Question: In this problem, the lender faces a single type of borrower who has a choice between two activities: Project 1 or Project 2. Given the

In this problem, the lender faces a single type of borrower who has a choice between two activities: Project 1 or Project 2.

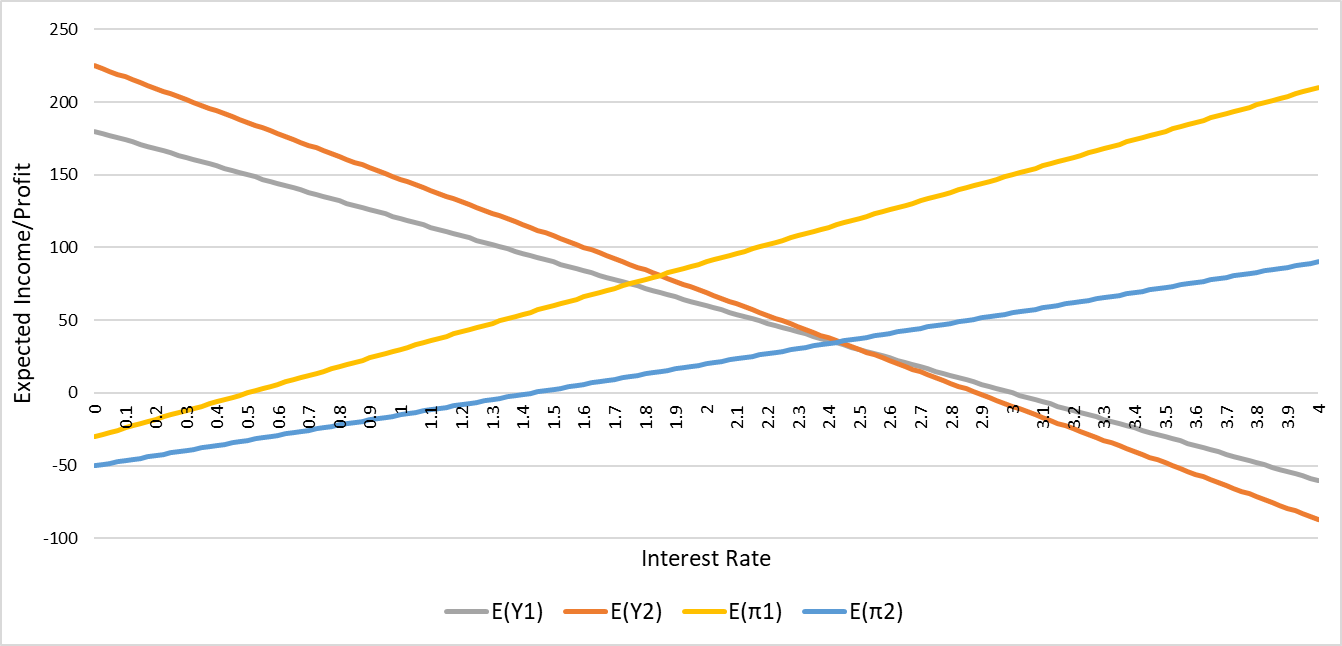

Given the four objective functions and the figure below, answer Question 1-8.

Expected income from Project 1: E(y1) = 180 - 60i

Expected income from Project 2:E(y2) = 225 - 78i

Expected profit from the loan to support Project 1: E(pi1) = -30 + 60i

Expected profit from the loan to support Project 2: E(pi2) = -50 + 35i

1. IF the lender sets the interest rate at 0.9, what project does the borrower want to take?

2. IF the lender sets the interest rate at 2.4, what project does the borrower want to take?

3. Under asymmetric information & monopoly, what interest rate i would be charged in equilibrium?

Note: Round your final answer to two decimal places.

4. Under asymmetric information & monopoly, in equilibrium, what project the borrowers would take?

5. Under symmetric information & monopoly, what interest rate i would be charged in equilibrium?

Note: Round your final answer to two decimal places.

6. Under symmetric information & monopoly, in equilibrium, what project would the lender make the borrower take?

7. Under asymmetric information & perfect competition, what interest rate i would be charged in equilibrium?

Note: Round your final answer to two decimal places.

8. Under symmetric information & perfect competition, what interest rate i would be charged in equilibrium?

Note: Round your final answer to two decimal places.

Expected Income/Profit 250 200 150 100 50 -50 -100 0 0.4 -E(Y1) Interest Rate -E(Y2) -E(1) E(2) 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts