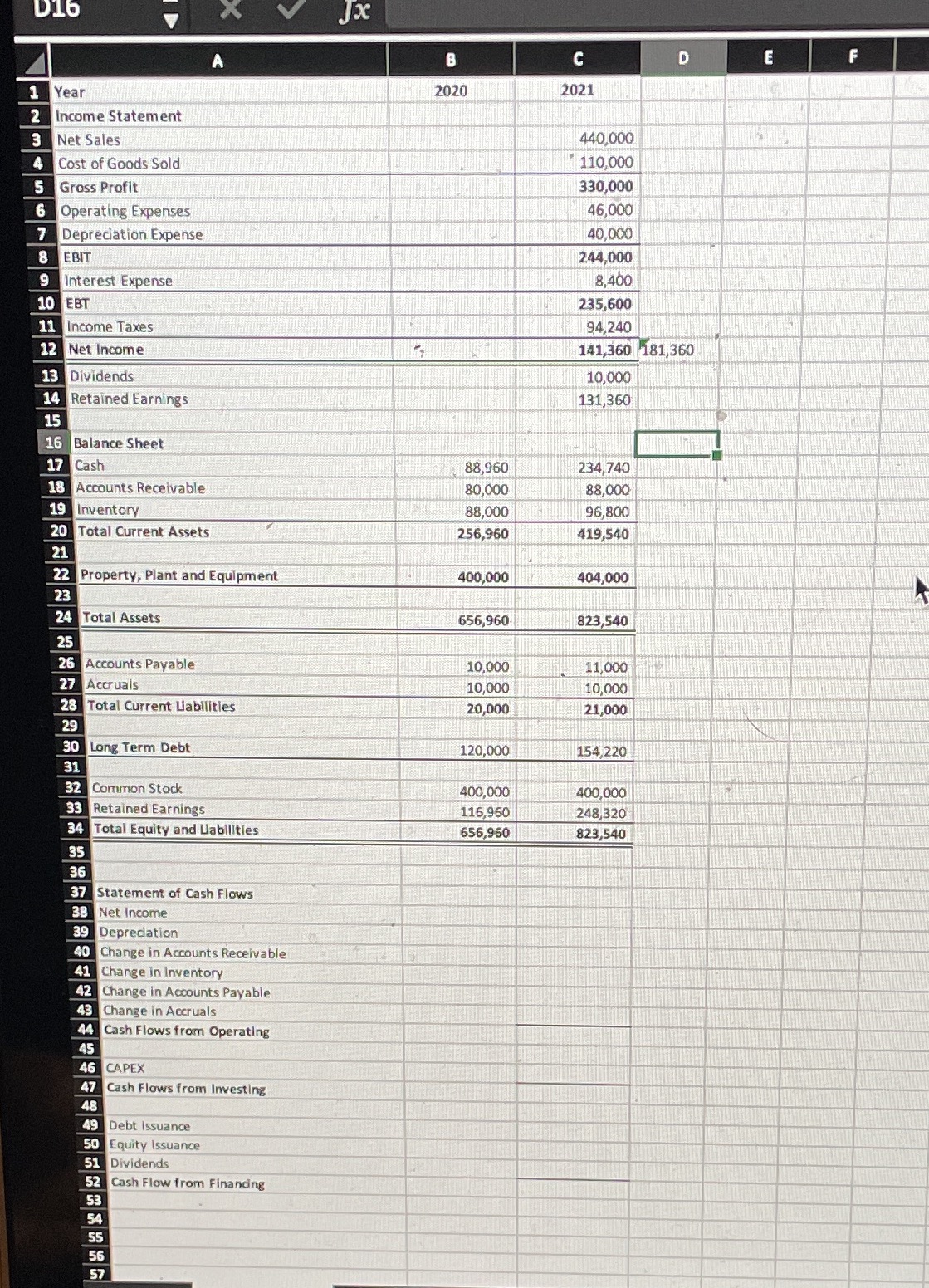

Question: In this exercise we will practice how to build the Statement of Cash Flows for the fiscal year end 2021. As discussed in the lecture,

In this exercise we will practice how to build the Statement of Cash Flows for the fiscal year end 2021. As discussed in the lecture, the Statement of Cash Flows can be built using information from the Income Statement and the Balance Sheet (we need the Balance Sheets of both 2020 and 2021 to calculate the changes). Here is step-by-step instruction on how to do it. First download the file below1. Cash flow from operating Step 1: Always start with net income from the income statement Step 2: Add back any non-cash item (which is depreciation expense)Step 3: Adjust for any changes in Current Assets and Current Liabilities item. Remember we need to consider the changes so you need to take the difference between the balance in 2020 and 2021. ? Any increase in asset item is a cash outflow - negative sign? Any decrease in asset item is cash inflow - positive sign? Any increase in liability item is cash inflow - positive sign?any decrease in liability item is a cash outflow - negative signCash flows from operating = sum of all items above. 2. Cash Flow from InvestingCash flow from investing solely comes from capital expenditure which is the change in Plant, Property and Equipment (PPE). Any increase in PPE means the firm bought some fixed assets > cash outflow > CAPEX has negative sign. Any decrease in PPE means the firm sold some fixed assets > cash inflow > CAPEX has positive sign. 3. Cash Flow from FinancingStep 1: debt issuance is the change in long term debt Step 2: stock issuance is the change in common stockKeep in mind that long term debt and common stock are both liability items, please advise the sign rule above to assign the correct sign for your calculation. Step 3: dividends come from the income statement. dividends are cash outflow (the company is paying their stockholders). Cash Flow from Financing = sun of all items above.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts