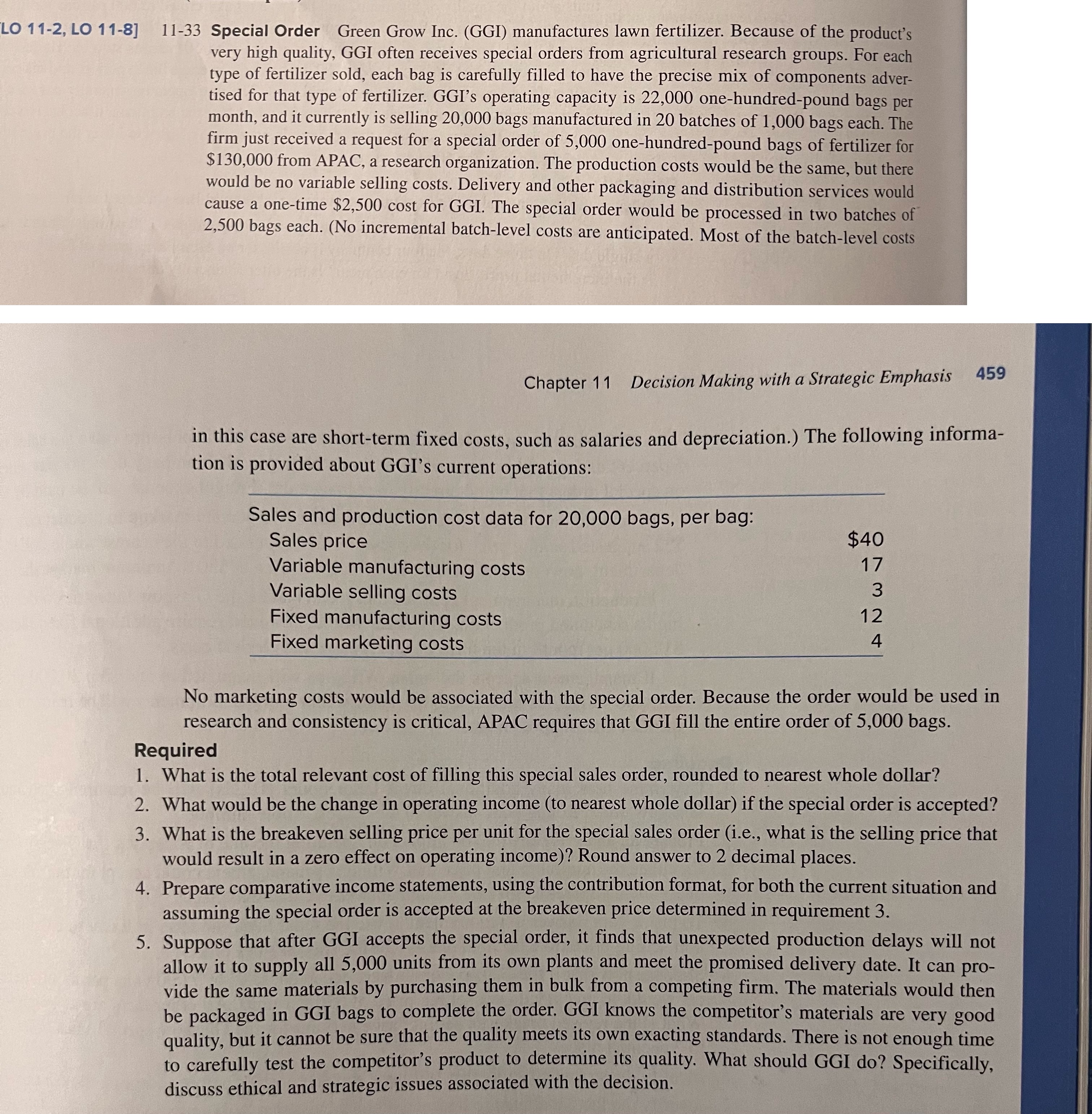

Question: in this case are short - term fixed costs, such as salaries and depreciation. ) The following informa - tion is provided about GGI's current

in this case are shortterm fixed costs, such as salaries and depreciation. The following informa

tion is provided about GGI's current operations:

No marketing costs would be associated with the special order. Because the order would be used in

research and consistency is critical, APAC requires that GGI fill the entire order of bags.

Required

What is the total relevant cost of filling this special sales order, rounded to nearest whole dollar?

What would be the change in operating income to nearest whole dollar if the special order is accepted?

What is the breakeven selling price per unit for the special sales order ie what is the selling price that

would result in a zero effect on operating income Round answer to decimal places.

Prepare comparative income statements, using the contribution format, for both the current situation and

assuming the special order is accepted at the breakeven price determined in requirement

Suppose that after GGI accepts the special order, it finds that unexpected production delays will not

allow it to supply all units from its own plants and meet the promised delivery date. It can pro

vide the same materials by purchasing them in bulk from a competing firm. The materials would then

be packaged in GGI bags to complete the order. GGI knows the competitor's materials are very good

quality, but it cannot be sure that the quality meets its own exacting standards. There is not enough time

to carefully test the competitor's product to determine its quality. What should GGI do Specifically,

discuss ethical and strategic issues associated with the decision.

Here is the informatin to ansawer for LO question. Thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock