Question: In which step in the transaction process used by surplus lines intermedianes does the surplus lines intermediary analyze loss exposures and understand the rating process

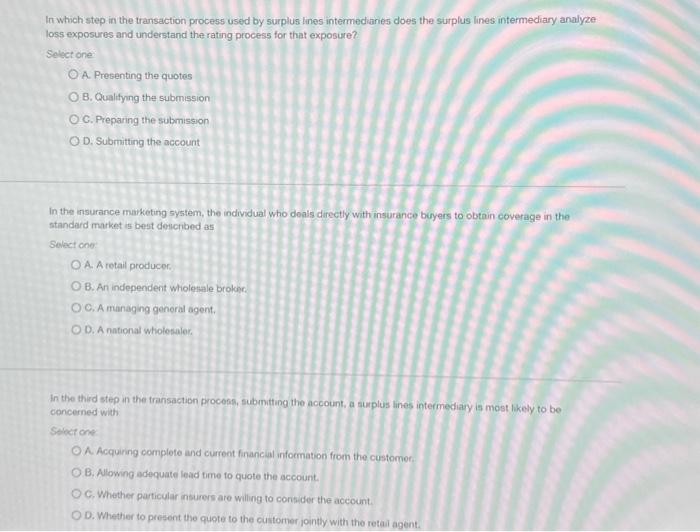

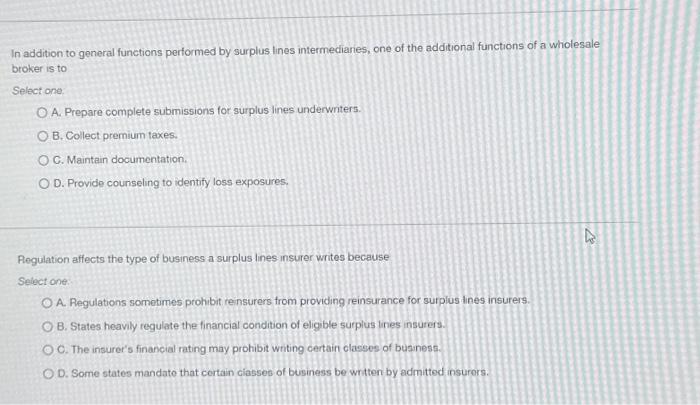

In which step in the transaction process used by surplus lines intermedianes does the surplus lines intermediary analyze loss exposures and understand the rating process for that exposure? Select one A. Presenting the quotes B. Qualifying the submission C. Preparing the submission D. Submitting the account In the insurance marketing system, the individual who deals directly with insurance buyers to obtain coverage in the standard market is best described as Select con: A. A retail producer. B. An independent wholessale broker. C. A managing general agent. D. A national wholesaler. In the third step in the transaction procoss, submitting the account, a sumplus lines intermediay is most likely to be concerned with Soloct one A. Acquiring complete and current financlal information from the customer. B. Allowing adequate lead time to quote the account. C. Whether particular insurers are wiling to corsider the account. D. Whether to present the quote to the customer jointly with the retail agent. In addition to general functions performed by surplus lines intermedianes, one of the additional functions of a wholesale broker is to Select one. A. Prepare complete submissions for surplus lines underwriters. B. Collect premium taxes. C. Maintain documentation. D. Provide counseling to identify loss exposures. Pegulation affects the type of business a surplus lines insurer writes because Select one: A. Regulations sometimes prohibit rensurers from providing reinsurance for surplus lines insurers. B. States heavily regulate the financial condition of eligible surplus lines insurers. C. The insurer's financial rating may prohibit writing certain claseses of busmess. D. Some states mandate that cortain ciasses of business be written by admitted insurors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts