Question: In this question we attempt to value a company (rather than a project) using the valuation technique we have learned so far. Specifically, the company

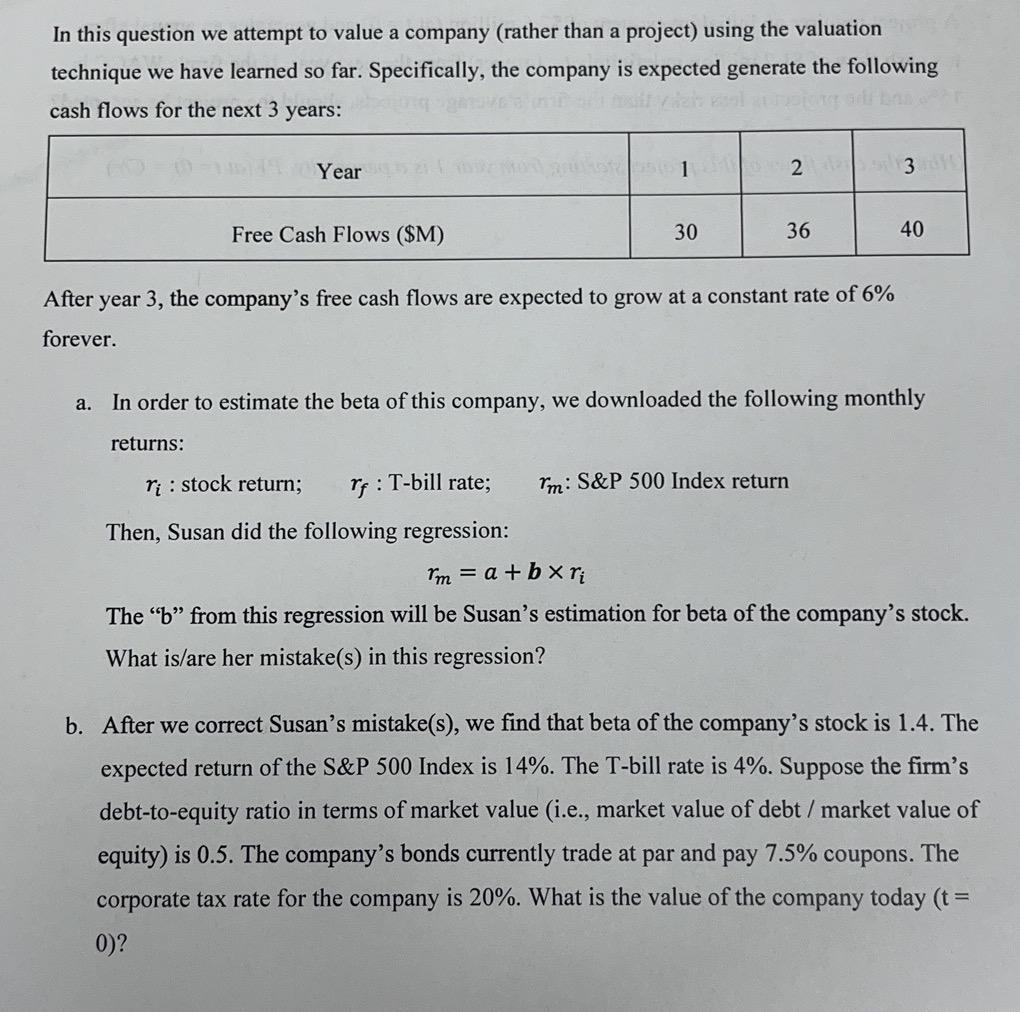

In this question we attempt to value a company (rather than a project) using the valuation technique we have learned so far. Specifically, the company is expected generate the following cash flows for the next 3 years: After year 3, the company's free cash flows are expected to grow at a constant rate of 6% forever. a. In order to estimate the beta of this company, we downloaded the following monthly returns: ri: stock return; rf: T-bill rate; rm: S\&P 500 Index return Then, Susan did the following regression: rm=a+bri The "b" from this regression will be Susan's estimation for beta of the company's stock. What is/are her mistake(s) in this regression? b. After we correct Susan's mistake(s), we find that beta of the company's stock is 1.4. The expected return of the S\&P 500 Index is 14%. The T-bill rate is 4%. Suppose the firm's debt-to-equity ratio in terms of market value (i.e., market value of debt / market value of equity) is 0.5 . The company's bonds currently trade at par and pay 7.5% coupons. The corporate tax rate for the company is 20%. What is the value of the company today (t= 0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts