Question: In Week Eight we work with the bonds that make up the securities portfolio of a bank. We should understand the calculation of the Yield

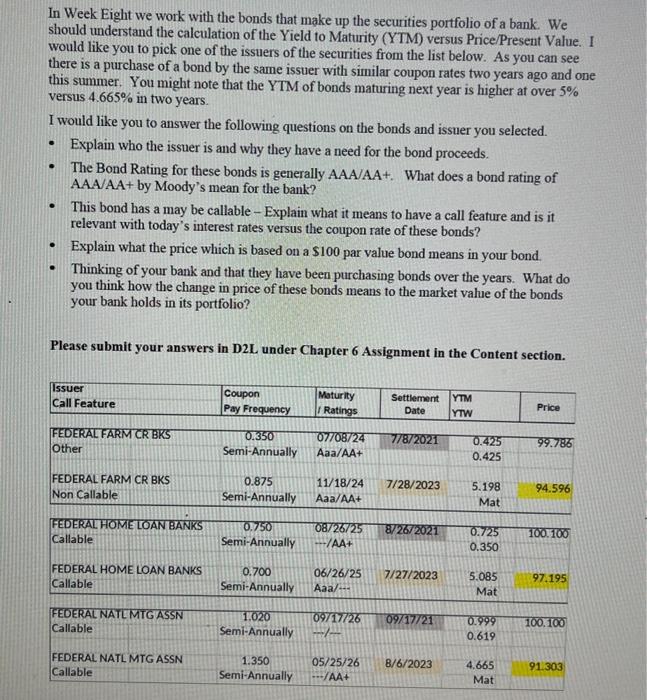

In Week Eight we work with the bonds that make up the securities portfolio of a bank. We should understand the calculation of the Yield to Maturity (YTM) versus Price/Present Value. I would like you to pick one of the issuers of the securities from the list below. As you can see there is a purchase of a bond by the same issuer with similar coupon rates two years ago and one this summer. You might note that the YTM of bonds maturing next year is higher at over 5% versus 4.665% in two years. I would like you to answer the following questions on the bonds and issuer you selected. - Explain who the issuer is and why they have a need for the bond proceeds. - The Bond Rating for these bonds is generally AAA/AA+. What does a bond rating of AAA/AA + by Moody's mean for the bank? - This bond has a may be callable - Explain what it means to have a call feature and is it relevant with today's interest rates versus the coupon rate of these bonds? - Explain what the price which is based on a $100 par value bond means in your bond. - Thinking of your bank and that they have been purchasing bonds over the years. What do you think how the change in price of these bonds means to the market value of the bonds your bank holds in its portfolio? Please submit your answers in D2L under Chapter 6 Assignment in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts