Question: In this mini case, the question being asked to find out the NPV of this project. Can you please find the NPV of the project

In this mini case, the question being asked to find out the NPV of this project. Can you please find the NPV of the project using an excel sheet and show in details the calculations that you do using the excel? If you are not using excel then any other ways you can apply to solve this, but please explain in detail with all the calculations so that would help me to understand.

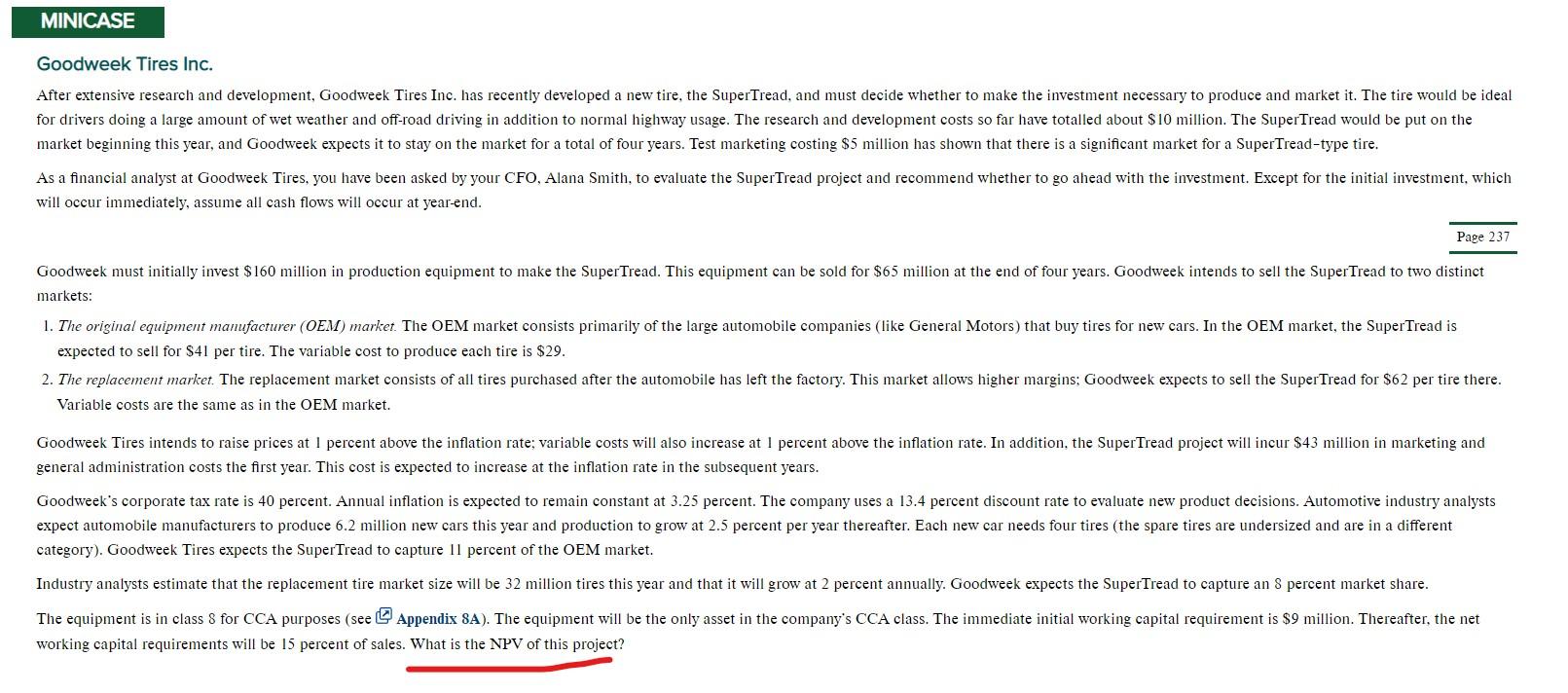

Goodweek Tires Inc. After extensive research and development, Goodweek Tires Inc. has recently developed a new tire, the SuperTread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal highway usage. The research and development costs so far have totalled about $10 million. The SuperTread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5 million has shown that there is a significant market for a SuperTread-type tire. As a financial analyst at Goodweek Tires, you have been asked by your CFO, Alana Smith, to evaluate the SuperTread project and recommend whether to go ahead with the investment. Except for the initial investment, which will occur immediately, assume all cash flows will occur at year-end. markets: expected to sell for $41 per tire. The variable cost to produce each tire is $29. Variable costs are the same as in the OEM market. general administration costs the first year. This cost is expected to increase at the inflation rate in the subsequent years. category). Goodweek Tires expects the SuperTread to capture 11 percent of the OEM market. working capital requirements will be 15 percent of sales. What is the NPV of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts