Question: In this casc, you will use the CAPM model and comparable firms to estimate the weighted average cost of capital ( WACC ) for a

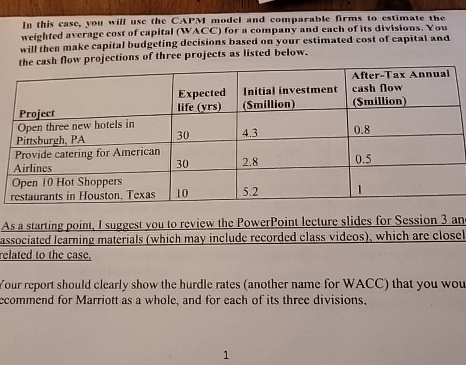

In this casc, you will use the CAPM model and comparable firms to estimate the weighted average cost of capital WACC for a company and each of its divisions. You will then make capital budgeting decisions based on your estimated cost of capital and the cash flow projections of three projects as listed below.

tabletableExpectedlife yrstableInitial investmentSmilliontableAfterTax Annualcash flowSmilliontableOpeject three new hotels inPittsburgh PAtableProvide catering for AmericanAirlinestableOpen Hot Shoppersrestaurants in Houston. Texas

As a starting point. I suggest vou to review the PowerPoint lecture slides for Session an associated learning materials which may include recorded class videos which are closel related to the case,

Cour report should clearly show the hurdle rates another name for WACC that you wou ecommend for Marriott as a whole, and for each of its three divisions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock