Question: In this problem you are required to compute and interpret bankruptcy prediction ratios. The information presented below relates to two competing technology firms Data

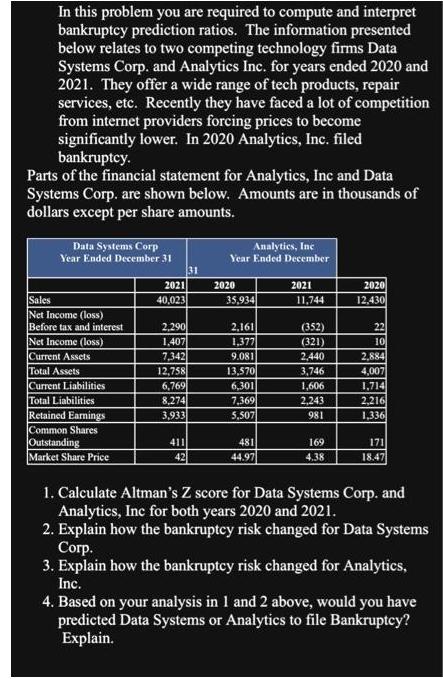

In this problem you are required to compute and interpret bankruptcy prediction ratios. The information presented below relates to two competing technology firms Data Systems Corp. and Analytics Inc. for years ended 2020 and 2021. They offer a wide range of tech products, repair services, etc. Recently they have faced a lot of competition from internet providers forcing prices to become significantly lower. In 2020 Analytics, Inc. filed bankruptcy. Parts of the financial statement for Analytics, Inc and Data Systems Corp. are shown below. Amounts are in thousands of dollars except per share amounts. Data Systems Corp Year Ended December 31 Sales Net Income (loss) Before tax and interest Net Income (loss) Current Assets Total Assets Current Liabilities Total Liabilities Retained Earnings Common Shares Outstanding Market Share Price 2021 40,023 2,290 1,407 7,342 12,758 6,769 8,274 3,933 411 42 31 Analytics, Inc Year Ended December 2020 35,934 2,161 1,377 9.081 13,570 6,301 7,369 5,507 481 44.97 2021 11,744 (352) (321) 2,440 3,746 1,606 2,243 981 169 4.38 2020 12,430 22 E 10 2,884 4,007 1,714 2,216 1,336 171 18.47 1. Calculate Altman's Z score for Data Systems Corp. and Analytics, Inc for both years 2020 and 2021. 2. Explain how the bankruptcy risk changed for Data Systems Corp. 3. Explain how the bankruptcy risk changed for Analytics, Inc. 4. Based on your analysis in 1 and 2 above, would you have predicted Data Systems or Analytics to file Bankruptcy? Explain.

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

1 Calculate Altmans Z score for Data Systems Corp and Analytics Inc for both years 2020 and 2021 Data Systems Corp Year Ended December 31 2020 Zscore ... View full answer

Get step-by-step solutions from verified subject matter experts