Question: In-Class problem - Shareholder effects of three entity types. Samaya helps forms Fish Ltd with a contribution of equipment with a FMV of $200,000 and

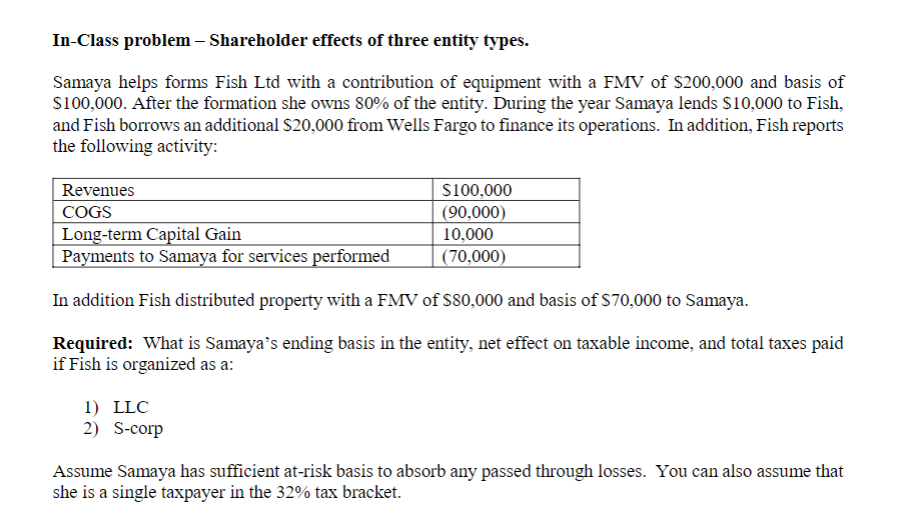

In-Class problem - Shareholder effects of three entity types. Samaya helps forms Fish Ltd with a contribution of equipment with a FMV of $200,000 and basis of $100,000. After the formation she owns 80% of the entity. During the year Samaya lends $10,000 to Fish, and Fish borrows an additional $20,000 from Wells Fargo to finance its operations. In addition, Fish reports the following activity: Revenues $100,000 COGS (90,000) Long-term Capital Gain 10,000 Payments to Samaya for services performed (70,000) In addition Fish distributed property with a FMV of $80,000 and basis of $70,000 to Samaya. Required: What is Samaya's ending basis in the entity, net effect on taxable income, and total taxes paid if Fish is organized as a: 1) LLC 2) S-corp Assume Samaya has sufficient at-risk basis to absorb any passed through losses. You can also assume that she is a single taxpayer in the 32% tax bracket

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts