Question: In this section, you MUST show your work/inputs so that the grader can determine what you did to reach your solution. You do not have

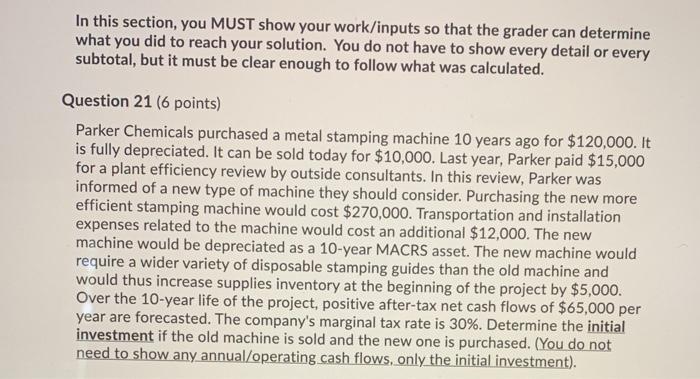

In this section, you MUST show your work/inputs so that the grader can determine what you did to reach your solution. You do not have to show every detail or every subtotal, but it must be clear enough to follow what was calculated. Question 21 (6 points) Parker Chemicals purchased a metal stamping machine 10 years ago for $120,000. It is fully depreciated. It can be sold today for $10,000. Last year, Parker paid $15,000 for a plant efficiency review by outside consultants. In this review, Parker was informed of a new type of machine they should consider. Purchasing the new more efficient stamping machine would cost $270,000. Transportation and installation expenses related to the machine would cost an additional $12,000. The new machine would be depreciated as a 10-year MACRS asset. The new machine would require a wider variety of disposable stamping guides than the old machine and would thus increase supplies inventory at the beginning of the project by $5,000. Over the 10-year life of the project, positive after-tax net cash flows of $65,000 per year are forecasted. The company's marginal tax rate is 30%. Determine the initial investment if the old machine is sold and the new one is purchased. (You do not need to show any annual/operating cash flows, only the initial investment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts