Question: In your chapter, refer to Case 10-1. Read the description provided and review the financial statements given on page 536-537. Calculate two (2) of the

In your chapter, refer to Case 10-1. Read the description provided and review the financial statements given on page 536-537.

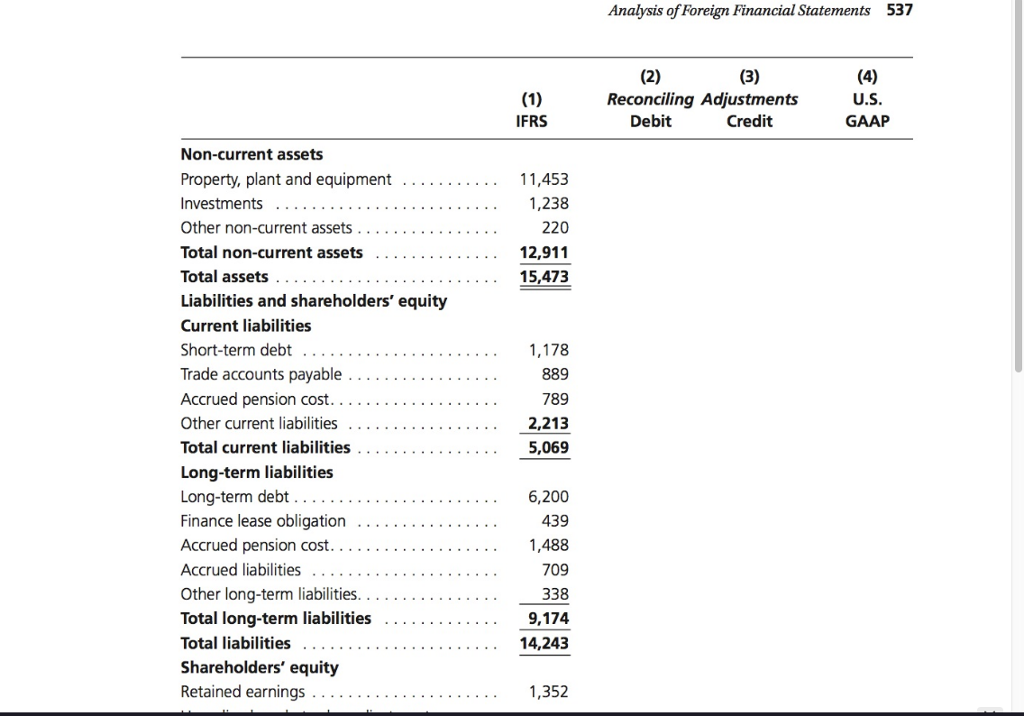

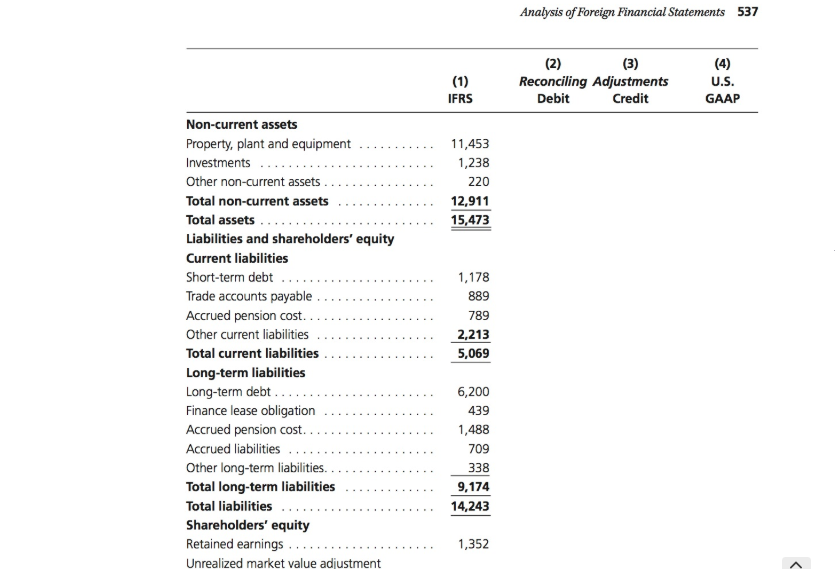

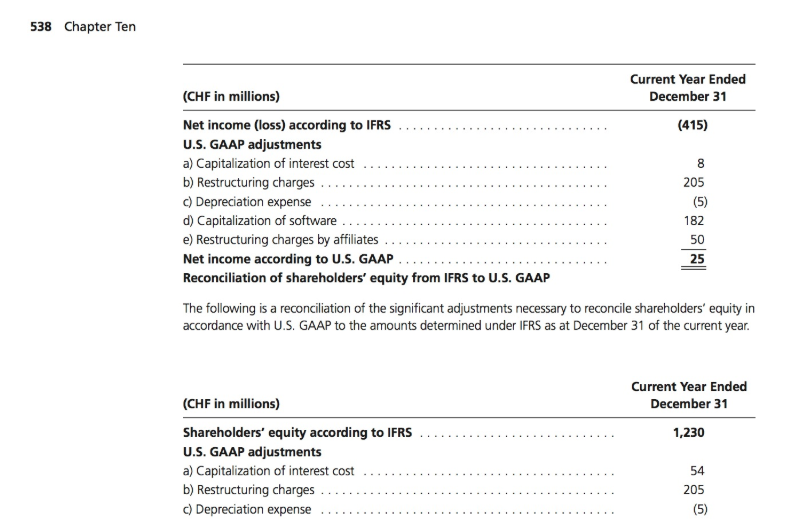

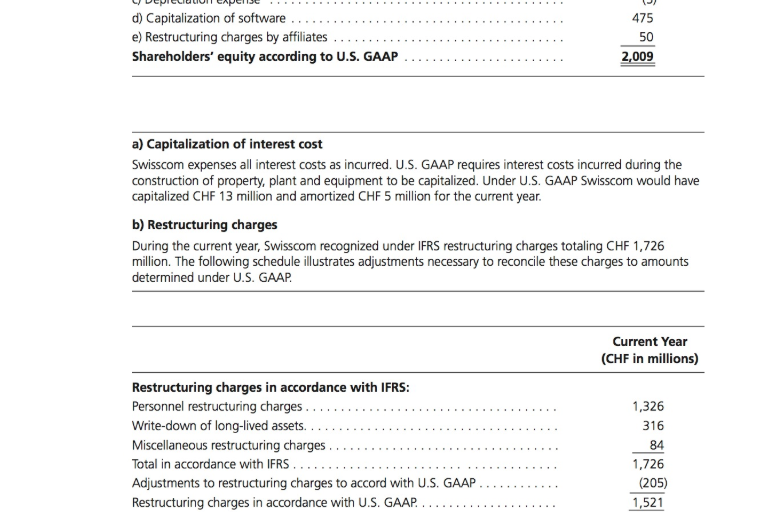

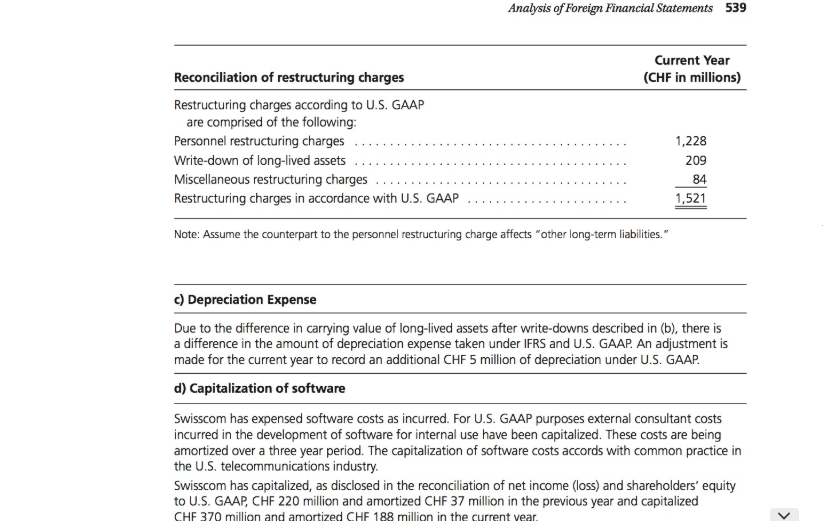

Calculate two (2) of the ratios listed under #2 of Case 10-1 under both IFRS and U.S. GAAP and determine the percentage differences between them, using IFRS ratios as the base.

Share your findings in your response.

Discuss whether these ratios are affected by the accounting standards being used and which ratios you think might be most or least affected.

Do not forget to include proper APA formatting and citation where necessary.

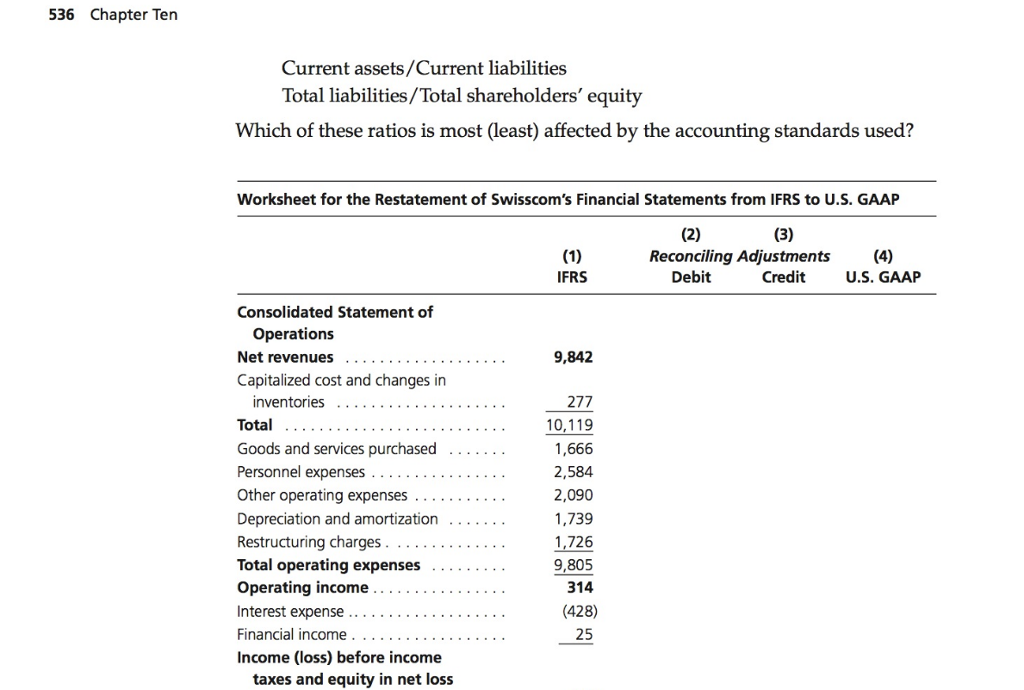

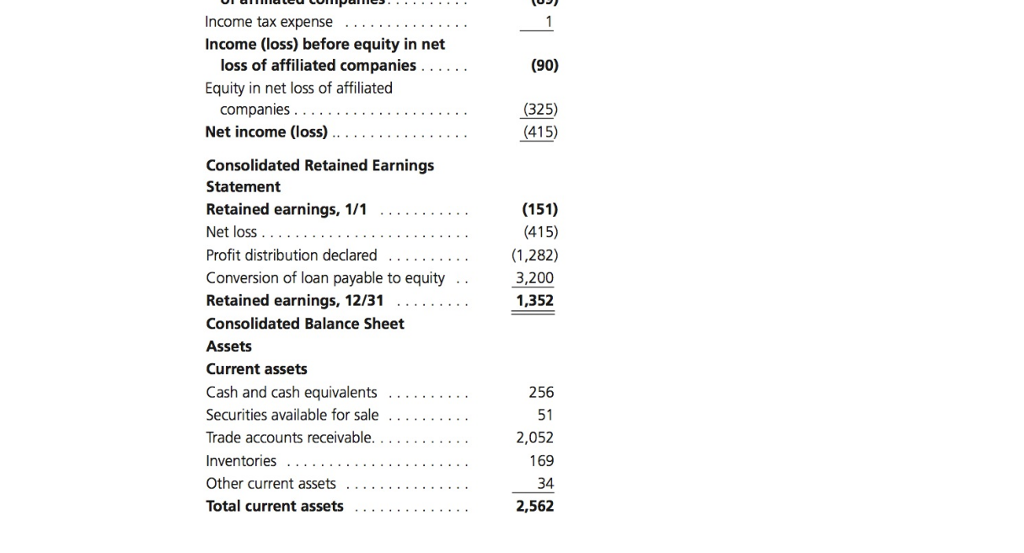

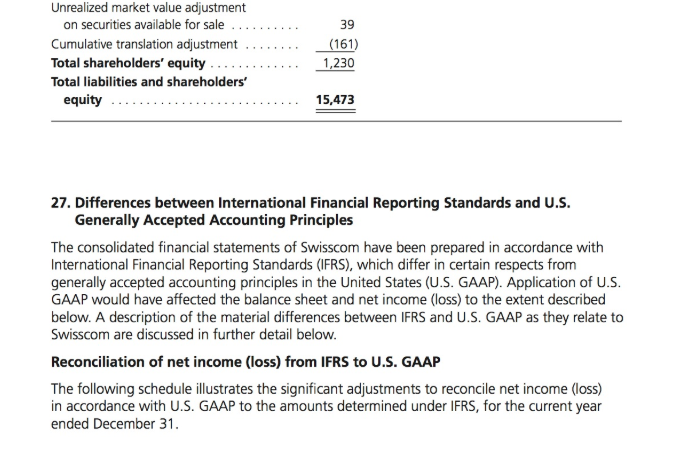

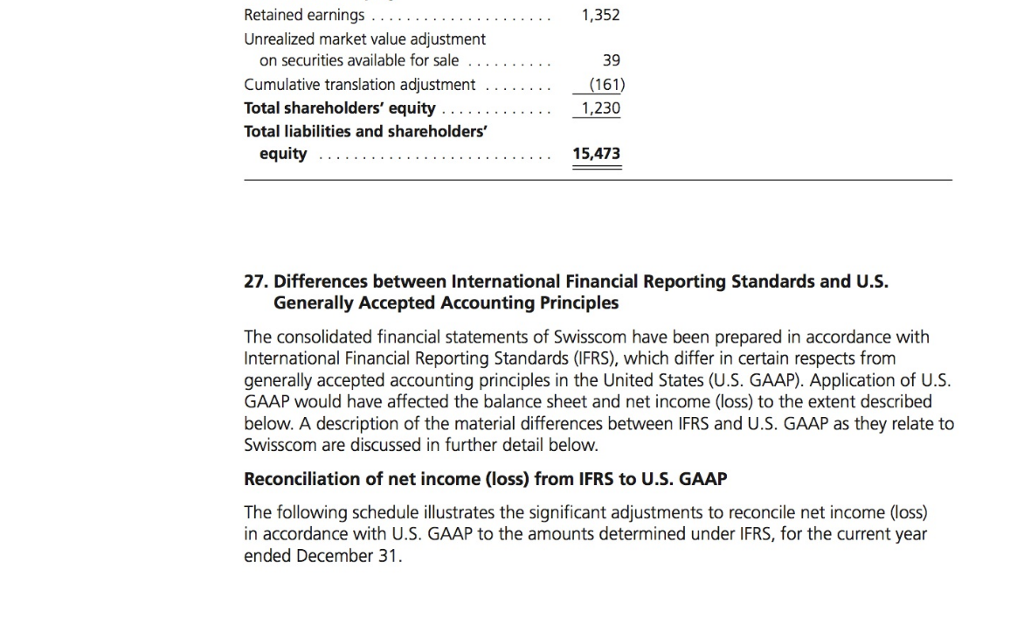

536 Chapter Ten Current assets/Current liabilities Total liabilities/Total shareholders' equity Which of these ratios is most (least) affected by the accounting standards used? Worksheet for the Restatement of Swisscom's Financial Statements from IFRS to U.S. GAAP (1) IFRS (2) (3) Reconciling Adjustments Debit Credit (4) U.S. GAAP 9,842 Consolidated Statement of Operations Net revenues ...... Capitalized cost and changes in inventories ....... Total ....... Goods and services purchased Personnel expenses. Other operating expenses ..... Depreciation and amortization ... Restructuring charges . Total operating expenses .... Operating income ... Interest expense .............. Financial income .. Income (loss) before income taxes and equity in net loss 277 10,119 1,666 2,584 2,090 1,739 1,726 9,805 314 (428) 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts