Question: In this problem we examine two stochastic processes for a stock price: PROCES5 A: Driftless geometric Brownian motion (GBM). Driftless means no dt term. So,

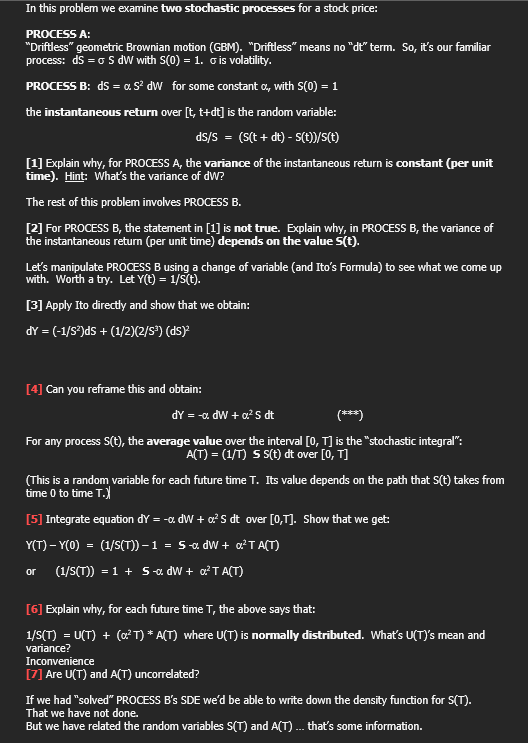

In this problem we examine two stochastic processes for a stock price: PROCES5 A: "Driftless" geometric Brownian motion (GBM). "Driftless" means no "dt" term. So, it's our familiar process: dS=S dW with S(0)=1. is volatility. PROCESS B: dS=S2dW for some constant , with S(0)=1 the instantaneous return over [t,t+dt] is the random variable: dS/S=(S(t+dt)S(t))/S(t) [1] Explain why, for PROCESS A, the variance of the instantaneous return is constant (per unit time). Hint: What's the variance of dW? The rest of this problem involves PROCESS B. [2] For PROCESS B, the statement in [1] is not true. Explain why, in PROCESS Br the variance of the instantaneous return (per unit time) depends on the value S(t). Let's manipulate PROCESS B using a change of variable (and Ito's Formula) to see what we come up with. Worth a try. Let Y(t)=1/S(t). [3] Apply Ito directly and show that we obtain: dY=(1/S2)dS+(1/2)(2/S3)(dS)2 [4] Can you reframe this and obtain: dY=dW+2Sdt For any process S(t), the average value over the interval [0,T] is the "stochastic integral": A(T)=(1/T)S(t)dtover[0,T] (This is a random variable for each future time T. Its value depends on the path that S(t) takes from time 0 to time T.y [5] Integrate equation dY=dW+2Sdt over [0,T]. Show that we get: Y(T)Y(0)=(1/S(T))1=5dW+2TA(T) or (1/S(T))=1+5dW+2TA(T) [6] Explain why, for each future time T, the above says that: 1/S(T)=U(T)+(2T)A(T) where U(T) is normally distributed. What's U(T) 's mean and variance? Inconvenience [7] Are U(T) and A(T) uncorrelated? If we had "solved" PROCESS B's SDE we'd be able to write down the density function for S(T). That we have not done. But we have related the random variables S(T) and A(T)... that's some information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts