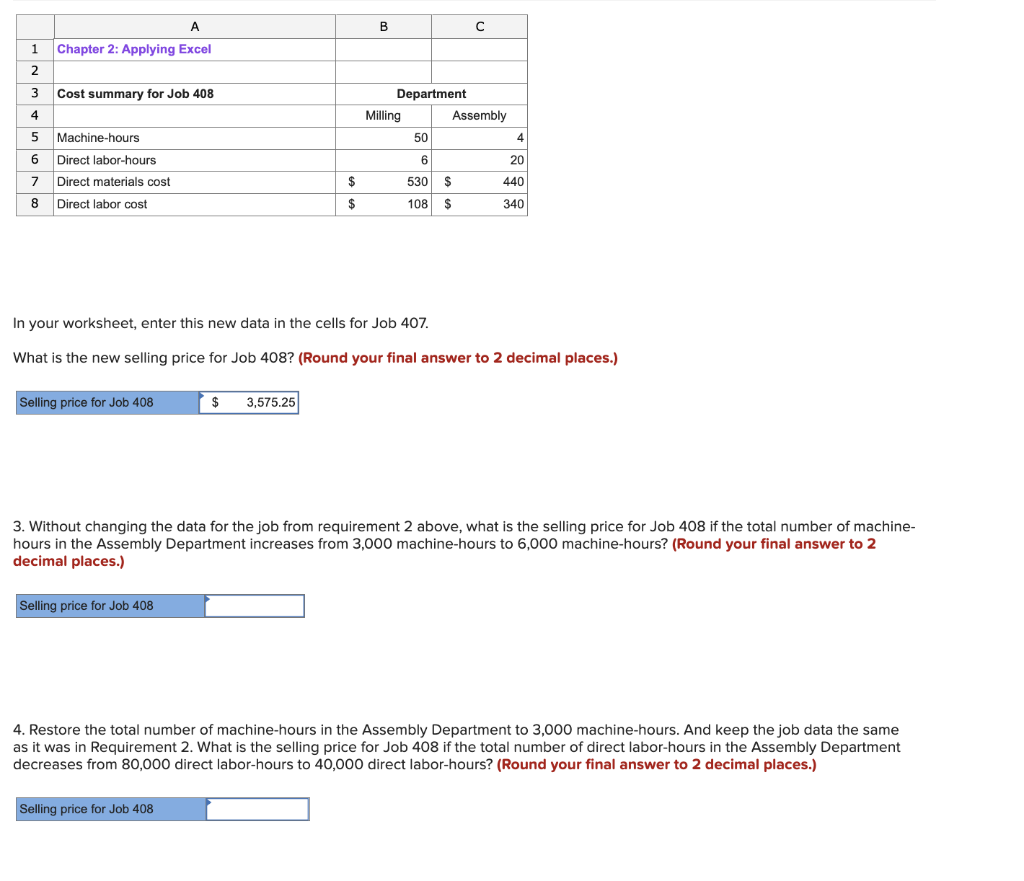

Question: In your worksheet, enter this new data in the cells for Job 407. What is the new selling price for Job 408 ? (Round your

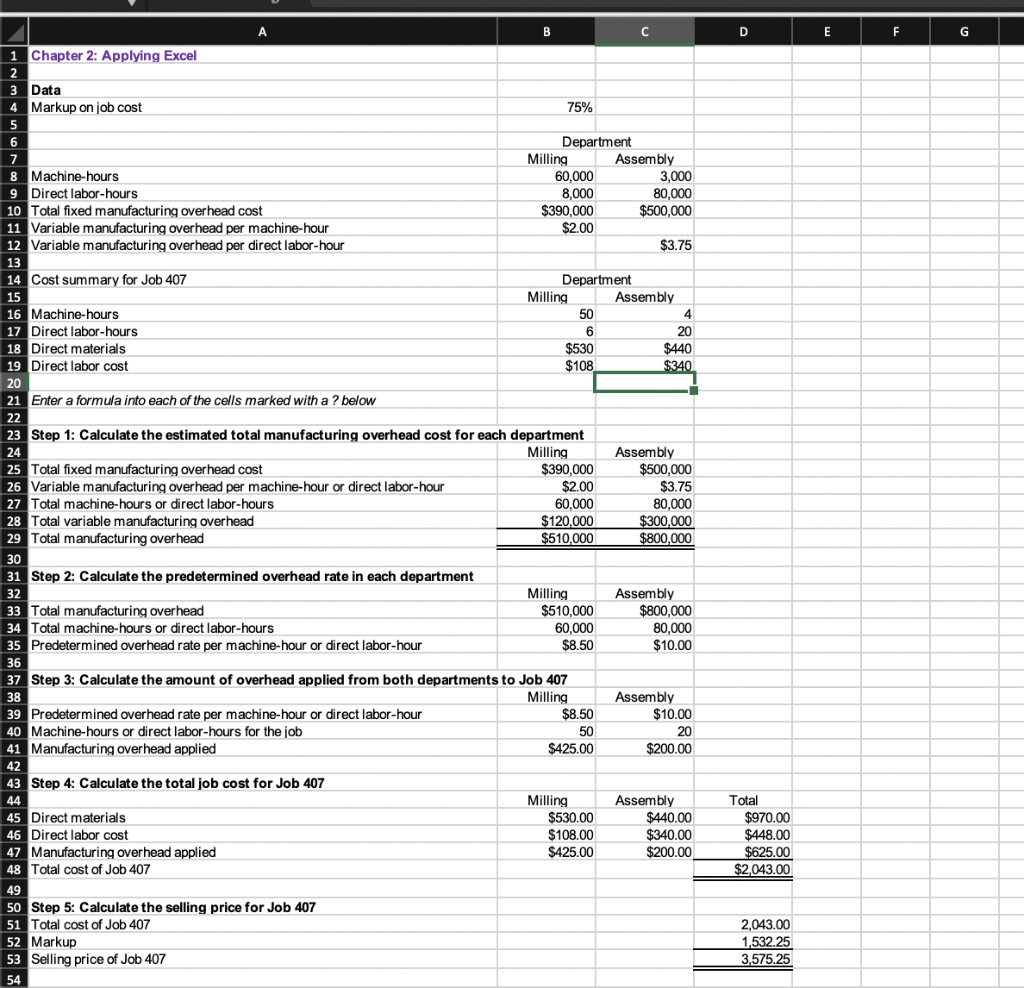

In your worksheet, enter this new data in the cells for Job 407. What is the new selling price for Job 408 ? (Round your final answer to 2 decimal places.) 3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machinehours in the Assembly Department increases from 3,000 machine-hours to 6,000 machine-hours? (Round your final answer to 2 decimal places.) 4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 40,000 direct labor-hours? (Round your final answer to 2 decimal places.) \begin{tabular}{|c|c|} \hline 1 & Chapter 2: Applying Excel \\ \hline \end{tabular} A B C D Data 4 Markup on job cost 75% 5 6 7 8 8 Machine-hours 9 Direct labor-hours 10 Total fixed manufacturing overhead cost 11 Variable manufacturing overhead per machine-hour Department 12 Variable manufacturing overhead per direct labor-hour \begin{tabular}{r|r|} \hline \multicolumn{1}{|c|}{ Milling } & \multicolumn{1}{c|}{ Assembly } \\ \hline 60,000 & 3,000 \\ \hline 8,000 & 80,000 \\ \hline$390,000 & $500,000 \\ \hline$2.00 & $3.75 \\ \hline \end{tabular} Cost summary for Job 407 Department 16 Machine-hours 17 Direct labor-hours 18 Direct materials Direct labor cost Enter a formula into each of the cells marked with a ? below 23 Step 1: Calculate the estimated total manufacturing overhead cost for each department \begin{tabular}{|l|r|r|r} \hline 24 & & Milling & \multicolumn{1}{|c}{ Assembly } \\ \hline 25 & Total fixed manufacturing overhead cost & $390,000 & $500,000 \\ \hline 26 & Variable manufacturing overhead per machine-hour or direct labor-hour & $2.00 & $3.75 \\ \hline 27 & Total machine-hours or direct labor-hours & 60,000 & 80,000 \\ \hline 28 & Total variable manufacturing overhead & $120,000 & $300,000 \\ \hline 29 & Total manufacturing overhead & $510,000 & $800,000 \\ \hline \end{tabular} Step 2: Calculate the predetermined overhead rate in each department \begin{tabular}{|l|r|r|r|} \hline 32 & & Milling & \multicolumn{1}{|c|}{ Assembly } \\ \hline 33 & Total manufacturing overhead & $510,000 & $800,000 \\ \hline 34 & Total machine-hours or direct labor-hours & 60,000 & 80,000 \\ \hline 35 & Predetermined overhead rate per machine-hour or direct labor-hour & $8.50 & $10.00 \\ \hline \end{tabular} 37 Step 3: Calculate the amount of overhead applied from both departments to Job 407 \begin{tabular}{|r|r|r|r|} \hline 38 & & Milling & Assembly \\ \hline 39 & Predetermined overhead rate per machine-hour or direct labor-hour & $8.50 & $10.00 \\ \hline 40 & Machine-hours or direct labor-hours for the job & 50 & 20 \\ \hline 41 & Manufacturing overhead applied & $425.00 & $200.00 \\ \hline \end{tabular} 42 43 Step 4: Calculate the total job cost for Job 407 \begin{tabular}{|l|l|r|r|r|} \hline 44 & & Milling & Assembly & Total \\ \hline 45 & Direct materials & $530.00 & $440.00 & $970.00 \\ \hline 46 & Direct labor cost & $108.00 & $340.00 & $448.00 \\ \hline 47 & Manufacturing overhead applied & $425.00 & $200.00 \\ \hline 48 & Total cost of Job 407 & & $625.00 \\ \hline \end{tabular} 50 Step 5: Calculate the selling price for Job 407 51 Total cost of Job 407 52 Markup 53 Selling price of Job 407 54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts