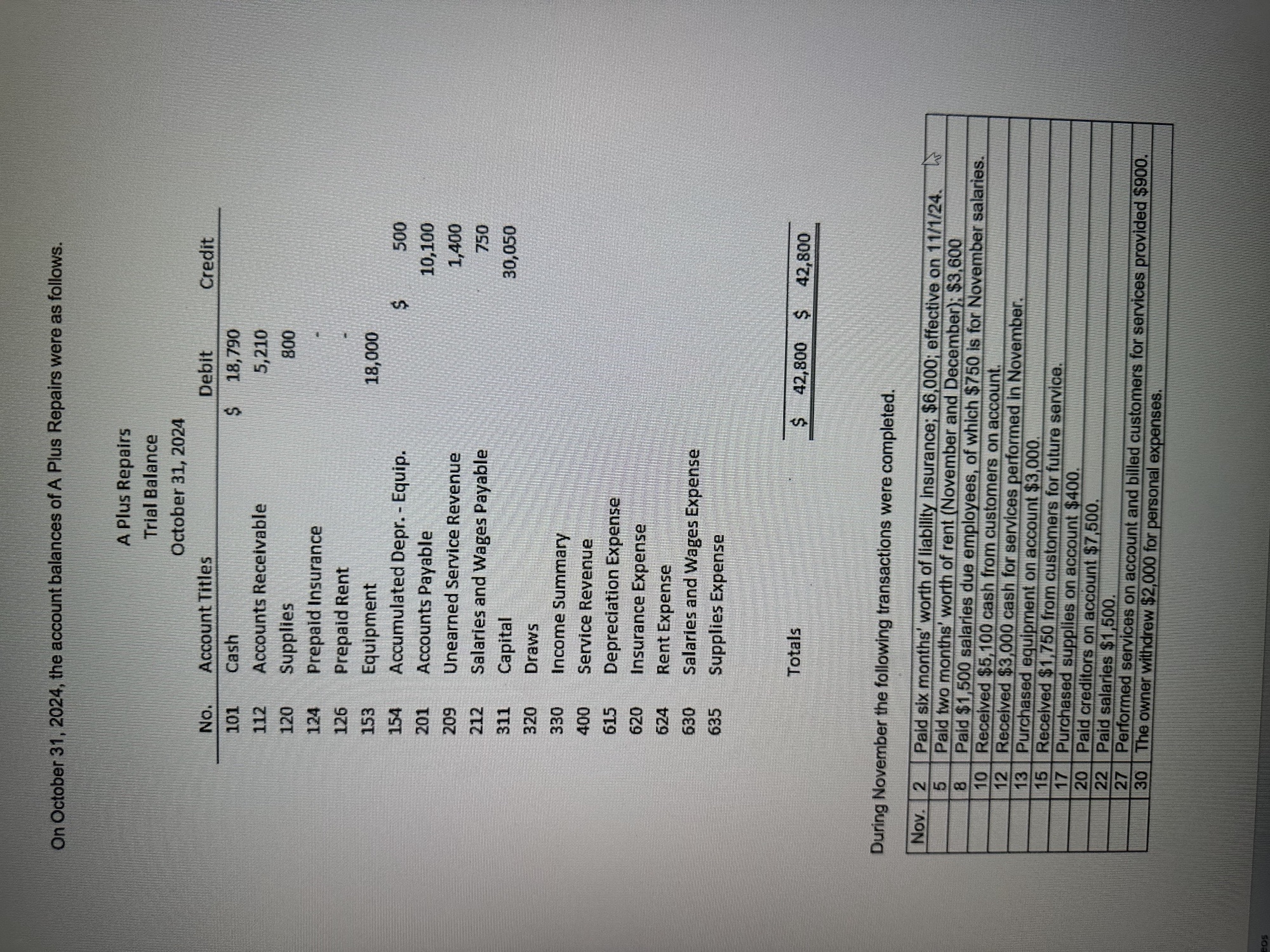

Question: In this assignment, you will complete the accounting cycle for A Plus Repairs, a service company. You will enter the beginning balances in the general

In this assignment, you will complete the accounting cycle for A Plus Repairs, a service company.

You will

enter the beginning balances in the general ledger;

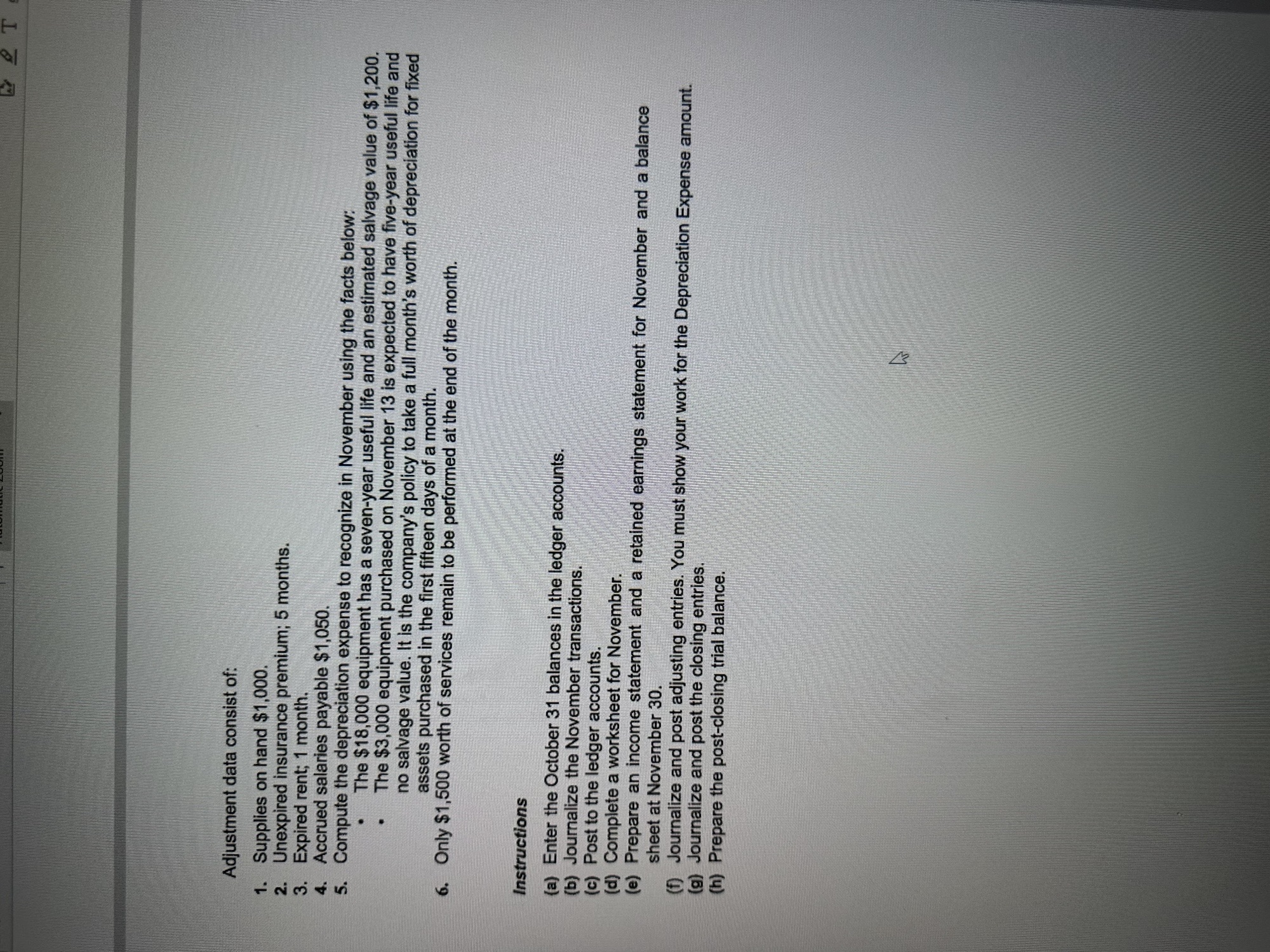

prepare in proper form journal entries for November;

post the entries to the general ledger; complete the worksheet; prepare the financial statements;

journalize and post the adjusting entries;

journalize and post the closing entries; and

prepare a post-closing trial balance.

Submission Requirements

Except for the general ledger and the worksheet, the work must be handwritten.

All work must be legible, neat, and in good form.

Use the working papers provided.

When you download the General Ledger Excel workbook, save it as [YourLastName]-APR-Ledger, e.g. Smith-APR-Ledger.

When you download the Worksheet Excel workbook, save it as [YourLastName]-APR-Worksheet.

If you do not want to use the General Ledger and the Worksheet Excel workbooks, print the PDF versions and complete them by hand. If you run out of room in the general ledger, print the page the account is on; show the balance carried forward; and continue posting.Note

Include an explanation for each journal entry and posting (i.e., do not leave the ledger's Explanation fields blank).

You may use the following abbreviations on the journal and only on the journal.

Accounts Receivable: A/Receivable

accumulated Depreciation: Accum. Depr.

Accounts Payable: A/Payable

Salaries and Wages Payable: S&W Payable

Unearned Service Revenue: Unearned Revenue Salaries and Wages Expense: S&W Expense

Balance Sheet: use the report format (i.e., place the Assets section above the Liabilities and Owner's Equity section).Narrative and Chart of Accounts

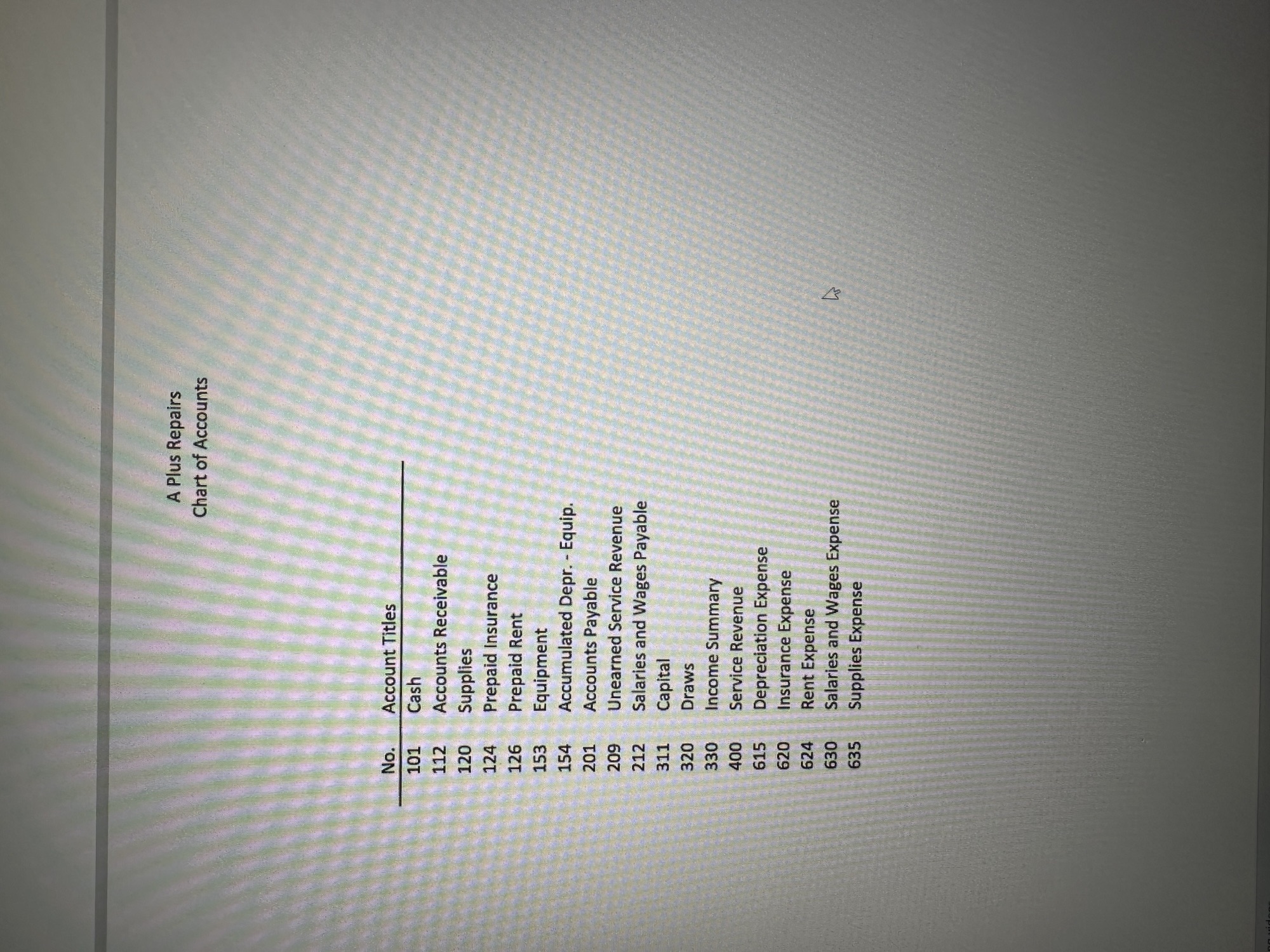

SU2025_A Plus Repairs.pdf

Download SU2025_A Plus Repairs.pdf

BUSAD310_A Plus Repairs_Chart of Accounts.pdf

Download BUSAD310_A Plus Repairs_Chart of Accounts.pdf

General Ledger

Use either the Excel workbook or the PDF file below.

The ledger is slightly different from the ones you worked with in the past. There is only one Balance column.

In a manual system, if an account balance is normal - be it a debit or a credit- enter it as a positive number. In this example, in the "one-column-balance ledger" you would enter both the Cash and the Accounts Payable balances as positive numbers even though Cash has a debit balance (which is the normal balance for an asset account) and Accounts Payable has a credit balance (which is the normal balance for a liability account).

If, as you post, you end up with an abnormal balance, enter it in brackets or red.

Remember to question abnormal balances. Often, they are an indication that a journal entry is incorrect or that the posting is off.

A Plus Repairs_General Ledger_Blank.xlsx

Download A Plus Repairs_General Ledger_Blank.xlsx

BUSAD310_A Plus Repairs_General Ledger_Blank.pdf

Download BUSAD310_A Plus Repairs_General Ledger_Blank.pdf

Worksheet

If you do not want to use the Excel workbook, print the content of the tab and complete by hand. Make sure that what you submit is legible.

A Plus Repairs_Work Sheet.xlsx

Download A Plus Repairs_Work Sheet.

Other Working Papers

Journal Pages

Download Journal Pages

Sheets-Lined Paper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts