Question: In this problem set, we analyse the trade-offs for monetary policy in the open economy. The model economy is described by the following relationships (same

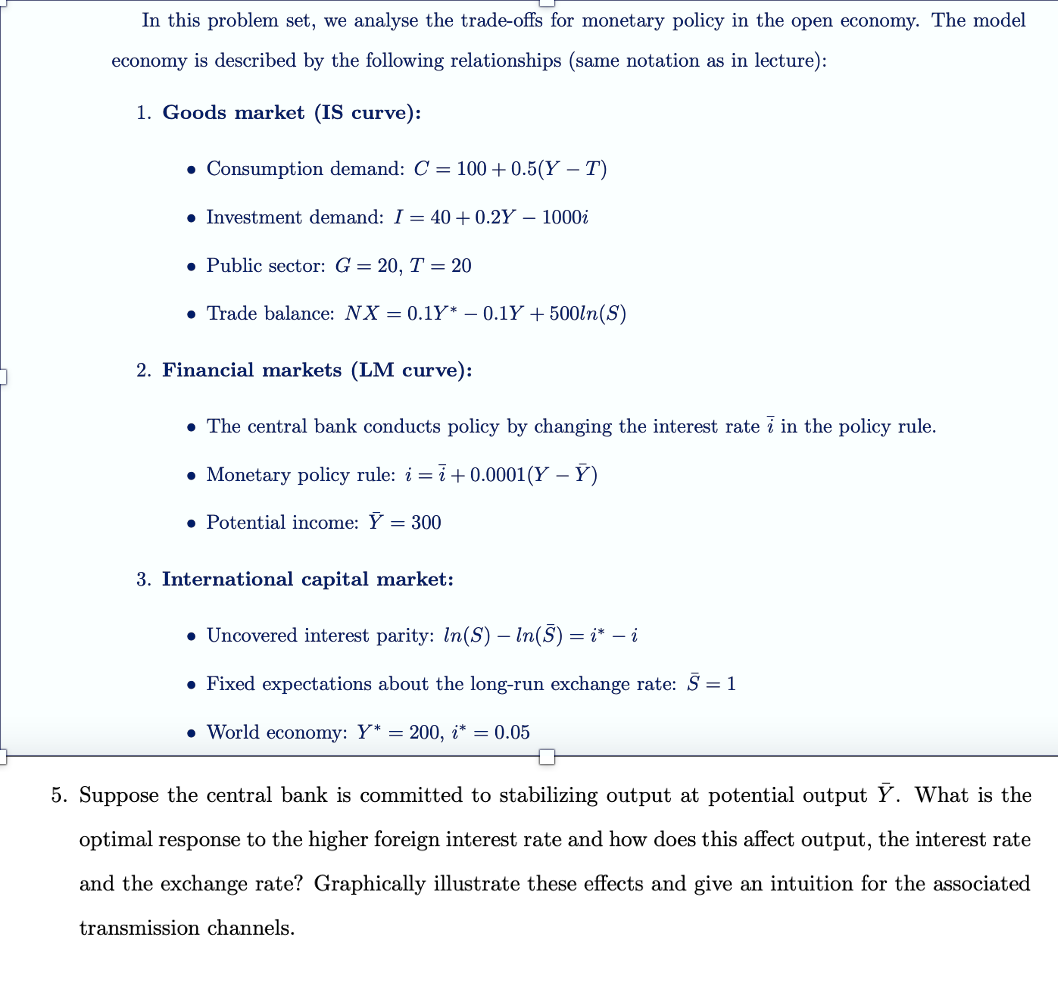

In this problem set, we analyse the trade-offs for monetary policy in the open economy. The model economy is described by the following relationships (same notation as in lecture): 1. Goods market (IS curve): - Consumption demand: C=100+0.5(YT) - Investment demand: I=40+0.2Y1000i - Public sector: G=20,T=20 - Trade balance: NX=0.1Y0.1Y+500ln(S) 2. Financial markets (LM curve): - The central bank conducts policy by changing the interest rate i in the policy rule. - Monetary policy rule: i=i+0.0001(YY) - Potential income: Y=300 3. International capital market: - Uncovered interest parity: ln(S)ln(S)=ii - Fixed expectations about the long-run exchange rate: S=1 - World economy: Y=200,i=0.05 5. Suppose the central bank is committed to stabilizing output at potential output Y. What is the optimal response to the higher foreign interest rate and how does this affect output, the interest rate and the exchange rate? Graphically illustrate these effects and give an intuition for the associated transmission channels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts