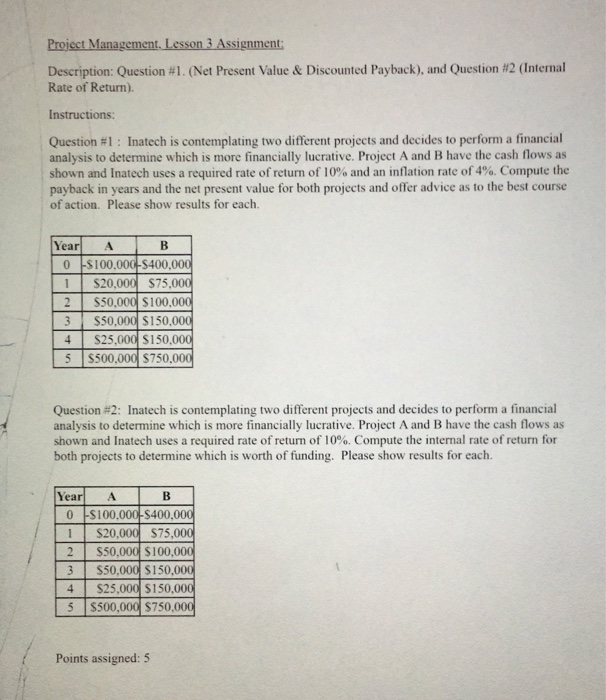

Question: Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative. Project A and B have

Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative. Project A and B have the cash flows as shown and Inatech uses a required rate of return of 10% and an inflation rate of 4%. Compute the payback in years and the net present value for both projects and offer advice as to the best course of action. Please show results for each. Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative. Project A and B have the cash flows as shown and Inatech uses a required rate of return of 10%. Compute the internal rate of return for both projects to determine which is worth of funding. Please show results for each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts