Question: Include a flowchart or pseudo code to understand the process and thinking tax. The tax is rite a program that can be used to calculate

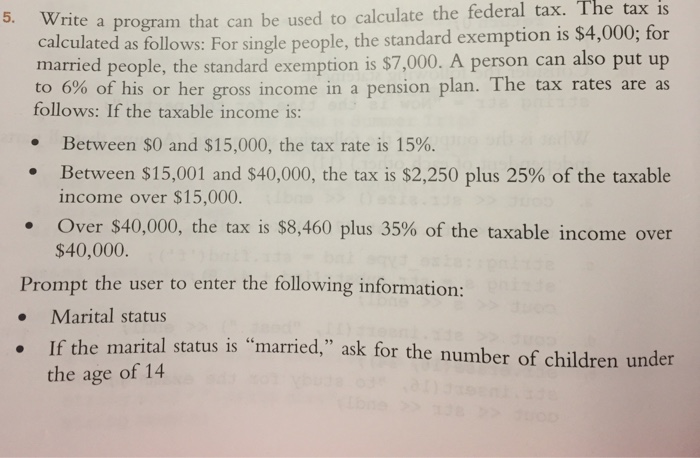

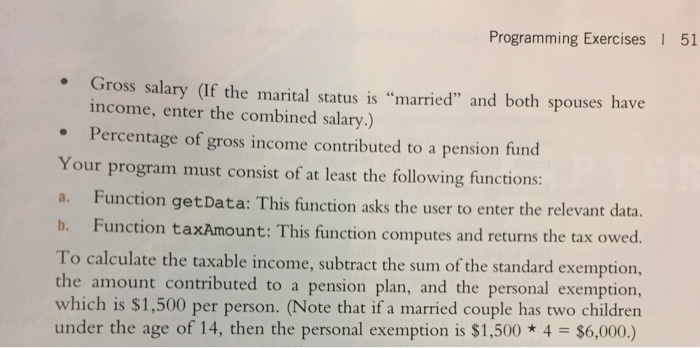

tax. The tax is rite a program that can be used to calculate the federal calculated as follows: For single people, the standard exemption is $4,000; for married people, the standard exemption is $7,000. A person can also put up to 6% of his or her gross income in a pension plan. The tax rates are as follows: If the taxable income is: 5. W Between $0 and $15,000, the tax rate is 15%. Between $15,001 and $40,000, the tax is $2,250 plus 25% of the taxable income over $15,000. Over $40,000, the tax is $8,460 plus 35% of the taxable income over $40,000. Prompt the user to enter the following information: .Marital status al status is "married," ask for the number of children under the age of 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts