Question: In this Exercise, you will validate the US 10 year bond valuation using discount cash flow methodology.T he annual coupon rate is 2.25% and the

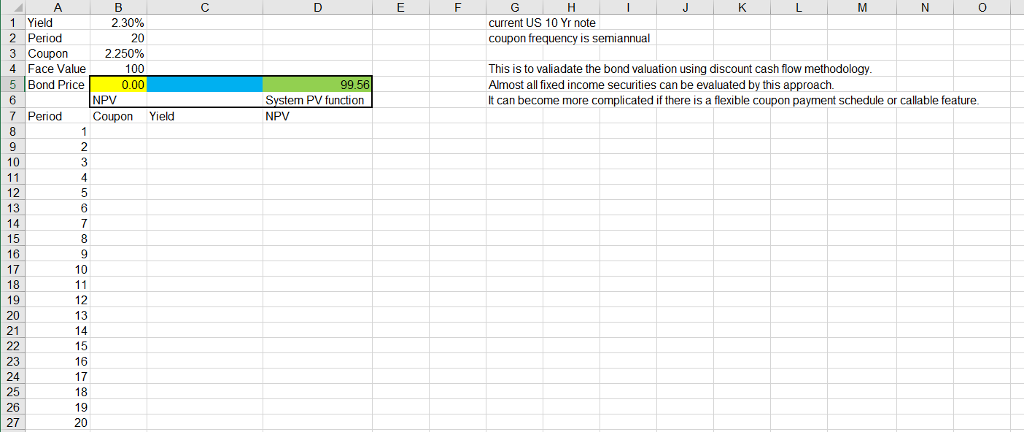

In this Exercise, you will validate the US 10 year bond valuation using discount cash flow methodology.The annual coupon rate is 2.25% and the coupon frequency is semiannual. The yield is 2.3%. Construct the discounted cash flow tables by filling Coupon,Yield, and NPV for Period 1 through 20. Your bond price for face value 100 in the yellow cell should match the system PV function in green cell.

0 current US 10 Yr note coupon frequency is semiannual 1 Yield 2 Period 3 Coupon 4 Face Value 5 Bond Price 2.30% 20 2.250% 100 0.00 This is to valiadate the bond valuation using discount cash flow methodology. Almost all fixed income securities can be evaluated by this approach. It can become more complicated if there is a flexible coupon payment schedule or callable feature Svstem PV function NPV NPV 7 Period Coupon Yield 10 12 14 15 16 10 18 19 12 13 21 23 24 25 15 16 17 18 19 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts