Question: In-Class Assignment 4 April 4, 2017 The following problem concerns chapter 22, objective 5: Compute nonseparately stated income and identify stated item. Required: Use the

In-Class Assignment 4

April 4, 2017

The following problem concerns chapter 22, objective 5: Compute nonseparately stated income and identify stated item.

Required: Use the data in the problem below and determine the nonseparately stated income or loss for the year. Present your determination in good form. This means all amounts must be labeled in proper order.

Problem----The profit and loss statement of Argos Inc., an S Corporation, shows $150,000 of book income. Argos is owned equally by 5 shareholders. The following items are included in book income. (Options: You may schedule the nonseparately (ordinary income) items directly or deduct the separately stated items from book income. See pages 22-10 & 11 of your text).

| Cost of Goods Sold | ($60,000) |

| Tax Exempt Interest | $1,000 |

| Sales | $188,000 |

| Dividends Received | $12,000 |

| Selling Expenses | ($10,000) |

| Long-Term Capital Gain | $6,000 |

| Depreciation Recapture Income | $2,000 |

| 1231 Gain | $7,500 |

| Long-Term Capital Loss | ($4,000) |

| Administrative Expenses | ($20,000) |

| Charitable Contributions | ($2,500) |

| Investment Income | $32,000 |

| Investment Expense | ($2,000) |

|

|

|

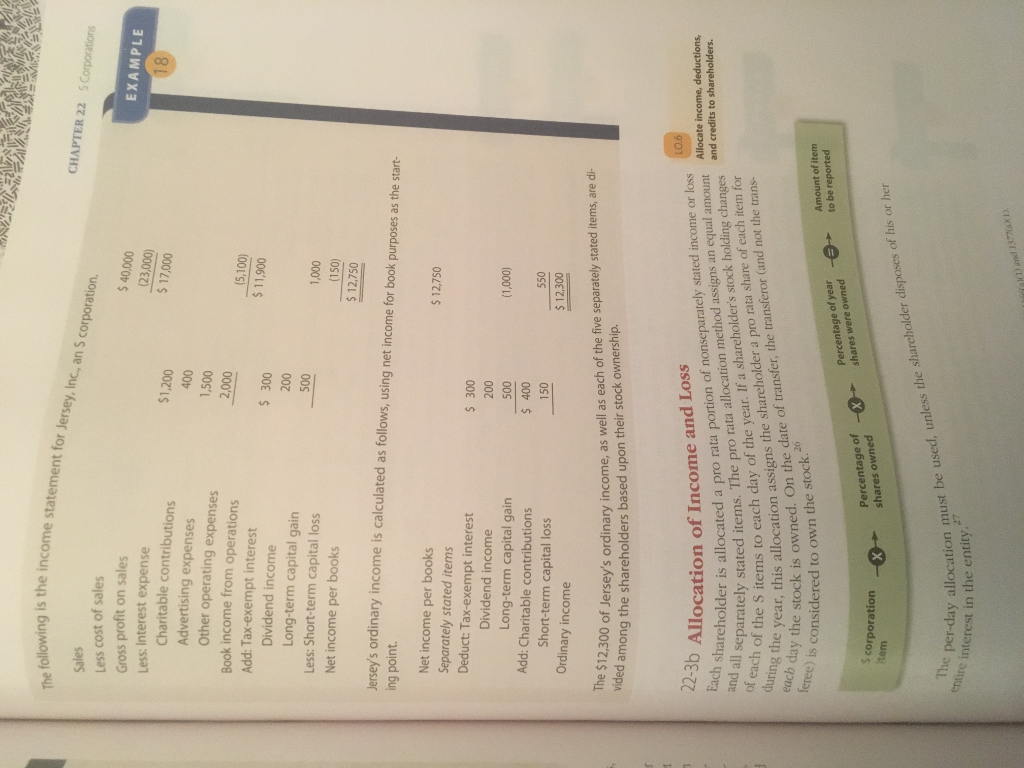

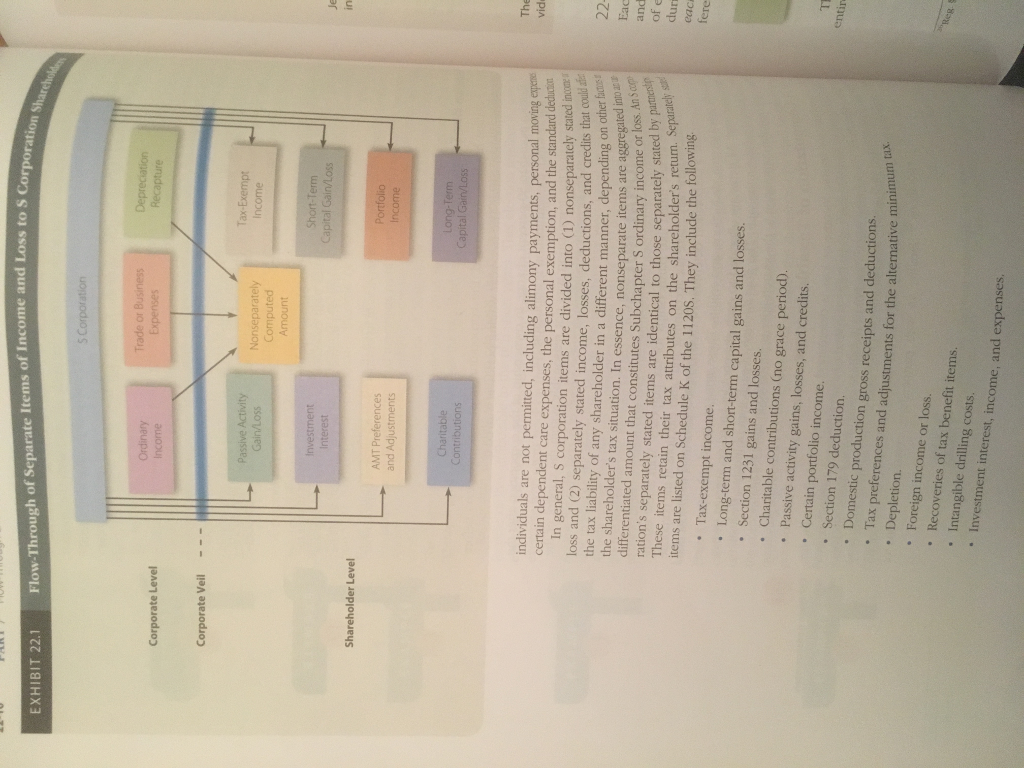

the income statement for Jersey, an Inc, S corporation. ne following is CHAPTER 22 SCorporations Sales Less cost of sales Gross profit on sales EXAMPLE Less: Interest expense Charitable contributions Advertising expenses Other operating expenses Book income from operations Add: Tax exempt interest Dividend income Long-term capital gain Less: Short-term capital loss Net income per books 50 12,750 Jersey's ordinary income is calculated as follows, using net income for book purposes as the start- Net income per books 12,750 Separately stated items Deduct: Tax exempt interest 300 Dividend income Long-term capital gain Add: Charitable contributions 400 550 Short-term capital loss 150 12,300 Ordinary income The $12,300 ordinary income, as well as each of the five separately stated items, are di vided of shareholders upon their stock ownership. among the based 22-3b of Income and of stated income or loss and credits to shareholders. Allocate income, deductions, Each shareholder a pro portion method s an equal and separately stated items. pro rata allocat stock holding changes is ocated each of year, this allocation The of the a shareholder's share of not the trains. ring the to each the shareholder a transferor (and each item If stock is On the date of the eree) is considered to own the st Amount of item to be reported Percentage of year owned shares Percentage of shares orporation per-day allocation must be used, unless the shareholder disposes of his or her e interest in the en

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts