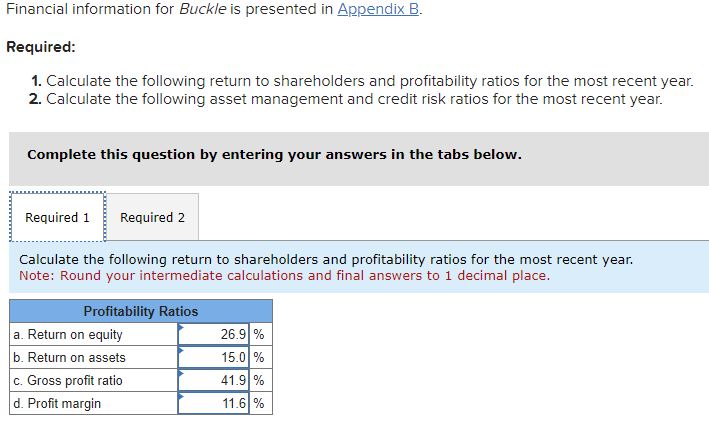

Question: -inancial information for Buckle is presented in Appendix B. Required: 1. Calculate the following return to shareholders and profitability ratios for the most recent year.

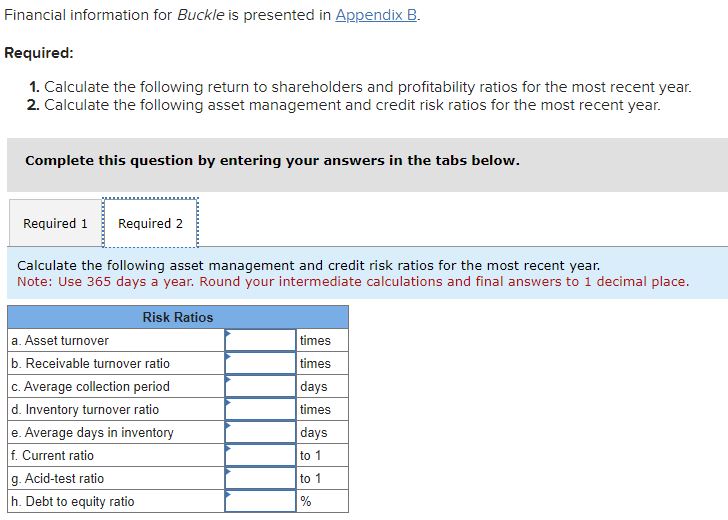

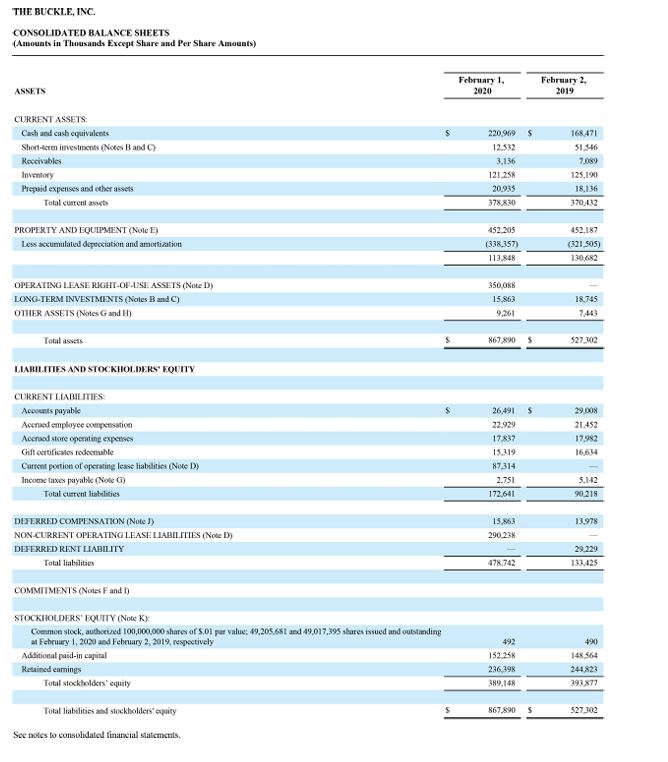

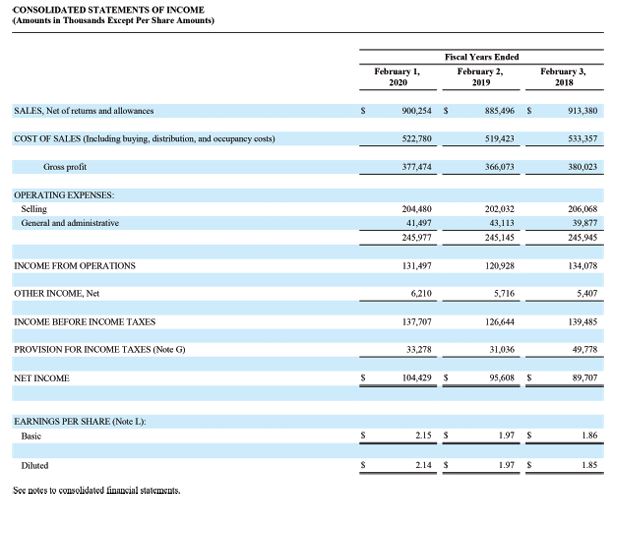

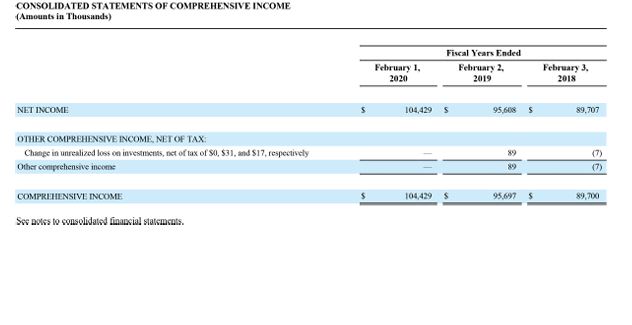

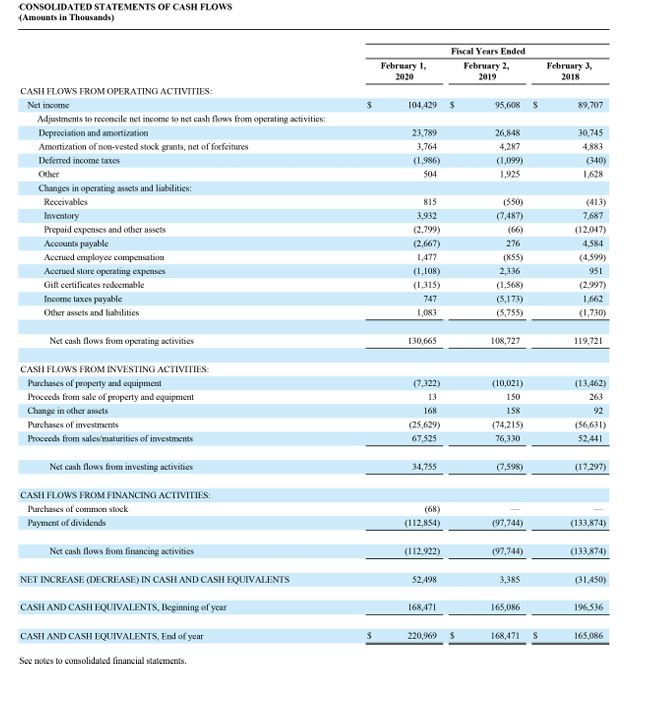

-inancial information for Buckle is presented in Appendix B. Required: 1. Calculate the following return to shareholders and profitability ratios for the most recent year. 2. Calculate the following asset management and credit risk ratios for the most recent year. Complete this question by entering your answers in the tabs below. Calculate the following return to shareholders and profitability ratios for the most recent year. Note: Round your intermediate calculations and final answers to 1 decimal place. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amouats in Thousands) CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thoasabds Except Per Share Amounts) SAIFS, Net of retums and allowances COST OF SALES (lncluding buying, distribution, and oceupancy eosts) Gross profit S Fical Years Ended February 1, February 2, 2020 2019 900,254 885,496 913,380 OPERATING EXPENSES: Sclling 522,780377,474 519,423 533,357 Gencral and adminitserative INCOME FROM OPERATIONS 131,497 120.928 380,023 OTHER INCOME, Net INCOME BEFORE INCOME TAXES \begin{tabular}{rrr} 204,480 & 202,032 & 206,068 \\ 41,497 \\ \hline 245,977 & 43,113 \\ \hline 245,145 & 39,877 \\ \hline \end{tabular} PROVISION FOR INCOME TAXES (Note G) NET INCOME EARNINGS PER SHARE (Note L) Basic Diluted \begin{tabular}{|c|c|c|c|c|} \hline & 6,210 & & 5,716 & 5,407 \\ \hline & 137,707 & & 126.644 & 139,485 \\ \hline & 33,278 & & 31,036 & 49,778 \\ \hline s & 104,429 & $ & 95,608 & 89,707 \\ \hline \end{tabular} Diluted \begin{tabular}{llllll} $ & 2.15 & $ & 1.97 & $ & 1.86 \\ & 2.14$ & 1.97 & $ & 1.85 \\ \hline \end{tabular} Soc notes to consolidated finawial statements. CONSOLIDATED STATEMENTS OF CASH FLOWS (Amounts in Thousands) CASH FLOWS FROM OPERATING ACTIVTTIES: Net income \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Fiucal Years Eaded } \\ \hline & February1,2020 & February22019 & February3,2018 \\ \hline \multirow[t]{15}{*}{5} & 104,429 & 95,608 & 89,707 \\ \hline & 23,789 & 26,848 & 30,745 \\ \hline & 3,764 & 4,287 & 4,883 \\ \hline & (1,986) & (1,099) & (340) \\ \hline & 504 & 1.925 & 1.628 \\ \hline & 815 & (550) & (413) \\ \hline & 3,932 & (7,487) & 7,687 \\ \hline & (2,799) & (66) & (12,047) \\ \hline & (2,667) & 276 & 4,584 \\ \hline & 1,477 & (855) & (4,599) \\ \hline & (1,108) & 2,336 & 951 \\ \hline & (1,315) & (1,568) & (2,997) \\ \hline & 747 & (5,173) & 1,662 \\ \hline & 1,083 & (5,755) & (1,730) \\ \hline & 130,665 & 108,727 & 119,72I \\ \hline \end{tabular} Adjustments to reconcile net income to net cash flows frem operating astivities: Depreciation and amertiration Amortization of non-vested stock grants, net of forfeitures Deferred income taxes Other Changer in operating assets and liabilities: Rectivables lnventory Prepaid expenses and otber assets Accounts payable Acerued employee compensatioa Accrued store operating expenses Gift eertificates redcemable Income taxes payable Other assets and liabilities Net eash flows from operating activities CASH FLOWS FROM INVESTING ACTIVTIES: Purchates of property and equipmend (7,322) (10,021) (13,462) Procceds from sale of property and equipment Change in odher asscts Purchases of investments Procecds from salesmaturities of imestments 13 150 263 168 158 92 (25,629) (74,215) (56,631) Proceeds from salesimaturities of investments Net eash flows from investing activities 34,755 (7,598) (17,297) CASH FLOWS FROM FINANCING ACTIVITIES: Purchises of common stock (68) Payment of dividends (112,854) (97,744) (133,874) Net cash flows from financing activities (112,922) (97,744) (133,874) NET INCREASE (DECRFASE) IN CASH AND CASH EQUIVAIENTS 52,498 3,385 (31,450) CASH AND CASH EQUIVAL.ENTS, Beginning of year 168,471165,086 196,536 CASH AND CASH EQUTVALENTS, End of year $220,969 5 168,471 165,086 See notss to consolidated finarxial statemknts. THE BUCKLE, INC. CONSOLIDATED BALANCE SHEETS (Amouats in Thousands Except Shure and Per Share Amounts) ASSETS CURRENT ASSETS: \begin{tabular}{|c|c|c|c|c|} \hline Cach acd cash equivalents & s & 220,969 & s & 168,471 \\ \hline Shot term inestmens (Notes B and C) & & 12.532 & & 51.546 \\ \hline Rockivables. & & 3,136 & & 7009 \\ \hline Inventory & & 121,258 & & 125,190 \\ \hline Preprid expenses and cher assets & & 20.935 & & 18,136 \\ \hline Total cument asods & & 378.830 & & 370,45 \\ \hline PROPERTY AND EQUIPMENT (Nole E) & & 452,205 & & 452,187 \\ \hline \multirow[t]{2}{*}{ Less sccumulated depociation and amortiation } & & (338,357) & & (321,505) \\ \hline & & 113,848 & & 130,682 \\ \hline OPERAIING LEASE RLGHT-OF-LSE ASSETS (Note D) & & 350,0ss & & - \\ \hline LONG-THRM INVESTMIENTS (Notes B and C) & & 15,863 & & 18,745 \\ \hline OTHER ASSETS (Notes G and H) & & 9,261 & & 7,44 \\ \hline Total assets & s & 867890 & \$ & 527.302 \\ \hline \end{tabular} LABIIITES AND STOCKHOLDERS' EQUTY CURRENT LLABHLMIES: Acovents payable Acerued employee coumpensation Accrued store operatine expetises. Gift ocrificines redocmuble Current portion of operating lesse liablitises (Noe D) Incone taxes payable (Note G) Totat current listalsies DEIERRED COMPENSATION (Note J) NON.CURRENT OPFRATLVO LEASE LABII.ITIES (Note D) DEFERID RENT LABH.TY Total liabelities s 26,491 5 29008 22.929 21,452 17982 17.83715.3191798216,64 87,314 2751 172,641 5.12 2,751172,641 COMMITIENTS (No4es F and D) STOCKIHOLDERS' EQUTIY (Note K): Commen steck, authcized 100,000,000 share of 5.01 pur value: 49,205,651 and 49,017,395, thares issued and outstinding at Februiry 1, 2020 and February 2, 2019, respoctively Additional paid-in cagiul Retainct earnings Total stocktbolders' equity 15.863 13.978 15,863 290,238 29,229478,742 See aotes to consolidated financial statcments. Financial information for Buckle is presented in Appendix B. Required: 1. Calculate the following return to shareholders and profitability ratios for the most recent year. 2. Calculate the following asset management and credit risk ratios for the most recent year. Complete this question by entering your answers in the tabs below. Calculate the following asset management and credit risk ratios for the most recent year. Note: Use 365 days a year. Round your intermediate calculations and final answers to 1 decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts