Question: In this exercise you will generate the envelope and efficient frontier for your two share portfolio. The expected portfolio return and portfolio variance calculated in

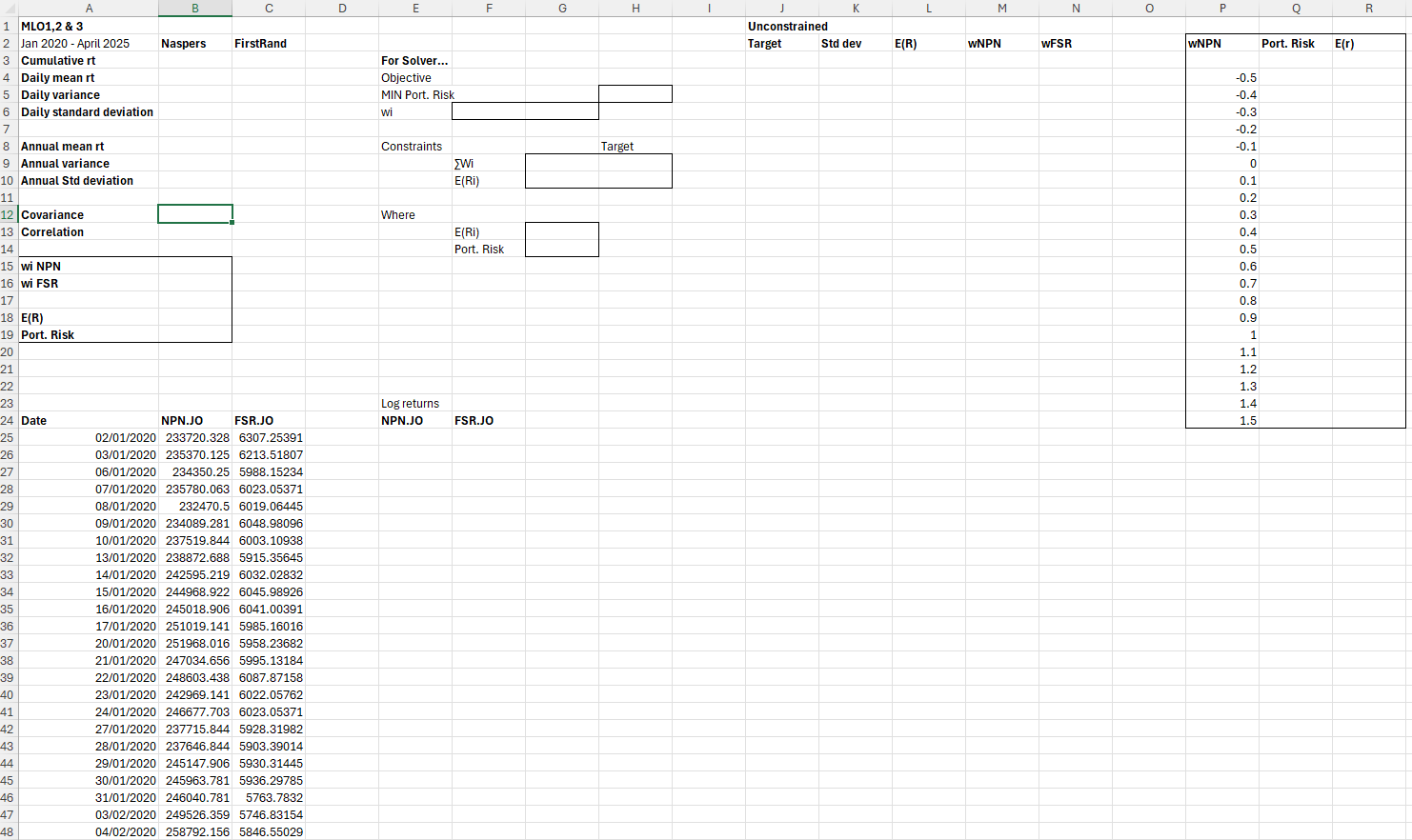

In this exercise you will generate the envelope and efficient frontier for your two share portfolio. The expected portfolio return and portfolio variance calculated in exercise 2, will be used as inputs for Solver to determine the lowest risk for a given level of return. The optimisation will have the following constraints. Portfolio weights must sum to 1 (short positions in either share are allowed) and each optimisation must be subjected to a prespecified return target. To trace the entire envelope and efficient frontier, you will need to input the objectives and constraints into Solver and run the optimisation for each level of portfolio return target. You must also be able to identify the weights in each share for every optimisation. The alternative method to Solver is Excel's What-If data table function. Set up a column of potential weights for share one and two more columns for the portfolio risk and portfolio return. Create a chart of the portfolio risk and return output.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts