Question: In this exercise, you will compute average daily return and standard deviation measures for two different portfolios. You will use the historical price data that

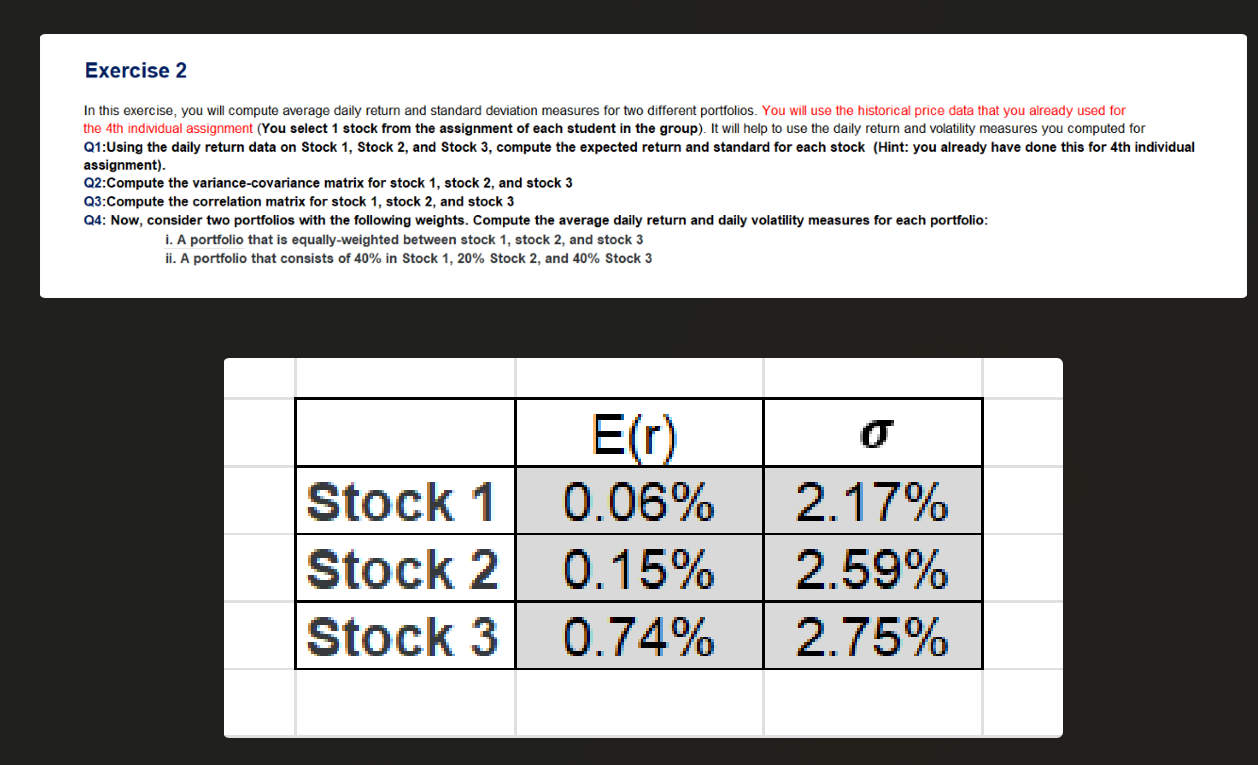

In this exercise, you will compute average daily return and standard deviation measures for two different portfolios. You will use the historical price data that you already used for the 4th individual assignment (You select 1 stock from the assignment of each student in the group). It will help to use the daily return and volatility measures you computed for Q1:Using the daily return data on Stock 1, Stock 2, and Stock 3, compute the expected return and standard for each stock (Hint: you already have done this for 4th individual assignment). Q2:Compute the variance-covariance matrix for stock 1, stock 2, and stock 3 Q3:Compute the correlation matrix for stock 1 , stock 2, and stock 3 Q4: Now, consider two portfolios with the following weights. Compute the average daily return and daily volatility measures for each portfolio: i. A portfolio that is equally-weighted between stock 1 , stock 2 , and stock 3 ii. A portfolio that consists of 40% in Stock 1,20% Stock 2 , and 40% Stock 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts