Question: In this project, we will use the financial Internet website, morningstar.com, to analyze a company of your choice, do not use Hewlett Packard. Once on

In this project, we will use the financial Internet website, morningstar.com, to analyze a company of your choice, do not use Hewlett Packard.

In this project, we will use the financial Internet website, morningstar.com, to analyze a company of your choice, do not use Hewlett Packard.

Once on the website, you simply enter the company's ticker symbol (Ex. Macy would use "M") to obtain the financial information needed. We will also perform a trend analysis, where we evaluate changes in key ratios over time. There will be two parts to this project. Part 1 will be gathering data points to put into excel. Part 2 will be analyzing those data points by answering a series of questions. Within these questions, you will explain what each topic means, why it is used and how your company has performed.

Through the Morningstar website, you can find the firm's financials (Income Statement, Balance Sheet, and Cash Flow) on an annual or quarterly basis for the five most recent time periods by clicking on each statement's name as you scroll down your screen. In addition, the site contains Key Ratios (Profitability, Growth, Cash Flow, Financial Health, and Efficiency) for 10 years. (From the home screen, click on "Key Ratios" and "Full Key Ratios Data." Then the next screen shows 10 years' worth of key ratios.) We will use the Key Ratios on this site to conduct the firm's trend analysis. (At the top of the home screen, you will see that you can click on the "Learn" tab and select "Investing Glossary" to find definitions.)

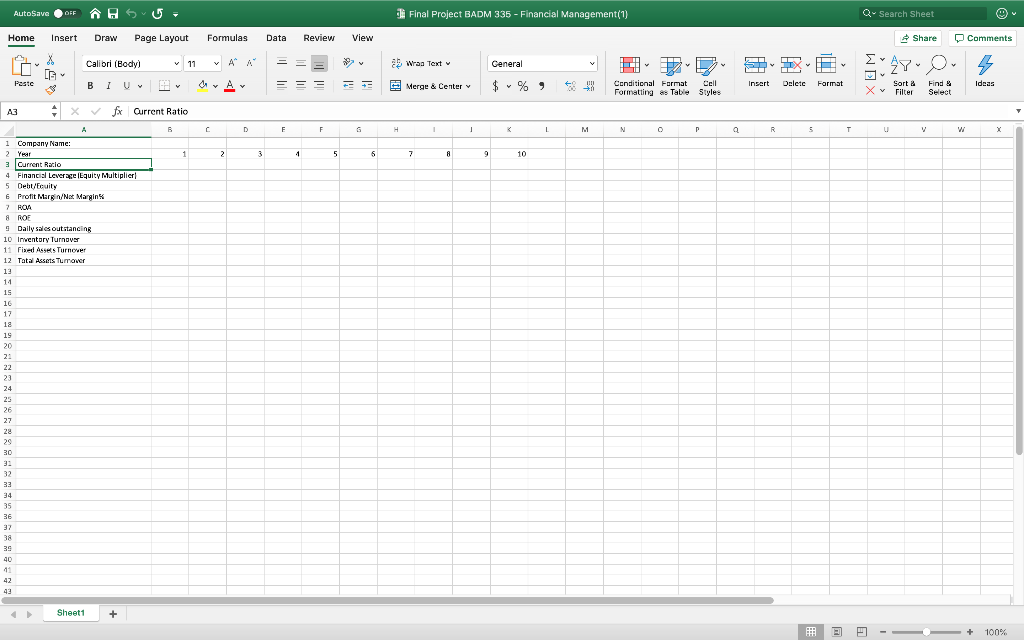

Part 1: Gather the following information and place it into excel to compare data. Use this Excel spreadsheet: Final Project BADM 335 - Financial Management.xlsx

- Current Ratio

- Financial Leverage (Equity Multiplier)

- Debt/Equity

- Profit Margin/Net Margin%

- ROA

- ROE

- Daily sales outstanding

- Inventory Turnover

- Fixed Assets Turnover

- Total Assets Turnover

Part 2: Based on your findings above answer the following questions:

- Briefly explain what each ratio means, why it is important and how it is calculated.

- Choose several ratios from above to explain what this company has done well over the last 10 years.

- Choose several ratios from above to explain what this company needs to work on moving forward or point out an area of concern for this company.

- Would you invest in this company? Why or why not? Is it a long-term investment, short term or a wait-and-see? Use specific data points from above to argue your position.

AutoSave OFF OFF HS 15 = Home Insert Draw Page Layout $ Calibri (Body) LO TA BIU IH x fx Current Ratio A B Paste A3 1 Company Name: 2 Year 3 Current Ratio 4 Financial Leverage (Liquity Multiplier 5 Debt/Equity 6 Profit Margin/Not Margin 7 ROA 8 ROE Daily sales outstanding 10 Inventory Turnover www 11 Fixed Assets Turnover 12 Tatal Assets Turnover 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Sheet1 + Formulas Data Review View == E G 11 VA A Av 1 C 2 D 3 4 F 5 6 H Final Project BADM 335 - Financial Management (1) Wras Text General Merge & Center $ 48 Y I K 7 8 J 9 10 L M D... Cell Conditional Format Formatting as Table Styles N 0 P q S Insert V R Delete V 5 v Format T Q Search Sheet Share Xv GO u V O Sort & Find & Filter Select Comments 4 Ideas X + 100% T AutoSave OFF OFF HS 15 = Home Insert Draw Page Layout $ Calibri (Body) LO TA BIU IH x fx Current Ratio A B Paste A3 1 Company Name: 2 Year 3 Current Ratio 4 Financial Leverage (Liquity Multiplier 5 Debt/Equity 6 Profit Margin/Not Margin 7 ROA 8 ROE Daily sales outstanding 10 Inventory Turnover www 11 Fixed Assets Turnover 12 Tatal Assets Turnover 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Sheet1 + Formulas Data Review View == E G 11 VA A Av 1 C 2 D 3 4 F 5 6 H Final Project BADM 335 - Financial Management (1) Wras Text General Merge & Center $ 48 Y I K 7 8 J 9 10 L M D... Cell Conditional Format Formatting as Table Styles N 0 P q S Insert V R Delete V 5 v Format T Q Search Sheet Share Xv GO u V O Sort & Find & Filter Select Comments 4 Ideas X + 100% T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts