Question: In this discussion assignment you will create an Amortization Schedule for a potential loan. You will research buying a home or a car, answer the

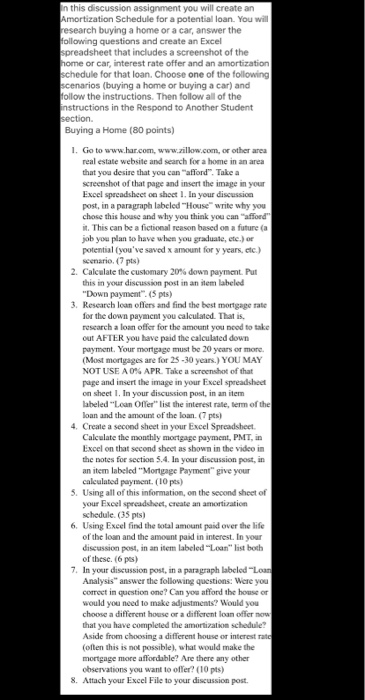

In this discussion assignment you will create an Amortization Schedule for a potential loan. You will research buying a home or a car, answer the Hollowing questions and create an Excel spreadsheet that includes a screenshot of the home or car, interest rate offer and an amortization schedule for that loan. Choose one of the following scenarios (buying a home or buying a car) and follow the instructions. Then follow all of the instructions in the Respond to Another Student section. Buying a Home (80 points) 1. Go to www.har.com, www.zillow.com, or other area real estate website and search for a home in an area that you desire that you can afford". Take a screenshot of that page and insert the image in your Excel spreadsheet on sheet 1. In your discussion post, in a paragraph labeled Hosse" write why you chose this house and why you think you can afford" it. This can be a fictional reason based on a future (a job you plan to have when you graduate, etc.) or potential (you've saved x amount for y years, etc.) scenario, (7 pts) 2. Calculate the customary 20% down payment. Put this in your discussion post in an item labeled "Down payment. (5 pts) 3. Research loan offers and find the best mortgage rate for the down payment you calculated. That is research a loan offer for the amount you need to take out AFTER you have paid the calculated down payment. Your mortgage must be 20 years or more (Most mortgages are for 25-30 years.) YOU MAY NOT USE A 0% APR. Take a screenshot of that page and insert the image in your Excel spreadsheet on sheet 1. In your discussion post, in an item labeled "Loon Offer" list the interest rate, term of the loan and the amount of the loan. (7 pts) 4. Create a second sheet in your Excel Spreadsheet Calculate the monthly mortgage payment, PMT, in Excel on that second sheet as shown in the video in the notes for section 5.4. In your discussion post, in an item labeled "Mortgage Payment" give your caleulated payment. (10 pts) 5. Using all of this information, on the second sheet of your Excel spreadsheet, create an amortization schedule. (35 pts) 6. Using Excel find the total amount paid over the life of the loan and the amount paid in interest. In your discussion post, in an item labeled "Loan" list both of these. (6 pts) 7. In your discussion post, in a paragraph labeled "Loan Analysis answer the following questions: Were you correct in question ono? Can you afford the house or would you need to make adjustments? Would you choose a different house or a different loan offer now that you have completed the amortization schedule Aside from choosing a different house or interest rate (often this is not possible), what would make the mortgage more affordable? Are there any other observations you want to offer? (10 pts) 8. Attach your Excel File to your discussion post. In this discussion assignment you will create an Amortization Schedule for a potential loan. You will research buying a home or a car, answer the Hollowing questions and create an Excel spreadsheet that includes a screenshot of the home or car, interest rate offer and an amortization schedule for that loan. Choose one of the following scenarios (buying a home or buying a car) and follow the instructions. Then follow all of the instructions in the Respond to Another Student section. Buying a Home (80 points) 1. Go to www.har.com, www.zillow.com, or other area real estate website and search for a home in an area that you desire that you can afford". Take a screenshot of that page and insert the image in your Excel spreadsheet on sheet 1. In your discussion post, in a paragraph labeled Hosse" write why you chose this house and why you think you can afford" it. This can be a fictional reason based on a future (a job you plan to have when you graduate, etc.) or potential (you've saved x amount for y years, etc.) scenario, (7 pts) 2. Calculate the customary 20% down payment. Put this in your discussion post in an item labeled "Down payment. (5 pts) 3. Research loan offers and find the best mortgage rate for the down payment you calculated. That is research a loan offer for the amount you need to take out AFTER you have paid the calculated down payment. Your mortgage must be 20 years or more (Most mortgages are for 25-30 years.) YOU MAY NOT USE A 0% APR. Take a screenshot of that page and insert the image in your Excel spreadsheet on sheet 1. In your discussion post, in an item labeled "Loon Offer" list the interest rate, term of the loan and the amount of the loan. (7 pts) 4. Create a second sheet in your Excel Spreadsheet Calculate the monthly mortgage payment, PMT, in Excel on that second sheet as shown in the video in the notes for section 5.4. In your discussion post, in an item labeled "Mortgage Payment" give your caleulated payment. (10 pts) 5. Using all of this information, on the second sheet of your Excel spreadsheet, create an amortization schedule. (35 pts) 6. Using Excel find the total amount paid over the life of the loan and the amount paid in interest. In your discussion post, in an item labeled "Loan" list both of these. (6 pts) 7. In your discussion post, in a paragraph labeled "Loan Analysis answer the following questions: Were you correct in question ono? Can you afford the house or would you need to make adjustments? Would you choose a different house or a different loan offer now that you have completed the amortization schedule Aside from choosing a different house or interest rate (often this is not possible), what would make the mortgage more affordable? Are there any other observations you want to offer? (10 pts) 8. Attach your Excel File to your discussion post

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts