Question: In this problem 1 year is equivalent to 360 days. Lumberton is a mid-sized town that was built along a rail line. It flourished in

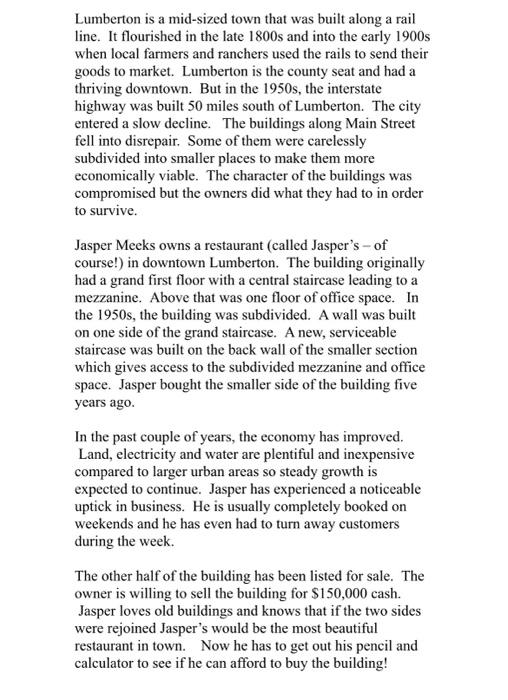

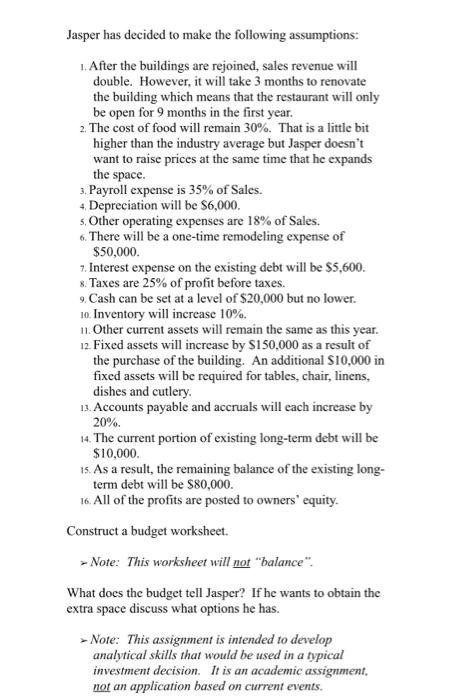

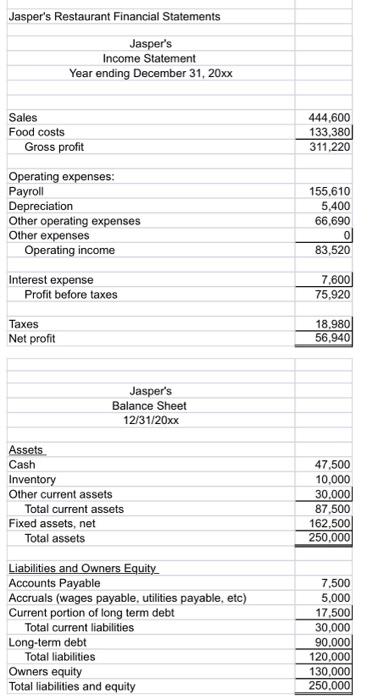

Lumberton is a mid-sized town that was built along a rail line. It flourished in the late 1800s and into the early 1900s when local farmers and ranchers used the rails to send their goods to market. Lumberton is the county seat and had a thriving downtown. But in the 1950s, the interstate highway was built 50 miles south of Lumberton. The city entered a slow decline. The buildings along Main Street fell into disrepair. Some of them were carelessly subdivided into smaller places to make them more economically viable. The character of the buildings was compromised but the owners did what they had to in order to survive. Jasper Meeks owns a restaurant (called Jasper's - of course!) in downtown Lumberton. The building originally had a grand first floor with a central staircase leading to a mezzanine. Above that was one floor of office space. In the 1950s, the building was subdivided. A wall was built on one side of the grand staircase. A new, serviceable staircase was built on the back wall of the smaller section which gives access to the subdivided mezzanine and office space. Jasper bought the smaller side of the building five years ago In the past couple of years, the economy has improved. Land, electricity and water are plentiful and inexpensive compared to larger urban areas so steady growth is expected to continue. Jasper has experienced a noticeable uptick in business. He is usually completely booked on weekends and he has even had to turn away customers during the week. The other half of the building has been listed for sale. The owner is willing to sell the building for $150,000 cash. Jasper loves old buildings and knows that if the two sides were rejoined Jasper's would be the most beautiful restaurant in town. Now he has to get out his pencil and calculator to see if he can afford to buy the building! Jasper has decided to make the following assumptions: After the buildings are rejoined, sales revenue will double. However, it will take 3 months to renovate the building which means that the restaurant will only be open for 9 months in the first year. 2. The cost of food will remain 30%. That is a little bit higher than the industry average but Jasper doesn't want to raise prices at the same time that he expands the space 3. Payroll expense is 35% of Sales. 4 Depreciation will be $6,000. s. Other operating expenses are 18% of Sales. 6. There will be a one-time remodeling expense of $50,000. 7. Interest expense on the existing debt will be $5,600. 8. Taxes are 25% of profit before taxes. 9 Cash can be set at a level of $20,000 but no lower. 10 Inventory will increase 10%. 11. Other current assets will remain the same as this year. 12 Fixed assets will increase by S150,000 as a result of the purchase of the building. An additional $10,000 in fixed assets will be required for tables, chair, linens, dishes and cutlery. 13. Accounts payable and accruals will each increase by 20%. 14. The current portion of existing long-term debt will be $10,000. 15. As a result, the remaining balance of the existing long- term debt will be $80,000. 16. All of the profits are posted to owners' equity. Construct a budget worksheet. Note: This worksheet will not "balance". What does the budget tell Jasper? If he wants to obtain the extra space discuss what options he has. > Note: This assignment is intended to develop analytical skills that would be used in a typical investment decision. It is an academic assignment, not an application based on current events. Jasper's Restaurant Financial Statements Jasper's Income Statement Year ending December 31, 20xx 444,600 133,380 311,220 Sales Food costs Gross profit Operating expenses: Payroll Depreciation Other operating expenses Other expenses Operating income 155.610 5,400 66,690 0 83,520 Interest expense Profit before taxes 7,600 75,920 Taxes Net profit 18,980 56,940 Jasper's Balance Sheet 12/31/20xx Assets Cash Inventory Other current assets Total current assets Fixed assets, net Total assets 47.500 10,000 30.000 87.500 162,500 250.000 Liabilities and Owners Equity Accounts Payable Accruals (wages payable, utilities payable, etc) Current portion of long term debt Total current liabilities Long-term debt Total liabilities Owners equity Total liabilities and equity 7.500 5.000 17,500 30,000 90.000 120,000 130,000 250.000 Analysis: What does the budget tell Jasper? If he wants to obtain the extra space discuss what options he has. o The narrative accurately describes what the budget tells Jasper. (2 points) If there is a shortage of funds, how much additional cash would Jasper need? If there is an excess of funds, how much additional cash does Jasper have? o If Jasper is short of the required funds, what options does he have? At least two options are presented and described. (4 points) Note: This assignment is intended to develop analytical skills that would be used in a typical investment decision. It is an academic assignment, not an application based on current events. Jasper has his heart set on buying a lovely old building in Lumberton. Can he afford to expand? Let's figure out his budget and make some suggestions. Lumberton is a mid-sized town that was built along a rail line. It flourished in the late 1800s and into the early 1900s when local farmers and ranchers used the rails to send their goods to market. Lumberton is the county seat and had a thriving downtown. But in the 1950s, the interstate highway was built 50 miles south of Lumberton. The city entered a slow decline. The buildings along Main Street fell into disrepair. Some of them were carelessly subdivided into smaller places to make them more economically viable. The character of the buildings was compromised but the owners did what they had to in order to survive. Jasper Meeks owns a restaurant (called Jasper's - of course!) in downtown Lumberton. The building originally had a grand first floor with a central staircase leading to a mezzanine. Above that was one floor of office space. In the 1950s, the building was subdivided. A wall was built on one side of the grand staircase. A new, serviceable staircase was built on the back wall of the smaller section which gives access to the subdivided mezzanine and office space. Jasper bought the smaller side of the building five years ago In the past couple of years, the economy has improved. Land, electricity and water are plentiful and inexpensive compared to larger urban areas so steady growth is expected to continue. Jasper has experienced a noticeable uptick in business. He is usually completely booked on weekends and he has even had to turn away customers during the week. The other half of the building has been listed for sale. The owner is willing to sell the building for $150,000 cash. Jasper loves old buildings and knows that if the two sides were rejoined Jasper's would be the most beautiful restaurant in town. Now he has to get out his pencil and calculator to see if he can afford to buy the building! Jasper has decided to make the following assumptions: After the buildings are rejoined, sales revenue will double. However, it will take 3 months to renovate the building which means that the restaurant will only be open for 9 months in the first year. 2. The cost of food will remain 30%. That is a little bit higher than the industry average but Jasper doesn't want to raise prices at the same time that he expands the space 3. Payroll expense is 35% of Sales. 4 Depreciation will be $6,000. s. Other operating expenses are 18% of Sales. 6. There will be a one-time remodeling expense of $50,000. 7. Interest expense on the existing debt will be $5,600. 8. Taxes are 25% of profit before taxes. 9 Cash can be set at a level of $20,000 but no lower. 10 Inventory will increase 10%. 11. Other current assets will remain the same as this year. 12 Fixed assets will increase by S150,000 as a result of the purchase of the building. An additional $10,000 in fixed assets will be required for tables, chair, linens, dishes and cutlery. 13. Accounts payable and accruals will each increase by 20%. 14. The current portion of existing long-term debt will be $10,000. 15. As a result, the remaining balance of the existing long- term debt will be $80,000. 16. All of the profits are posted to owners' equity. Construct a budget worksheet. Note: This worksheet will not "balance". What does the budget tell Jasper? If he wants to obtain the extra space discuss what options he has. > Note: This assignment is intended to develop analytical skills that would be used in a typical investment decision. It is an academic assignment, not an application based on current events. Jasper's Restaurant Financial Statements Jasper's Income Statement Year ending December 31, 20xx 444,600 133,380 311,220 Sales Food costs Gross profit Operating expenses: Payroll Depreciation Other operating expenses Other expenses Operating income 155.610 5,400 66,690 0 83,520 Interest expense Profit before taxes 7,600 75,920 Taxes Net profit 18,980 56,940 Jasper's Balance Sheet 12/31/20xx Assets Cash Inventory Other current assets Total current assets Fixed assets, net Total assets 47.500 10,000 30.000 87.500 162,500 250.000 Liabilities and Owners Equity Accounts Payable Accruals (wages payable, utilities payable, etc) Current portion of long term debt Total current liabilities Long-term debt Total liabilities Owners equity Total liabilities and equity 7.500 5.000 17,500 30,000 90.000 120,000 130,000 250.000 Analysis: What does the budget tell Jasper? If he wants to obtain the extra space discuss what options he has. o The narrative accurately describes what the budget tells Jasper. (2 points) If there is a shortage of funds, how much additional cash would Jasper need? If there is an excess of funds, how much additional cash does Jasper have? o If Jasper is short of the required funds, what options does he have? At least two options are presented and described. (4 points) Note: This assignment is intended to develop analytical skills that would be used in a typical investment decision. It is an academic assignment, not an application based on current events. Jasper has his heart set on buying a lovely old building in Lumberton. Can he afford to expand? Let's figure out his budget and make some suggestions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts