Question: In this problem, we consider replacing an existing electrical water heater with an array of solar panels. The net installed investment cost of the panels

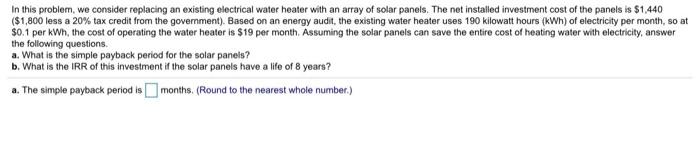

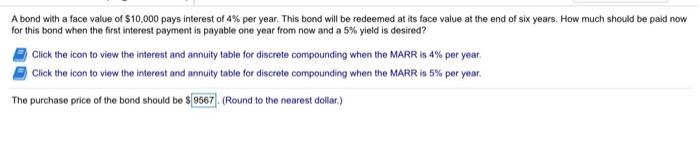

In this problem, we consider replacing an existing electrical water heater with an array of solar panels. The net installed investment cost of the panels is $1,440 ($1,800 less a 20% tax credit from the government). Based on an energy audit. the existing water heater uses 190 kilowatt hours (kWh) of electricity per month, so at $0.1 per kWh, the cost of operating the water heater is $19 per month. Assuming the solar panels can save the entire cost of heating water with electricity, answer the following questions. a. What is the simple payback period for the solar panels? b. What is the IRR of this investment if the solar panels have a life of 8 years? a. The simple payback period is months. (Round to the nearest whole number.) A bond with a face value of $10,000 pays interest of 4% per year. This bond will be redeemed at its face value at the end of six years. How much should be paid now for this bond when the first interest payment is payable one year from now and a 5% yield is desired? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 4% per year, Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per year. The purchase price of the bond should be $9567) (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts