Question: In this problem set, you will be assessing the impact of economic events on the financial statement equation. You will also be preparing an income

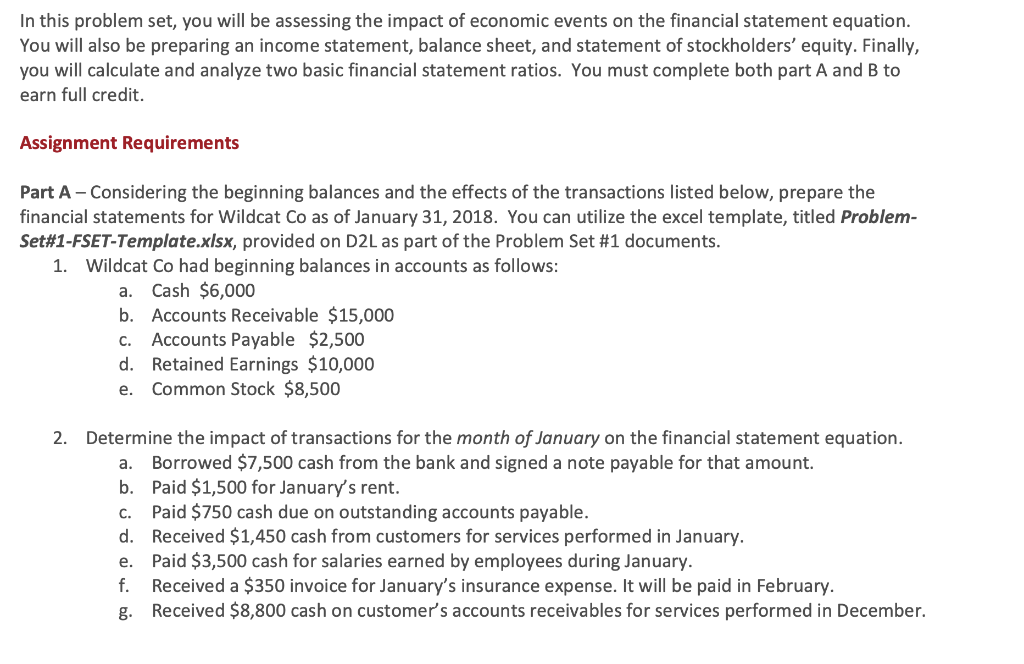

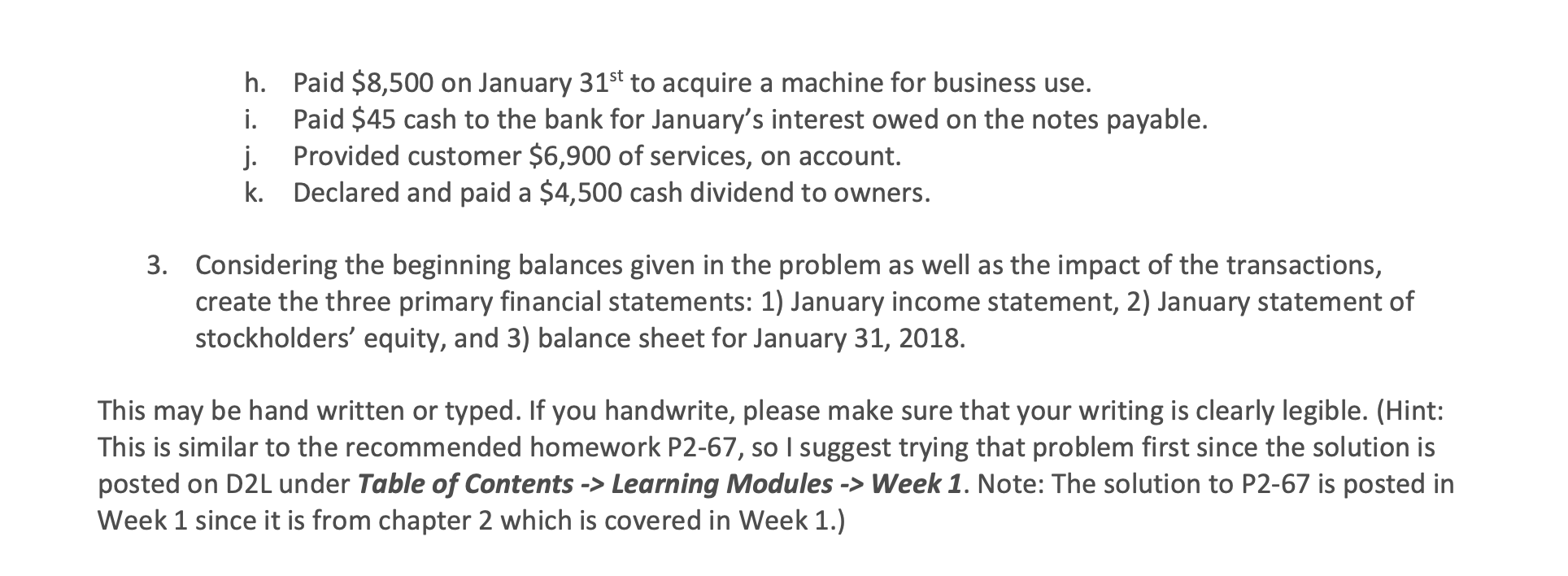

In this problem set, you will be assessing the impact of economic events on the financial statement equation. You will also be preparing an income statement, balance sheet, and statement of stockholders' equity. Finally, you will calculate and analyze two basic financial statement ratios. You must complete both part A and B to earn full credit. Assignment Requirements Part A-Considering the beginning balances and the effects of the transactions listed below, prepare the financial statements for Wildcat Co as of January 31, 2018. You can utilize the excel template, titled Problem- Set#1-FSET-Template.xlsx, provided on D2L as part of the Problem Set #1 documents. 1. Wildcat Co had beginning balances in accounts as follows: Cash $6,000 Accounts Receivable $15,000 Accounts Payable $2,500 d. Retained Earnings $10,000 Common Stock $8,500 . b. . . Determine the impact of transactions for the month of January on the financial statement equation. 2. Borrowed $7,500 cash from the bank Paid $1,500 for January's rent. Paid $750 cash due on outstanding accounts payable. Received $1,450 cash from customers for services performed in January Paid $3,500 cash for salaries earned by employees during January Received a $350 invoice for January's insurance expense. It will be paid in February. Received $8,800 cash on customer's accounts receivables for services performed in December. signed a note payable for that amount. . b. . d. . f. g. Paid $8,500 on January 31st to acquire a machine for business use. Paid $45 cash to the bank for January's interest owed on the notes payable. Provided customer $6,900 of services, on account. h. j. Declared and paid a $4,500 cash dividend to owners. k. Considering the beginning balances given in the problem as well as the impact of the transactions, create the three primary financial statements: 1) January income statement, 2) January statement of stockholders' equity, and 3) balance sheet for January 31, 2018. 3. This may be hand written or typed. If you handwrite, please make sure that your writing is clearly legible. (Hint: This is similar to the recommended homework P2-67, so I suggest trying that problem first since the solution is posted on D2L under Table of Contents -> Learning Modules -> Week 1. Note: The solution to P2-67 is posted in Week 1 since it is from chapter 2 which is covered in Week 1.) Part B- Accounts from Max Company's 12/31/19 adjusted pre-closing trial balance for the 2019 fiscal year appear below: balance Sales Revenue 197,000 Property, Plant & Equipment 115,300 Cost of Goods Sold 97,000 41,500 Inventory Notes Payable (due 12/31/23) Salaries and Wage Expense 41,000 38,900 Common Stock 35,000 Accumulated Depreciation Equipment 33,000 Retained Earnings (beginning balance) 31,000 Accounts Receivable 22,000 Rent Expense Accounts Payable 14,100 8,500 Cash 8,000 Prepaid Insurance 5,650 Salaries Payable 3,700 3,250 Interest Expense Allowance for Doubtful Accounts 2,500 Depreciation Expense Insurance Expense 2,400 2,300 Bad Debt Expense 1,300 First classify the accounts above (asset, liability, equity, revenue, expense). Then calculate 2019 net income and determine the ending balance of retained earnings. Finally prepare a classified balance sheet (current vs long term) using the information above. Using balance sheet, answer the questions below. What is the total amount reported as Current Assets as of 12/31/19? What is the total amount reported as Total Liabilities as of 12/31/19? What is the total amount report as Total Stockholders' Equity as of 12/31/19? Calculate the Debt to Equity ratio as of 12/31/19 and briefly discuss what this means. Calculate the Current Ratio as of 12/31/19 and briefly discuss what this means. 1. 2. 3. 4. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts