Question: In this question you are asked to re-work Example 8-1 (Example 8-1 given below) under a different set of assumptions. Remember that Example 8-1 assumes

In this question you are asked to re-work Example 8-1 (Example 8-1 given below) under a different set of assumptions. Remember that Example 8-1 assumes that if the firm has negative income in a given year, then the income tax will also be negative (i.e., the firm will get a tax credit from the government equal to 40% of the negative net income). You can see this in Year 0 in Example 8-1.

Suppose that the amortization of the Intangible Drilling Cost currently allowed for oil projects was no longer allowed. This means that the Intangible Drilling Cost is a $6 million investing activity at time zero. Calculate the NPV for the project under this assumption.

Hint: If amortization for the IDC is no longer allowed, you need to do more than just zero out the amortization line items from the financial statement. The IDC would be removed from lines 6 and 7 (referring to the Table in Example 8-1) and the IDC in line 18 would be -$6,000,000.

EXAMPLE 8-1:

An integrated petroleum company is planning to invest in acquiring and developing an oil reserve with the following considerations:

- Total producible oil in the reserve is estimated to be 1,000,000 barrels.

- Project life is 5 years and after reserve will be depleted

- Production rate will be 200,000 barrels of oil per year for these 5 years.

- Mineral rights acquisition cost for property would be $1,200,000 at time zero.

- Intangible drilling cost (IDC) is expected to be $6,000,000 at time zero.

- Tangible equipment cost (producing equipment, gathering lines, and well completion and so on) is $2,500,000 at time zero.

- Working capital of $1,000,000 also at time zero.

- Equipment depreciation will be based on MACRS 7 years life depreciation starting from year 1.

- Write off the remaining equipment book value at year 5.

- The production selling price is assumed $40 per barrel which has 12% escalation each year starting from year 2.

- Operating cost is $750,000 annually with escalation rate of 10% starting from year 2.

- Income tax is 40%

- Royalty 15%.

- Amortization of IDC starts from time zero.

- Minimum After tax rate of return is 24%.

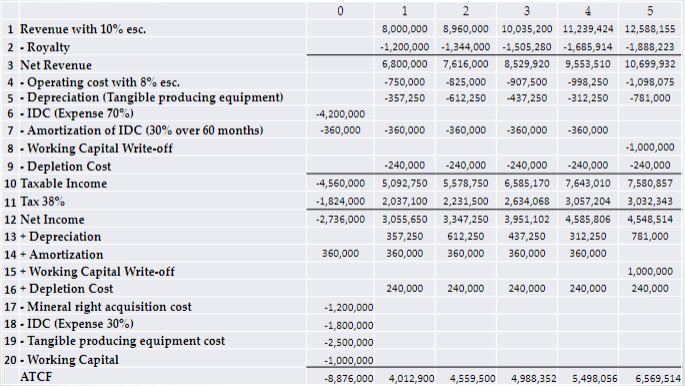

1 Revenue with 10% esc. 2 Royalty 3 Net Revenue 4-Operating cost with 8% esc. 8,000,000 8,960,000 10,035,200 11,239,424 12,588,155 1,200,000 1,344,000 -1,505,280 -1,685,914 -1,888,223 6,800,000 7,616,000 8,529,920 9,553,510 10,699,932 50,000 -825,000 907,500 998,250-1,098,075 357,250 612,250 437,250 -312,250781,000 Depreciation (Tangible producing equipment) 6 -IDC (Expense 70%) 7 . Amortization of IDC (30% over 60 months) 8 Working Capital Write-off 9 - Depletion Cost 10 Taxable Income 11 Tax 38% 12 Net Income 13 Depreciation 14 Amortization 15 Working Capital Write-off 16 Depletion Cost 17- Mineral right acquisition cost 18-IDC (Expense 30%) 19 - Tangible producing equipment cost 20 - Working Capital 4,200,000 360,000 360,000 -360,000 360,000 360,000 1,000,000 240,000 4,560,000 5,092,750 5,578,750 6,585,170 7,643,010 7,530,857 1,824,000 2,037,100 2,231,500 2,634,068 3,057,204 3,032,343 2,736,000 3,055,650 3,347,250 3,951,102 4,585,806 4,548,514 357,250 612,250 437,250 312,250 781,000 240,000 240,000 -240,000 -240,000 - 360,000 360,000 360,000 30,000 360,000 1,000,000 240,000 240,000 240,000 240,000 240,000 1,200,000 1,800,000 2,500,000 1,000,000 -8,876,000 4,012,900 4,559,500 4,988,352 5,498,0566,569,514 ATCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts