Question: In this question, we try to understand how convertible bonds work and are priced. Suppose the stock of company ABC is traded at $105 per

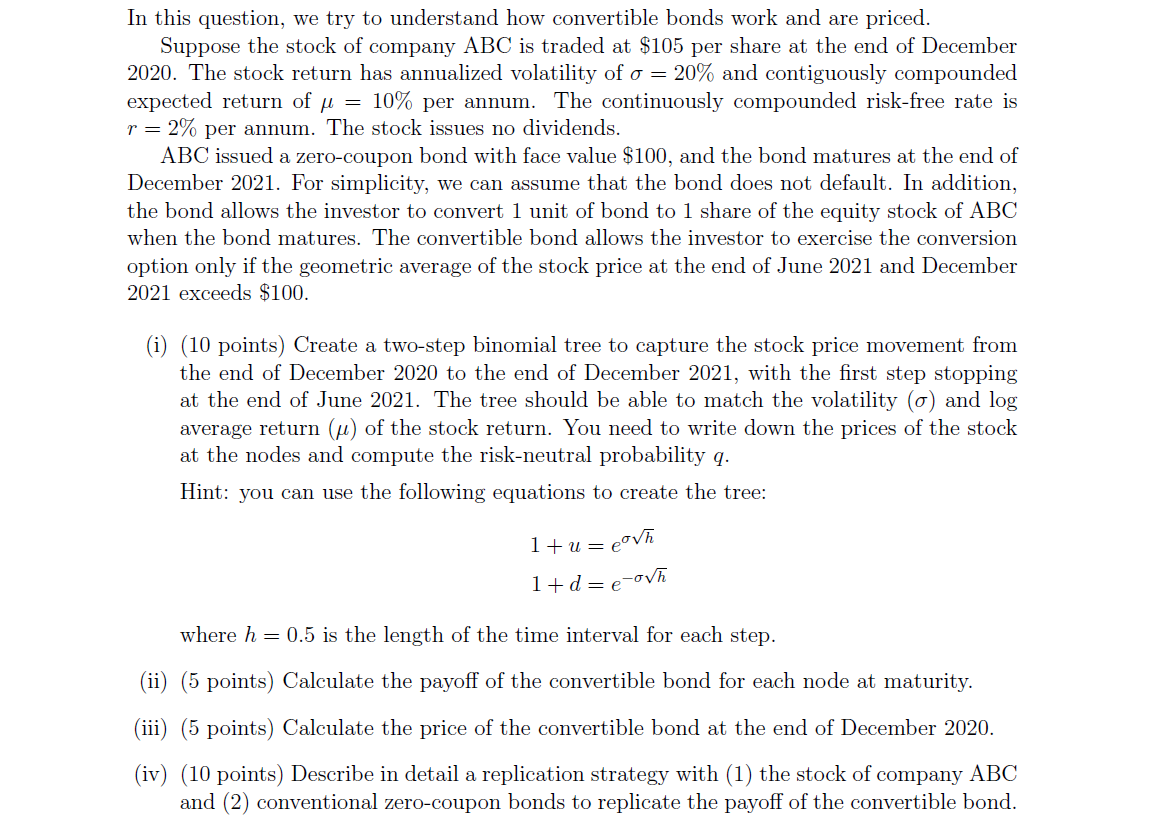

In this question, we try to understand how convertible bonds work and are priced. Suppose the stock of company ABC is traded at $105 per share at the end of December 2020. The stock return has annualized volatility of o = 20% and contiguously compounded expected return of u = 10% per annum. The continuously compounded risk-free rate is r = 2% per annum. The stock issues no dividends. ABC issued a zero-coupon bond with face value $100, and the bond matures at the end of December 2021. For simplicity, we can assume that the bond does not default. In addition, the bond allows the investor to convert 1 unit of bond to 1 share of the equity stock of ABC when the bond matures. The convertible bond allows the investor to exercise the conversion option only if the geometric average of the stock price at the end of June 2021 and December 2021 exceeds $100. (i) (10 points) Create a two-step binomial tree to capture the stock price movement from the end of December 2020 to the end of December 2021, with the first step stopping at the end of June 2021. The tree should be able to match the volatility (0) and log average return (u) of the stock return. You need to write down the prices of the stock at the nodes and compute the risk-neutral probability q. Hint: you can use the following equations to create the tree: 1+u = cova 1+d=e-ova where h = 0.5 is the length of the time interval for each step. (ii) (5 points) Calculate the payoff of the convertible bond for each node at maturity. (iii) (5 points) Calculate the price of the convertible bond at the end of December 2020. (iv) (10 points) Describe in detail a replication strategy with (1) the stock of company ABC and (2) conventional zero-coupon bonds to replicate the payoff of the convertible bond. In this question, we try to understand how convertible bonds work and are priced. Suppose the stock of company ABC is traded at $105 per share at the end of December 2020. The stock return has annualized volatility of o = 20% and contiguously compounded expected return of u = 10% per annum. The continuously compounded risk-free rate is r = 2% per annum. The stock issues no dividends. ABC issued a zero-coupon bond with face value $100, and the bond matures at the end of December 2021. For simplicity, we can assume that the bond does not default. In addition, the bond allows the investor to convert 1 unit of bond to 1 share of the equity stock of ABC when the bond matures. The convertible bond allows the investor to exercise the conversion option only if the geometric average of the stock price at the end of June 2021 and December 2021 exceeds $100. (i) (10 points) Create a two-step binomial tree to capture the stock price movement from the end of December 2020 to the end of December 2021, with the first step stopping at the end of June 2021. The tree should be able to match the volatility (0) and log average return (u) of the stock return. You need to write down the prices of the stock at the nodes and compute the risk-neutral probability q. Hint: you can use the following equations to create the tree: 1+u = cova 1+d=e-ova where h = 0.5 is the length of the time interval for each step. (ii) (5 points) Calculate the payoff of the convertible bond for each node at maturity. (iii) (5 points) Calculate the price of the convertible bond at the end of December 2020. (iv) (10 points) Describe in detail a replication strategy with (1) the stock of company ABC and (2) conventional zero-coupon bonds to replicate the payoff of the convertible bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts