Question: As the head of the Planning and Analysis department you have received the following report for the period just ended You are Senior Analyst

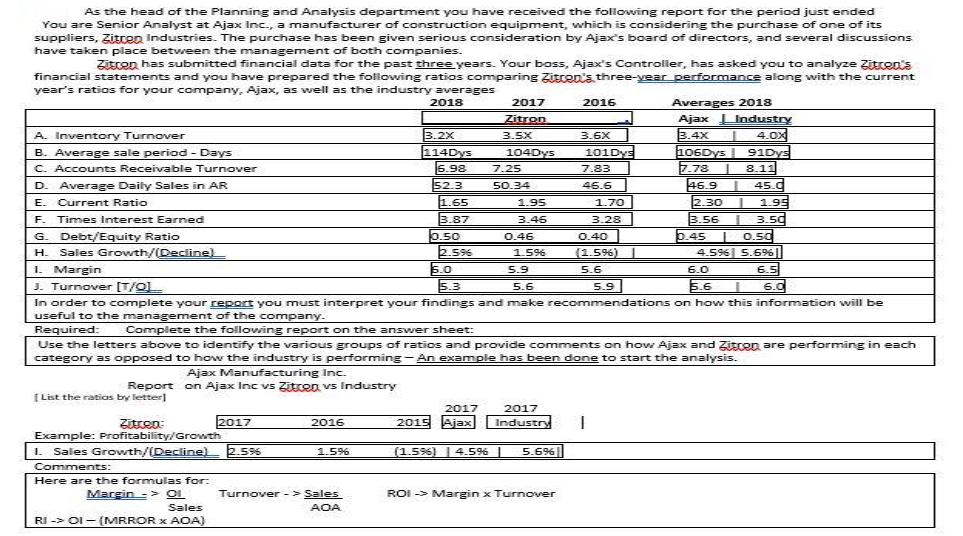

As the head of the Planning and Analysis department you have received the following report for the period just ended You are Senior Analyst at Ajax Inc., a manufacturer of construction equipment, which is considering the purchase of one of its suppliers, Zitcen Industries. The purchase has been given serious consideration by Ajax's board of directors, and several discussions have taken place between the management of both companies Zitcen has submitted financial data for the past three years. Your boss, Ajax's Controller, has asked you to analyze Zitron's financial statements and you have prepared the following ratios comparing Zitcen's three-year performance along with the current year's ratios for your company, Ajax, as well as the industry averages Averages 2018 Ajax I Industry 2018 2017 2016 Zitron A. Inventory Turnover B. Average sale period - Days C. Accounts Receivable Turnover D. Average Daily Sales in AR 3.2X 114Dys 3.4X 4.0x 10SDys 91Dys 8 I 8.11 46.9 3.5X 3.6X 104Dys 101Dys 7.78 6.98 52.3 7.25 7.83 46.6 45.0 1.95 50.34 E. Current Ratio 1.65 1.95 1.70 2.30 3.87 0.50 2.596 5.0 5.3 | 3.50 0.50 4.596 5.69% 6.5 5.6I F. Times Interest Earned 3.46 3.28 3.56 6.45 G. Debt/Equity Ratio H. Sales Growth/(Deciine) 1. Margin J. Turnover [T/Q In order to complete your report you must interpret your findings and make recommendations on how this information will be useful to the management of the company. Required: Use the letters above to identify the various groups of ratios and provide comments on how Ajax and Zitron are performing in each category as opposed to how the industry is performing - An example has been done to start the analysis. 0.46 0.40 1.5%6 (1.5%) 5.9 5.6 6.0 5.6 5.9 6.0 Complete the following report on the answer sheet: Ajax Manufacturing Inc. Report on Ajax Inc vs Zitcen vs Industry ( List the ratios by letter] 2017 2017 2017 2015 Ajax Industry Zitron: Example: Profitability/Growth 2016 Sales Growth/(Decline) 2.59%6 1.5% (1.56) | 4.596 | 5.6%| Comments: Here are the formulas for: Margin -> OI Turnover -> Sales ROI -> Margin x Turnover Sales AOA RI -> OI- (MRROR x AOA)

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

A Inventory Turnover Cost of Sales Average inventory Zitron Inventory turnover is declined from 36x ... View full answer

Get step-by-step solutions from verified subject matter experts