Question: In-class Exercise 7 1. Random price movements indicate A. irrational markets B. that prices cannot equal fundamental values C. that technical analysis to uncover trends

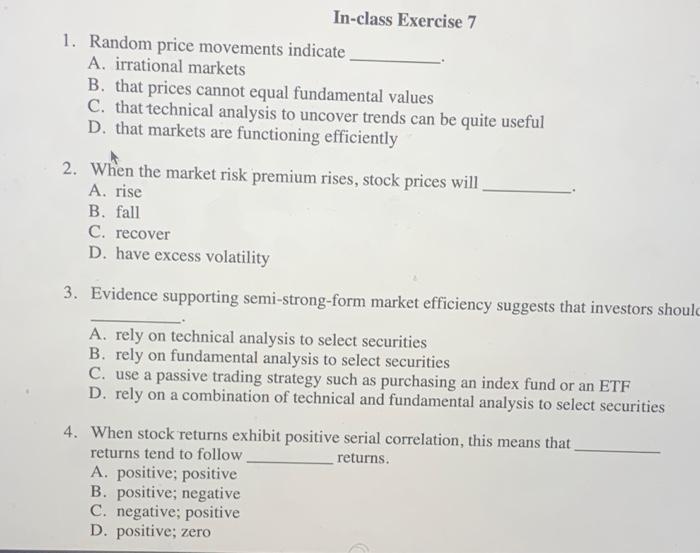

In-class Exercise 7 1. Random price movements indicate A. irrational markets B. that prices cannot equal fundamental values C. that technical analysis to uncover trends can be quite useful D. that markets are functioning efficiently 2. When the market risk premium rises, stock prices will A. rise B. fall C. recover D. have excess volatility 3. Evidence supporting semi-strong-form market efficiency suggests that investors should A. rely on technical analysis to select securities B. rely on fundamental analysis to select securities C. use a passive trading strategy such as purchasing an index fund or an ETF D. rely on a combination of technical and fundamental analysis to select securities 4. When stock returns exhibit positive serial correlation, this means that returns tend to follow returns. A. positive; positive B. positive; negative C. negative; positive D. positive; zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts