Question: in your short answers, please cite the applicable code section, regulation case or other authority in support of the analysis. please note if the answer

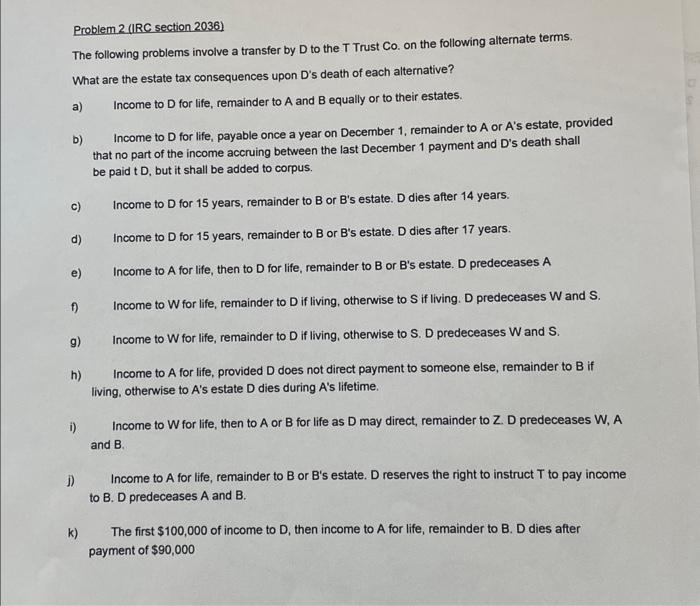

Problem 2 (IRC section 2036) The following problems involve a transfer by D to the T Trust Co. on the following alternate terms. What are the estate tax consequences upon D's death of each alternative? a) Income to D for life, remainder to A and B equally or to their estates. b) Income to D for life, payable once a year on December 1, remainder to A or A 's estate, provided that no part of the income accruing between the last December 1 payment and D's death shall be paid tD, but it shall be added to corpus. c) Income to D for 15 years, remainder to B or B's estate. D dies after 14 years. d) Income to D for 15 years, remainder to B or B's estate. D dies after 17 years. e) Income to A for life, then to D for life, remainder to B or B's estate. D predeceases A f) Income to W for life, remainder to D if living, otherwise to S if living. D predeceases W and S. g) Income to W for life, remainder to D if living, otherwise to S. D predeceases W and S. h) Income to A for life, provided D does not direct payment to someone else, remainder to B if living, otherwise to A 's estate D dies during A 's lifetime. i) Income to W for life, then to A or B for life as D may direct, remainder to Z. D predeceases W, A and B. j) Income to A for life, remainder to B or B's estate. D reserves the right to instruct T to pay income to B. D predeceases A and B. k) The first $100,000 of income to D, then income to A for life, remainder to B. D dies after payment of $90,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts