Question: In this question, you are given a well recognized procedure of internal control. You are to identify the irregularity that will be discovered or prevented

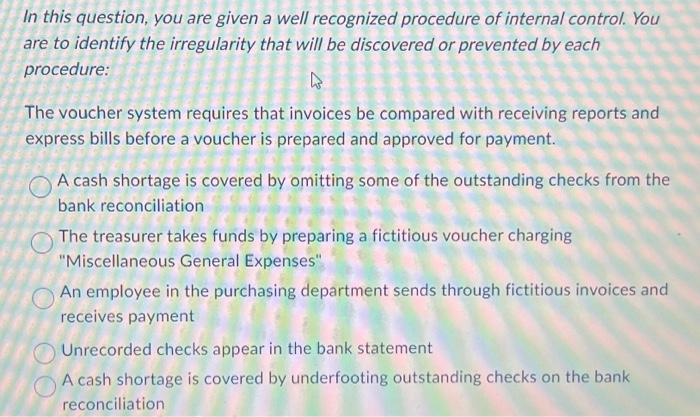

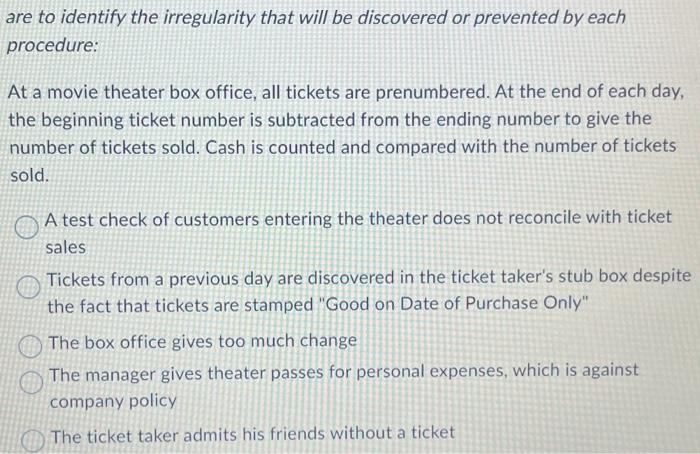

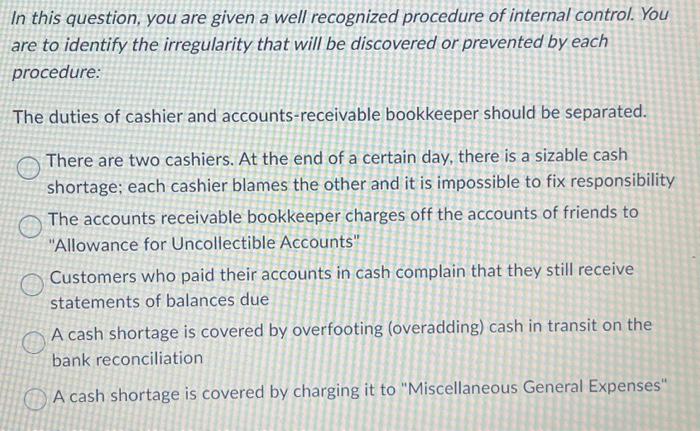

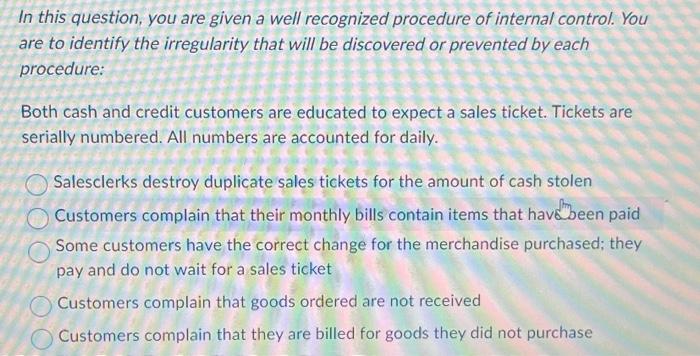

In this question, you are given a well recognized procedure of internal control. You are to identify the irregularity that will be discovered or prevented by each procedure: The voucher system requires that invoices be compared with receiving reports and express bills before a voucher is prepared and approved for payment. A cash shortage is covered by omitting some of the outstanding checks from the bank reconciliation The treasurer takes funds by preparing a fictitious voucher charging "Miscellaneous General Expenses" An employee in the purchasing department sends through fictitious invoices and receives payment Unrecorded checks appear in the bank statement A cash shortage is covered by underfooting outstanding checks on the bank reconciliation are to identify the irregularity that will be discovered or prevented by each procedure: At a movie theater box office, all tickets are prenumbered. At the end of each day, the beginning ticket number is subtracted from the ending number to give the number of tickets sold. Cash is counted and compared with the number of tickets sold. A test check of customers entering the theater does not reconcile with ticket sales Tickets from a previous day are discovered in the ticket taker's stub box despite the fact that tickets are stamped "Good on Date of Purchase Only" The box office gives too much change The manager gives theater passes for personal expenses, which is against company policy The ticket taker admits his friends without a ticket In this question, you are given a well recognized procedure of internal control. You are to identify the irregularity that will be discovered or prevented by each procedure: The duties of cashier and accounts-receivable bookkeeper should be separated. There are two cashiers. At the end of a certain day, there is a sizable cash shortage; each cashier blames the other and it is impossible to fix responsibility The accounts receivable bookkeeper charges off the accounts of friends to "Allowance for Uncollectible Accounts" Customers who paid their accounts in cash complain that they still receive statements of balances due A cash shortage is covered by overfooting (overadding) cash in transit on the bank reconciliation A cash shortage is covered by charging it to "Miscellaneous General Expenses" In this question, you are given a well recognized procedure of internal control. You are to identify the irregularity that will be discovered or prevented by each procedure: Both cash and credit customers are educated to expect a sales ticket. Tickets are serially numbered. All numbers are accounted for daily. Salesclerks destroy duplicate sales tickets for the amount of cash stolen Customers complain that their monthly bills contain items that haveen paid Some customers have the correct change for the merchandise purchased; they pay and do not wait for a sales ticket Customers complain that goods ordered are not received Customers complain that they are billed for goods they did not purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts