Question: In which instance does the taxpayer not a dependent? Question 2 of 16. Noah is a qualifying child to three taxpayers: his grandmother, whose AGI

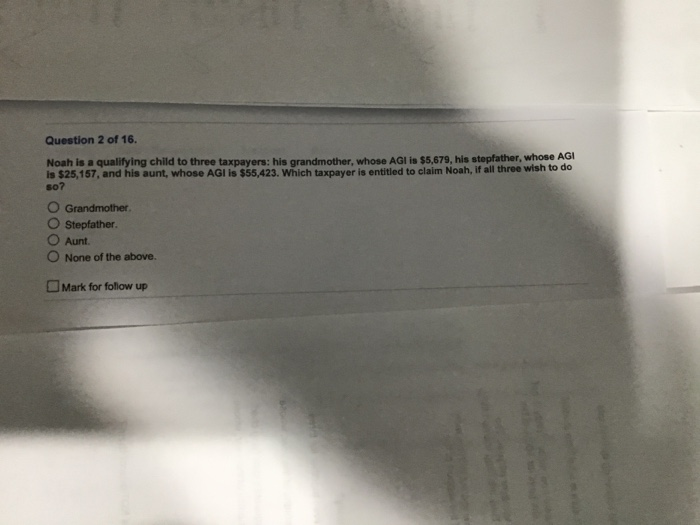

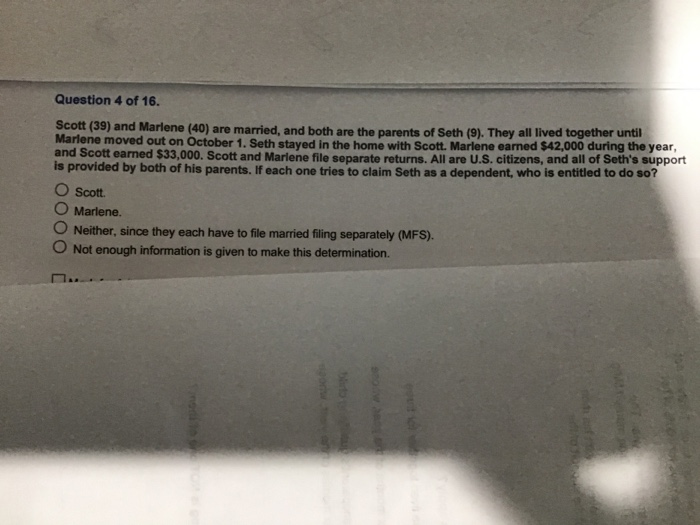

Question 2 of 16. Noah is a qualifying child to three taxpayers: his grandmother, whose AGI is $5,679, his stepfather, whose AGI Is $25,167, and his aunt, whose AGI is $55.423. Which taxpayer is entitled to claim Noah, if all three wish to do so? O Grandmother O Stepfather O Aunt O None of the above. Mark for follow up Question 4 of 16. Scott (39) and Marlene (40) are married, and both are the parents of Soth (9). They all lived together until Marlene moved out on October 1. Seth staved in the home with Scott. Marlene earned $42,000 during the year, and Scott earned $33,000. Scott and Marlene file separate returns. All are U.S. citizens, and all of Seth's support is provided by both of his parents. If each one tries to claim Seth as a dependent, who is entitled to do so? O Scott O Marlene. Neither, since they each have to file married filing separately (MFS). Not enough information is given to make this determination

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts