Question: In this chapter, we discussed the DuPont model. Using that framework, find the missing amount in each case below. ROE is 12 percent, net earnings

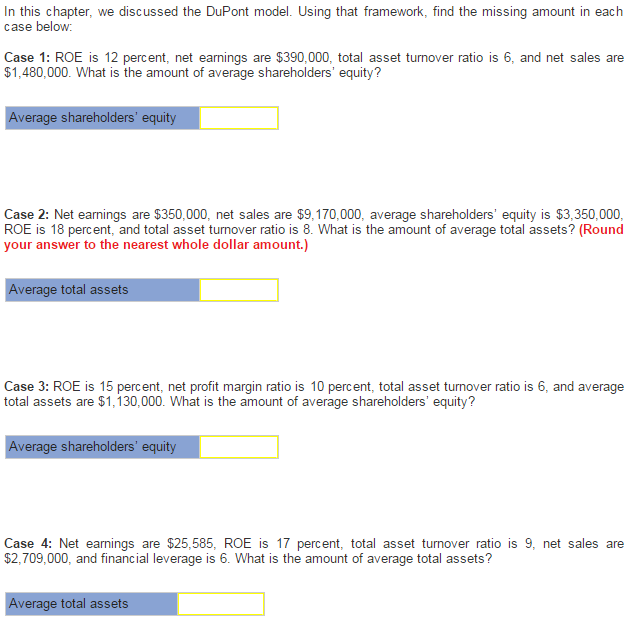

In this chapter, we discussed the DuPont model. Using that framework, find the missing amount in each case below. ROE is 12 percent, net earnings are $390,000, total asset turnover ratio is 6, and net sales are $1, 480,000. What is the amount of average shareholders' equity? Net earnings are $350,000, net sales are $9, 170,000, average shareholders' equity is $3, 350,000, ROE is 18 percent, and total asset turnover ratio is 8. What is the amount of average total assets? (Round your answer to the nearest whole dollar amount.) ROE is 15 percent, net profit margin ratio is 10 percent, total asset turnover ratio is 6, and average total assets are $1, 130,000. What is the amount of average shareholders' equity? Net earnings are $25, 585, ROE is 17 percent, total asset turnover ratio is 9, net sales are $2, 709,000, and financial leverage is 6. What is the amount of average total assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts