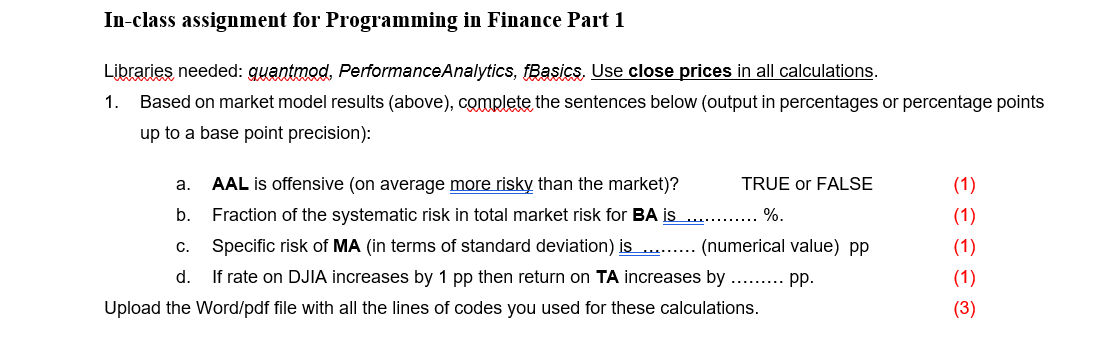

Question: In-class assignment for Programming in Finance Part 1 Libraries needed: quantmod, Performance Analytics, fBasics. Use close prices in all calculations. 1. Based on market model

In-class assignment for Programming in Finance Part 1 Libraries needed: quantmod, Performance Analytics, fBasics. Use close prices in all calculations. 1. Based on market model results (above), complete the sentences below (output in percentages or percentage points up to a base point precision) a. AAL is offensive (on average more risky than the market)? TRUE or FALSE b. Fraction of the systematic risk in total market risk for BA is %. Specific risk of MA (in terms of standard deviation) is (numerical value) pp d. If rate on DJIA increases by 1 pp then return on TA increases by ......... pp. Upload the Word/pdf file with all the lines of codes you used for these calculations. EEEE C. (3) In-class assignment for Programming in Finance Part 1 Libraries needed: quantmod, Performance Analytics, fBasics. Use close prices in all calculations. 1. Based on market model results (above), complete the sentences below (output in percentages or percentage points up to a base point precision) a. AAL is offensive (on average more risky than the market)? TRUE or FALSE b. Fraction of the systematic risk in total market risk for BA is %. Specific risk of MA (in terms of standard deviation) is (numerical value) pp d. If rate on DJIA increases by 1 pp then return on TA increases by ......... pp. Upload the Word/pdf file with all the lines of codes you used for these calculations. EEEE C. (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts