Question: In this question you are only asked for the answer in Part C. Nevertheless, you should answer the previous parts to get to the answer

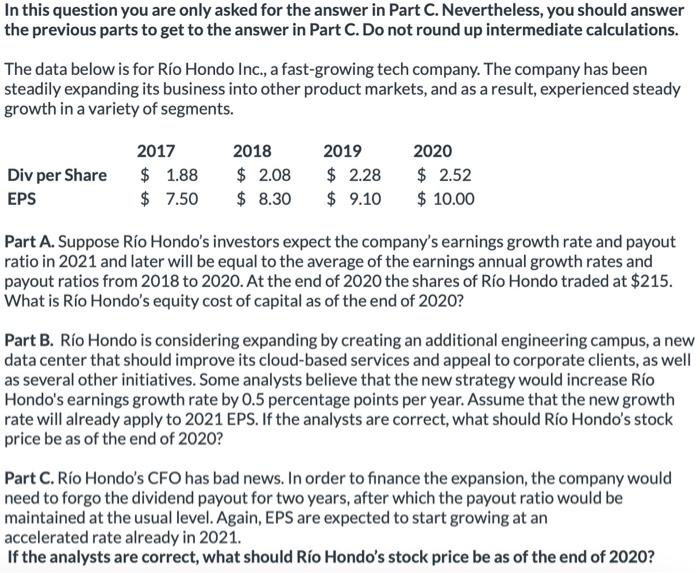

In this question you are only asked for the answer in Part C. Nevertheless, you should answer the previous parts to get to the answer in Part C. Do not round up intermediate calculations. The data below is for Ro Hondo Inc., a fast-growing tech company. The company has been steadily expanding its business into other product markets, and as a result, experienced steady growth in a variety of segments. Part A. Suppose Ro Hondo's investors expect the company's earnings growth rate and payout ratio in 2021 and later will be equal to the average of the earnings annual growth rates and payout ratios from 2018 to 2020 . At the end of 2020 the shares of Rio Hondo traded at $215. What is Ro Hondo's equity cost of capital as of the end of 2020 ? Part B. Ro Hondo is considering expanding by creating an additional engineering campus, a new data center that should improve its cloud-based services and appeal to corporate clients, as well as several other initiatives. Some analysts believe that the new strategy would increase Rio Hondo's earnings growth rate by 0.5 percentage points per year. Assume that the new growth rate will already apply to 2021 EPS. If the analysts are correct, what should Rio Hondo's stock price be as of the end of 2020 ? Part C. Ro Hondo's CFO has bad news. In order to finance the expansion, the company would need to forgo the dividend payout for two years, after which the payout ratio would be maintained at the usual level. Again, EPS are expected to start growing at an accelerated rate already in 2021. If the analysts are correct, what should Ro Hondo's stock price be as of the end of 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts