Question: In this assignment you will first complete the problem by hand ( part A ) and then automate the work ( Part B ) on

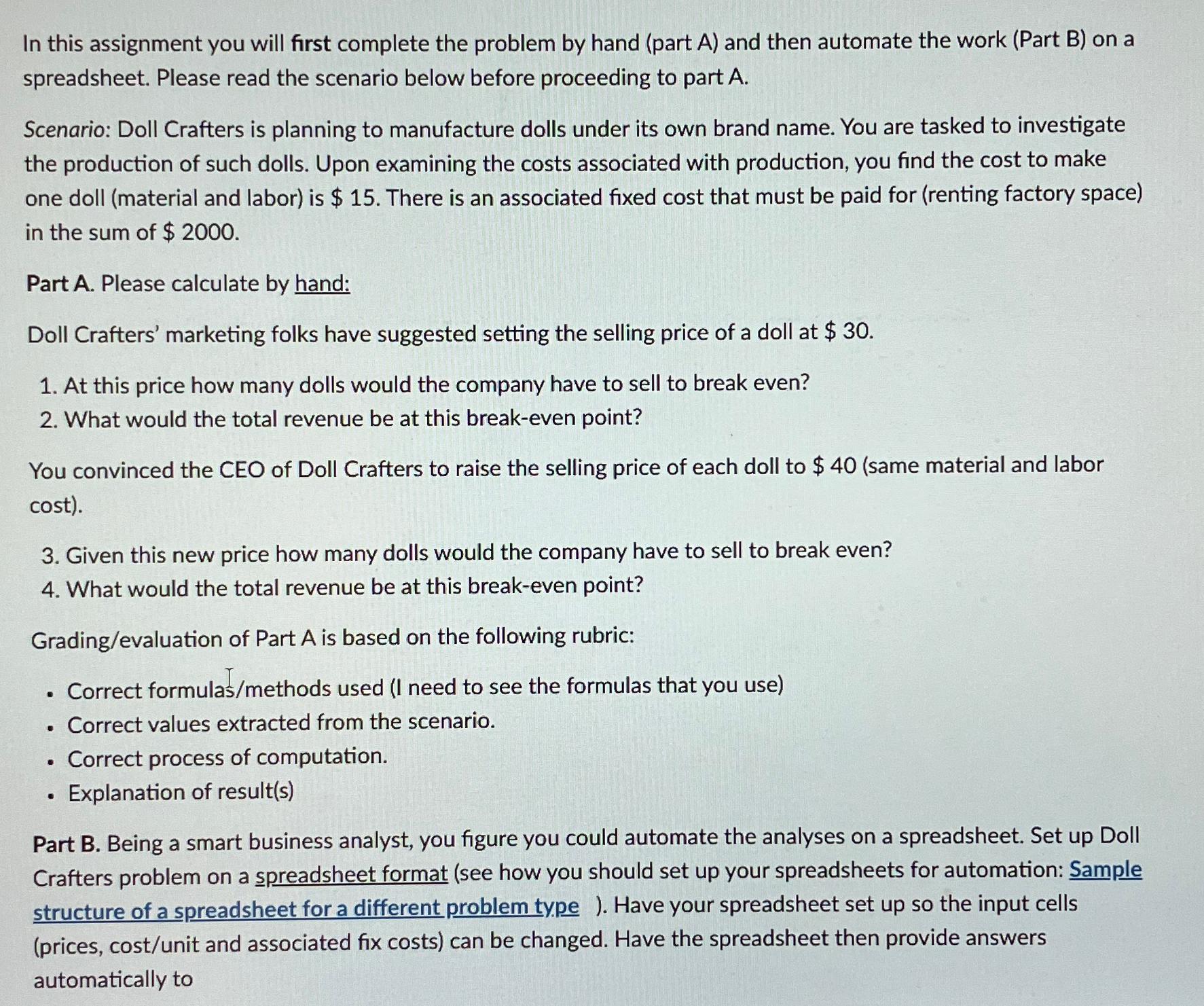

In this assignment you will first complete the problem by hand part A and then automate the work Part B on a spreadsheet. Please read the scenario below before proceeding to part

Scenario: Doll Crafters is planning to manufacture dolls under its own brand name. You are tasked to investigate the production of such dolls. Upon examining the costs associated with production, you find the cost to make one doll material and labor is $ There is an associated fixed cost that must be paid for renting factory space in the sum of $

Part A Please calculate by hand:

Doll Crafters' marketing folks have suggested setting the selling price of a doll at $

At this price how many dolls would the company have to sell to break even?

What would the total revenue be at this breakeven point?

You convinced the CEO of Doll Crafters to raise the selling price of each doll to $same material and labor cost

Given this new price how many dolls would the company have to sell to break even?

What would the total revenue be at this breakeven point?

Gradingevaluation of Part is based on the following rubric:

Correct formulasmethods used I need to see the formulas that you use

Correct values extracted from the scenario.

Correct process of computation.

Explanation of results

Part B Being a smart business analyst, you figure you could automate the analyses on a spreadsheet. Set up Doll Crafters problem on a spreadsheet format see how you should set up your spreadsheets for automation: Sample structure of a spreadsheet for a different problem type Have your spreadsheet set up so the input cells prices costunit and associated fix costs can be changed. Have the spreadsheet then provide answers automatically to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock