Question: in this model, the Terminal Value (cell G49) and the Discounted Value (cell B52) are both calculated using a Weighted Average Cost of Capital

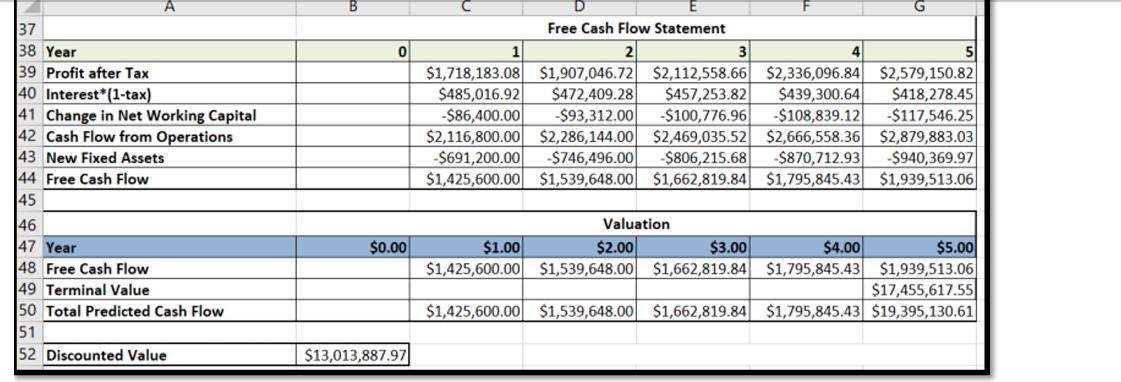

in this model, the Terminal Value (cell G49) and the Discounted Value (cell B52) are both calculated using a Weighted Average Cost of Capital of 20%. IFthe Weighted Average Cost of Capital is increased above 20%, what would happen to the size of: The Terminal Value? The Discounted Value? 37 38 Year 39 Profit after Tax 40 Interest*(1-tax) 41 Change in Net Working Capital 42 Cash Flow from Operations 43 New Fixed Assets 44 Free Cash Flow 45 46 47 Year 48 Free Cash Flow 49 Terminal Value 50 Total Predicted Cash Flow 51 52 Discounted Value 0 $0.00 $13,013,887.97 Free Cash Flow Statement 2 3 $1,425,600.00 4 $439,300.64 $1,718,183.08 $1,907,046.72 $2,112,558.66 $2,336,096.84 $2,579,150.82 $485,016.92 $472,409.28 $457,253.82 $418,278.45 -$86,400.00 -$93,312.00 -$100,776.96 -$108,839.12 -$117,546.25 $2,116,800.00 $2,286,144.00 $2,469,035.52 $2,666,558.36 $2,879,883.03 -$691,200.00 -$746,496.00 -$806,215.68 -$870,712.93 -$940,369.97 $1,425,600.00 $1,539,648.00 $1,662,819.84 $1,795,845.43 $1,939,513.06 Valuation $2.00 $1.00 $3.00 $1,425,600.00 $1,539,648.00 $1,662,819.84 $1,795,845.43 5 $4.00 $5.00 $1,939,513.06 $17,455,617.55 $1,539,648.00 $1,662,819.84 $1,795,845.43 $19,395,130.61

Step by Step Solution

There are 3 Steps involved in it

As the discount rate increases The terminal value decreases bec... View full answer

Get step-by-step solutions from verified subject matter experts