Question: inancial_Derivatives_MT1.pdf 1/2 100% + 0 COMPUTATIONAL PROBLEMS. 1. Consider a two period (-0,1.2) world where the stock of ABC Company is selling for $90 at

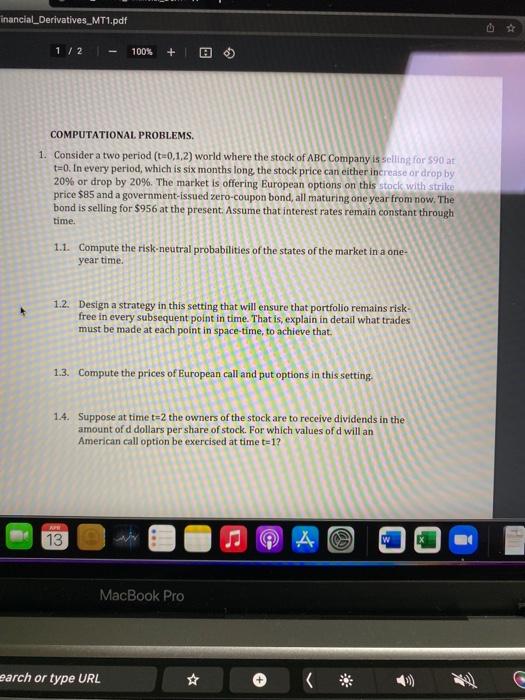

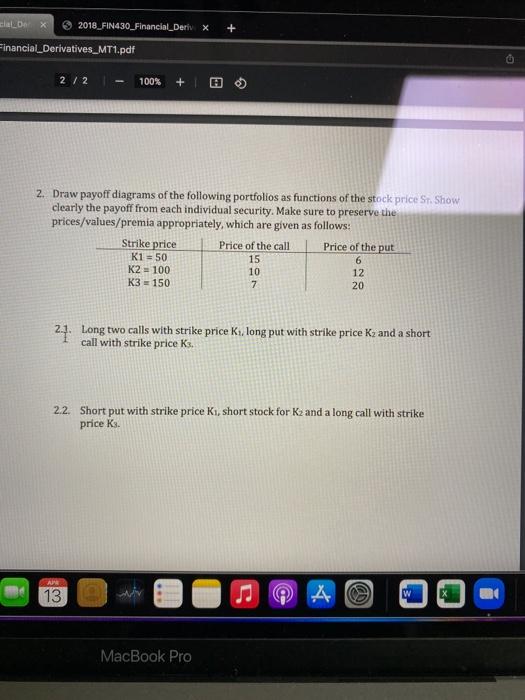

inancial_Derivatives_MT1.pdf 1/2 100% + 0 COMPUTATIONAL PROBLEMS. 1. Consider a two period (-0,1.2) world where the stock of ABC Company is selling for $90 at t=0. In every period, which is six months long the stock price can either increase or drop by 20% or drop by 20%. The market is offering European options on this stock with strike price $85 and a government-issued zero-coupon bond, all maturing one year from now. The bond is selling for $956 at the present. Assume that interest rates remain constant through time. 1.1. Compute the risk-neutral probabilities of the states of the market in a one- year time. 1.2. Design a strategy in this setting that will ensure that portfolio remains risk- free in every subsequent point in time. That is, explain in detail what trades must be made at each point in space-time, to achieve that 1.3. Compute the prices of European call and put options in this setting 1.4. Suppose at time t=2 the owners of the stock are to receive dividends in the amount of d dollars per share of stock. For which values of d will an American call option be exercised at time t=1? 13 O A @ MacBook Pro earch or type URL zlalo 2018_FIN430_Financial_DerivX + Financial_Derivatives_MT1.pdf 0 2/2 100% + 2. Draw payoff diagrams of the following portfolios as functions of the stock price Sr. Show clearly the payoff from each individual security. Make sure to preserve the prices/values/premia appropriately, which are given as follows: Strike price Price of the call Price of the put K1 = 50 15 K2 = 100 12 K3 = 150 7 6 10 20 21. Long two calls with strike price K, long put with strike price Kz and a short call with strike price Ks. 2.2. Short put with strike price K, short stock for Kz and a long call with strike price ks. AN 13 J A MacBook Pro inancial_Derivatives_MT1.pdf 1/2 100% + 0 COMPUTATIONAL PROBLEMS. 1. Consider a two period (-0,1.2) world where the stock of ABC Company is selling for $90 at t=0. In every period, which is six months long the stock price can either increase or drop by 20% or drop by 20%. The market is offering European options on this stock with strike price $85 and a government-issued zero-coupon bond, all maturing one year from now. The bond is selling for $956 at the present. Assume that interest rates remain constant through time. 1.1. Compute the risk-neutral probabilities of the states of the market in a one- year time. 1.2. Design a strategy in this setting that will ensure that portfolio remains risk- free in every subsequent point in time. That is, explain in detail what trades must be made at each point in space-time, to achieve that 1.3. Compute the prices of European call and put options in this setting 1.4. Suppose at time t=2 the owners of the stock are to receive dividends in the amount of d dollars per share of stock. For which values of d will an American call option be exercised at time t=1? 13 O A @ MacBook Pro earch or type URL zlalo 2018_FIN430_Financial_DerivX + Financial_Derivatives_MT1.pdf 0 2/2 100% + 2. Draw payoff diagrams of the following portfolios as functions of the stock price Sr. Show clearly the payoff from each individual security. Make sure to preserve the prices/values/premia appropriately, which are given as follows: Strike price Price of the call Price of the put K1 = 50 15 K2 = 100 12 K3 = 150 7 6 10 20 21. Long two calls with strike price K, long put with strike price Kz and a short call with strike price Ks. 2.2. Short put with strike price K, short stock for Kz and a long call with strike price ks. AN 13 J A MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts