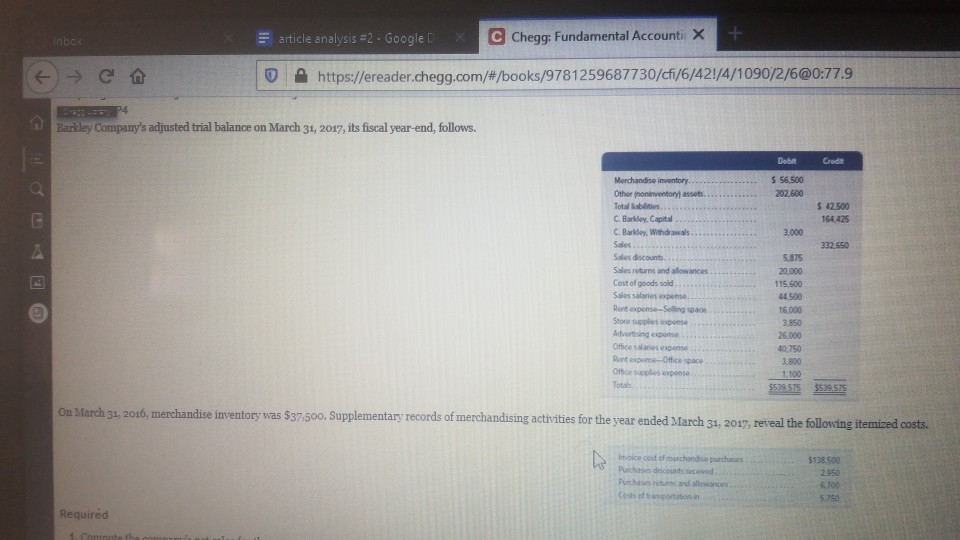

Question: Inbox = article analysis #2 - Google D X C Chegg: Fundamental Accountil X F C O A https://ereader.chegg.com/#/books/9781259687730/cfi/6/42/4/1090/2/6@0:77.9 Barkley Company's adjusted trial balance on

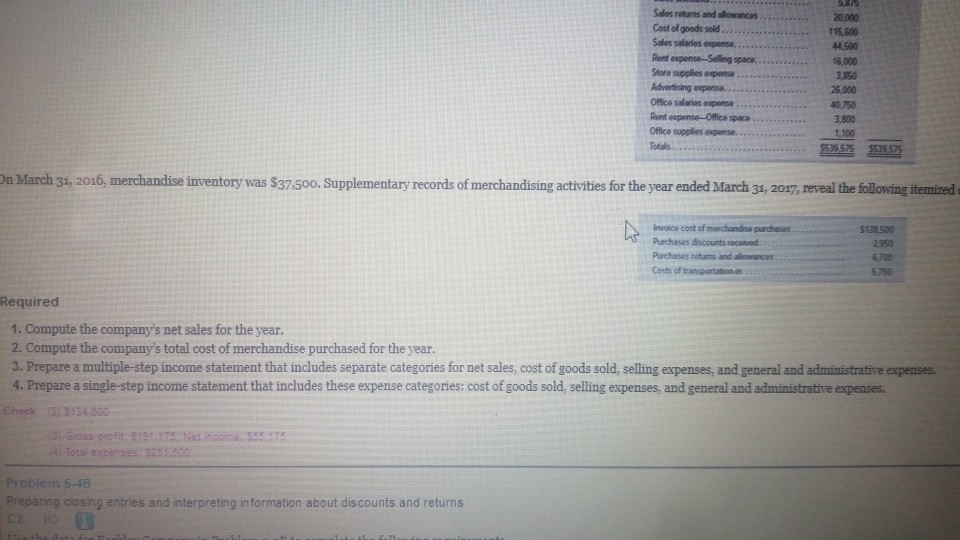

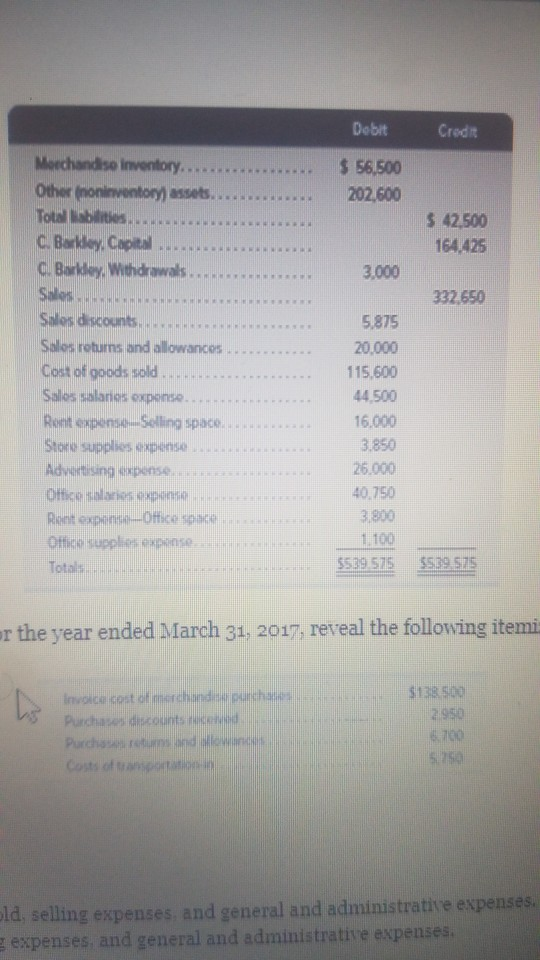

Inbox = article analysis #2 - Google D X C Chegg: Fundamental Accountil X F C O A https://ereader.chegg.com/#/books/9781259687730/cfi/6/42/4/1090/2/6@0:77.9 Barkley Company's adjusted trial balance on March 31, 2017, its fiscal year-end, follows. Debate Crocs $ 56,500 202.600 $ 42,500 164.425 3.000 332.650 Merchandise inventory....... Other noninventory assets........ Total abilities C. Barkley, Capital C. Barkley, Withdrawals Sales Sales discounts Sales returns and a lowances Cost of goods sold Sales salaries expense Rent pense-Selling Store Supplies expense Advertisingen Office is expens Rent expense-Office Space Office Supplies ponte 5.875 20,000 115.600 44.500 16.000 3.850 25.000 40.750 3930 1,100 On March 31, 2016, merchandise inventory was $37500, Supplementary records of merchandising activities for the year ended March 31, 2017, reveal the following itemized costs. Invoice cost of merchandise purchases Purchases desconoce Purchase and allowances Costs of transportation in $138.500 2.950 5190 Required 4. Commute the commumtantanen Starrimadam. Cost of goods sold.............. Sales sales expense Pont expense-Sing ......... Store supplies ..... .. Advertising expense. Office sores expense Rent pense-Office Space Office supplies 20.000 115.500 44500 16.000 250 $519.575 On March 31, 2016, merchandise inventory was $37500. Supplementary records of merchandising activities for the year ended March 31, 2017, reveal the following itemized involow cost of merchandise purchases Purchases discounts received Purchase returns and allowances Costs of transportation 5132500 2.950 6.700 5.750 Required 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Check $134.800 Gross profit 3191.175. Net Incomas Problem 5-48 Prepanng closing entries and interpreting information about discounts and returns Credit Debit $ 56,500 202.600 $ 42,500 164,425 3,000 332.650 Merchandise inventory..... Other (noninventory) assets.... Total sites. C. Barkley, Capital C. Barkday Withdrawals Shes . . Soos discounts Salos returns and allowances Cost of goods sold Sales salaries oxponse... Rent expenselling space Sare supplies expense Advertising expenses Ofic - t x- . uplo Totals 5.875 20.000 115.500 44.500 16.000 3.850 26.000 40.750 3.800 1 100 $539.575 5599 STE or the year ended March 31, 2017, reveal the following itemi $138.500 2950 Invoice cost of merchandit purcha Purchases discounts received Purchase and low Costs of transport 6700 old, selling expenses and general and administrative expenses. expenses, and general and administrative expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts