Question: In year 1 , A , B , and C , each United States citizens and residents, own one - third of the stock of

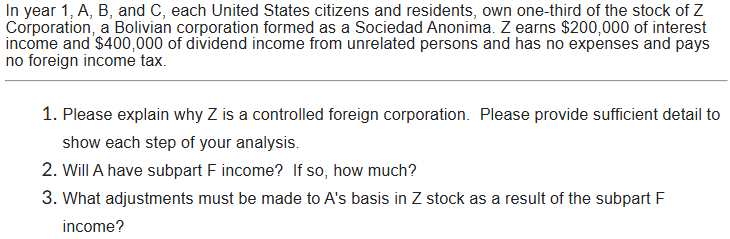

In year A B and C each United States citizens and residents, own onethird of the stock of Z Corporation, a Bolivian corporation formed as a Sociedad Anonima. Z earns $ of interest income and $ of dividend income from unrelated persons and has no expenses and pays no foreign income tax. Please explain why Z is a controlled foreign corporation. Please provide sufficient detail to show each step of your analysis. Will A have subpart F income? If so how much? What adjustments must be made to As basis in Z stock as a result of the subpart F income?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock