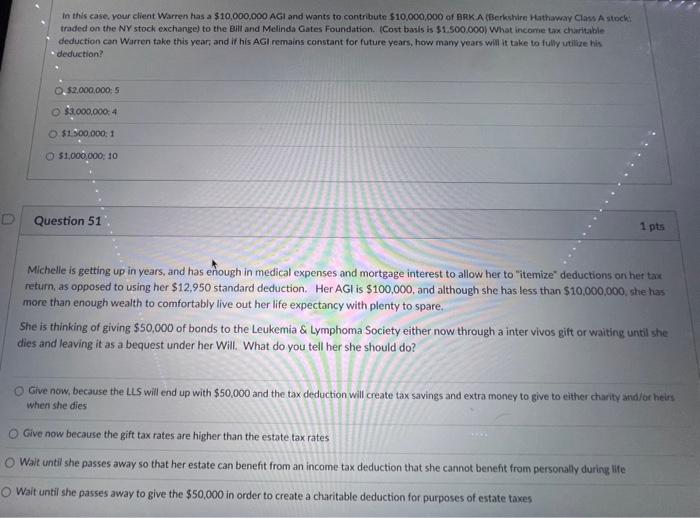

Question: In this case your client Warren has a $10,000.000 AGI and wants to contribute $10.000,000 of BRK A CBerkchire Hathaway Class A stoch: Inaded on

In this case your client Warren has a $10,000.000 AGI and wants to contribute $10.000,000 of BRK A CBerkchire Hathaway Class A stoch: Inaded on the NY stack exchange) to the Bill and Melinda Gates Foundation. (Cost basis is $1.500,000) What income Lax charitable deduction can Warren take this year, and if his AGI remains constant for future years, how many years will it take to fully utilize his - deduction? 52,000,000:5 $3,000,0004 $1,500.000:1 51,000,000:10 Question 51 Michelle is getting up in years, and has enough in medical expenses and mortgage interest to allow her to "itemize" deductions on her tak retum, as opposed to using her $12,950 standard deduction. Her AGt is $100,000, and although she has less than $10,000,000, she has more than enough wealth to comfortably live out her life expectancy with plenty to spare. She is thinking of giving $50,000 of bonds to the Leukemia \& Lymphoma Society either now through a inter vivos gift or waiting until she dies and leaving it as a bequest under her Will. What do you tell her she should do? Give now, because the LLS will end up with $50,000 and the tax deduction will create tax savings and extra money to give to either charity and/or heirs when she dies Give now because the gift tax rates are higher than the estate tax rates Wait untii she passes away so that her estate can benefit from an income tax deduction that she cannot benefit from personally during ilife Wait until she passes away to give the $50,000 in order to create a charitable deduction for purposes of estate taxes In this case your client Warren has a $10,000.000 AGI and wants to contribute $10.000,000 of BRK A CBerkchire Hathaway Class A stoch: Inaded on the NY stack exchange) to the Bill and Melinda Gates Foundation. (Cost basis is $1.500,000) What income Lax charitable deduction can Warren take this year, and if his AGI remains constant for future years, how many years will it take to fully utilize his - deduction? 52,000,000:5 $3,000,0004 $1,500.000:1 51,000,000:10 Question 51 Michelle is getting up in years, and has enough in medical expenses and mortgage interest to allow her to "itemize" deductions on her tak retum, as opposed to using her $12,950 standard deduction. Her AGt is $100,000, and although she has less than $10,000,000, she has more than enough wealth to comfortably live out her life expectancy with plenty to spare. She is thinking of giving $50,000 of bonds to the Leukemia \& Lymphoma Society either now through a inter vivos gift or waiting until she dies and leaving it as a bequest under her Will. What do you tell her she should do? Give now, because the LLS will end up with $50,000 and the tax deduction will create tax savings and extra money to give to either charity and/or heirs when she dies Give now because the gift tax rates are higher than the estate tax rates Wait untii she passes away so that her estate can benefit from an income tax deduction that she cannot benefit from personally during ilife Wait until she passes away to give the $50,000 in order to create a charitable deduction for purposes of estate taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts