Question: In this problem, we will simulate data from m=1000 fund managers. Generate the data using np.random.seed(5)np.random.normal(size=(n,m)) These data represent each fund manager's percentage returns for

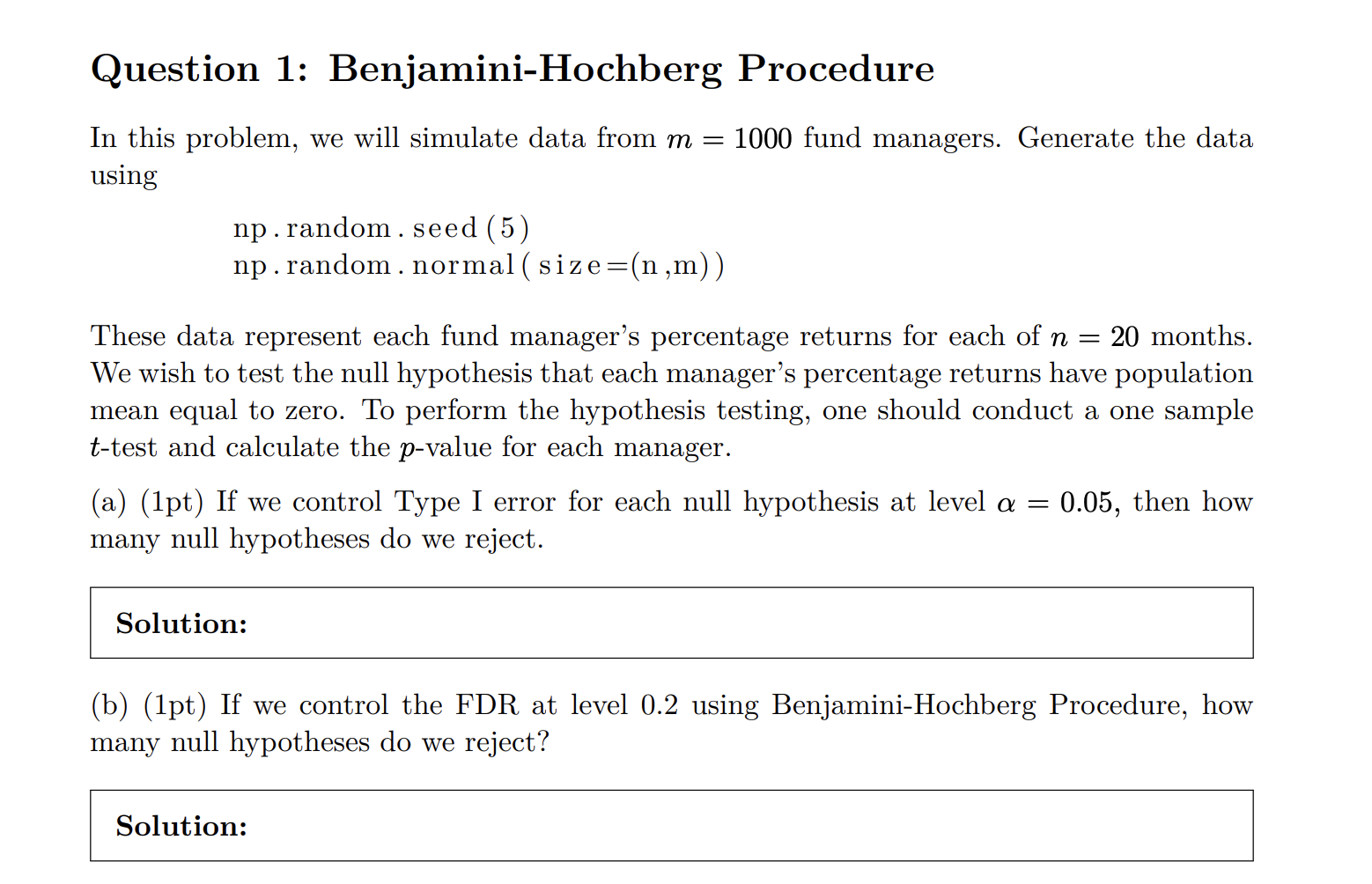

In this problem, we will simulate data from m=1000 fund managers. Generate the data using np.random.seed(5)np.random.normal(size=(n,m)) These data represent each fund manager's percentage returns for each of n=20 months. We wish to test the null hypothesis that each manager's percentage returns have population mean equal to zero. To perform the hypothesis testing, one should conduct a one sample t-test and calculate the p-value for each manager. (a) (1pt) If we control Type I error for each null hypothesis at level =0.05, then how many null hypotheses do we reject. (b) (1pt) If we control the FDR at level 0.2 using Benjamini-Hochberg Procedure, how many null hypotheses do we reject

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts