Question: INCLUDE ALL SUPPORTING CALCLUATIONS please include all supporting calculations Question 2 (25 points) On January 1, 2022, Bunk Corporation issued $160,000,00 of 8-year, 9% bonds

ALL SUPPORTING CALCLUATIONS

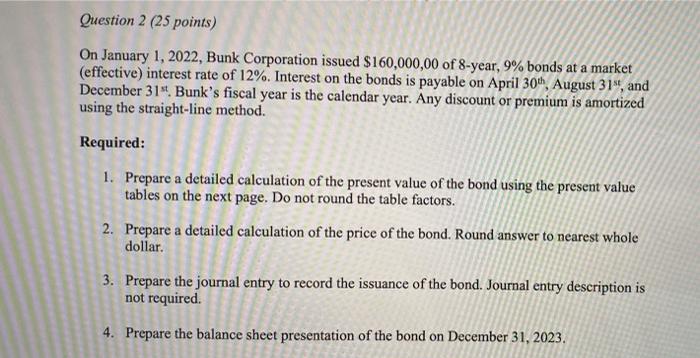

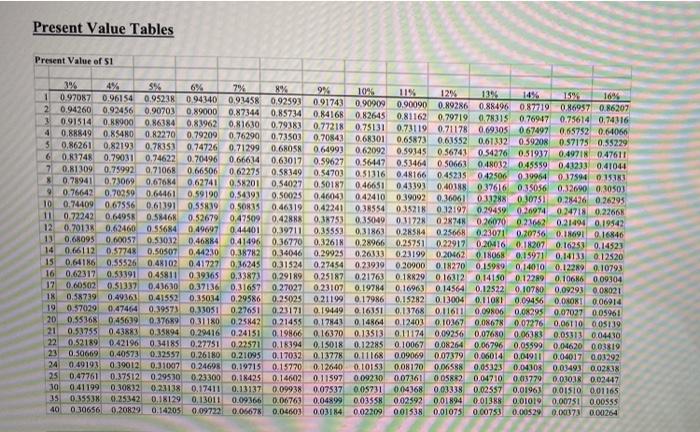

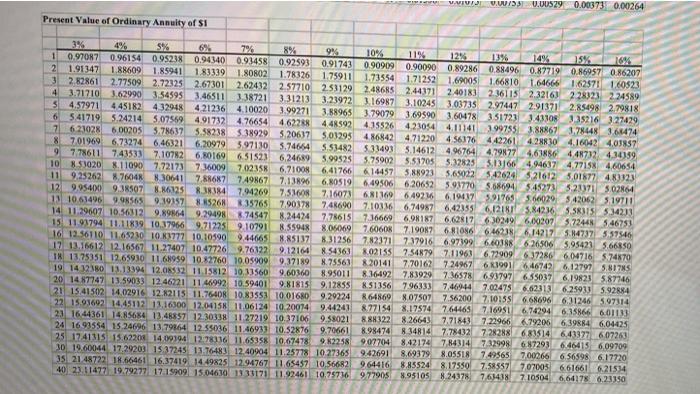

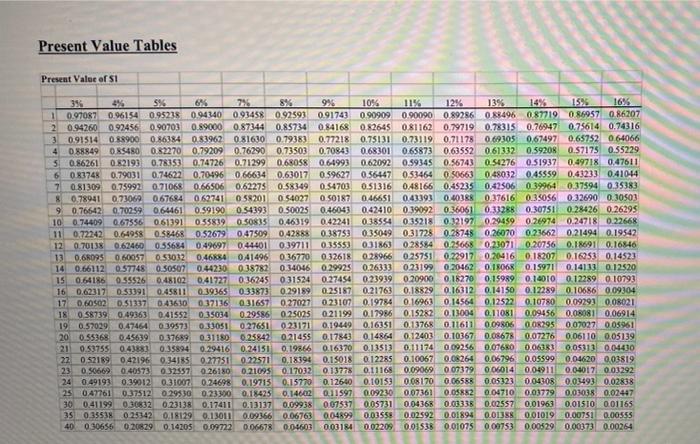

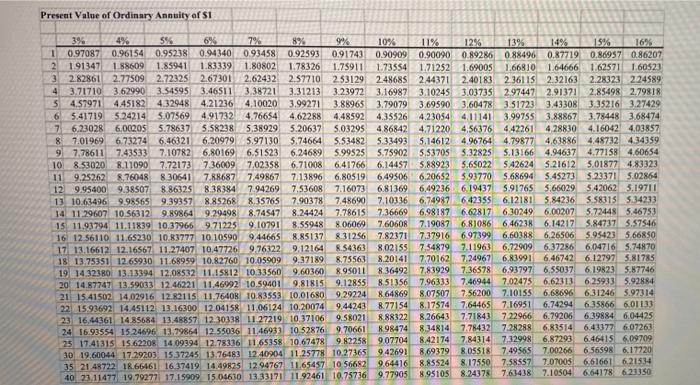

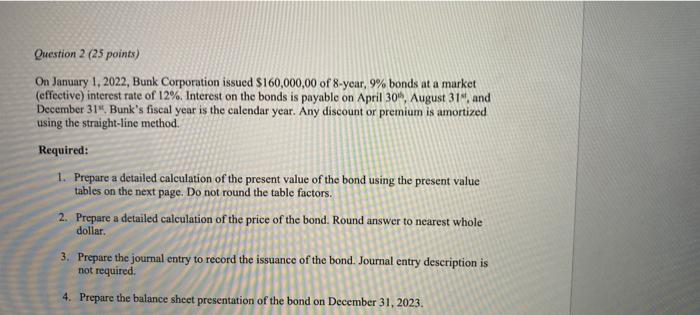

Question 2 (25 points) On January 1, 2022, Bunk Corporation issued $160,000,00 of 8-year, 9% bonds at a market (effective) interest rate of 12%. Interest on the bonds is payable on April 30th, August 31st, and December 31st. Bunk's fiscal year is the calendar year. Any discount or premium is amortized using the straight-line method. Required: 1. Prepare a detailed calculation of the present value of the bond using the present value tables on the next page. Do not round the table factors. 2. Prepare a detailed calculation of the price of the bond. Round answer to nearest whole dollar. 3. Prepare the journal entry to record the issuance of the bond. Journal entry description is not required. 4. Prepare the balance sheet presentation of the bond on December 31, 2023. Present Value Tables Present Value of $1 3% 4% 5% 6% 7% 8% 11% 12% 15% 16% 1 0.97087 0.96154 0.95238 0.54276 0.51937 0.48032 0.45559 042506 0.399564 037616 0.35056 0.49718 047611 043233 0.41044 0.37594 035383 0.32690 0.30503 0.39092 0.36061 033288 030751 9% 10% 13% 14% 0.94340) 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 2 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.78315 0.76947 0.75614 0.74316 3 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75131 4 0.73119 0.71178 0.69305 067497 0.65752 0.64066 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.61332 0.59208 0.57175 0.55229 5 0.86261 0,82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 6 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 050663 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.78941 0.73069 0.67684 0,62741 0.58201 0,54027 0.50187 0.46651 043393 0.40388 0.76642 0.70259 0.64461 0.59190 0,54393 0.50025 0,46043 0.42410 0.28426 0.26295 10 0.74409 0.67556 0.61391 0,55839 0.50835 0.46319 0,42241 0.38554 0.35218 0.32197 0.29459 0.26974 0.24718 0.22668 11 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0,38753 0.35049 0.31728 028748 0.26070 0.23662 0.21494 0.19542 12 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.355 0,315 0.28584 0.25668 0.23071 0.20756 0.18691 0,16846 13 0.68095 0.60057 0.53032 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.20416 0.18207 0.16253 0.14523 14 0.66112 0.57748 0.50507 0,44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 018068 0.15971 0,14133 0.12520 15 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.15989 0.14010 0.12289 0.10793 16 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 016312 0,14150 0.12289 0.10686 0.09304 17 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19784 0.16963 0.14564 0.12522 0.10780 0.09293 0.08021 18 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.11081 0.09456 0.08081 0.06914 19 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.09806 0.08295 0.07027 0.05961 20 0.55368 045639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.08678 007276 0.06110 0.05139 21 0.53755 0.43883 0.35894 0.29416 0.24151 0.19866 0.16370 0.13513 0.11174 0,09256 0,07680 0.06383 0.05313 0.04430 22 0.52189 042196 0.34185 0.27751 0.22571 0.18394 0,15018 23 0.50669 0.40573 0.32557 0.26180 0.21095 0.17032 0.13778 24 0.49193 0.39012 0.31007 0.24698 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 0.05323 0.04308 0.03493 0.02838 25 0,47761 0.37512 0.29530 0.23300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 0.03038 0.02447 30 041199 0.30832 0.23138 0.17411 0.13137 0.09938 0.07537 005731 004368 0.03338 0.02557 0.01963 0.01510 001165) 35 0.35538 0.25342 0.18129 0,13011 0.09366 0.06763 0.04899 0.03558 0.02592 0.01894 0.01388 0.01019 0.00751 0.00555 40 0.30656) 0,20829 0.14205 0.09722 0.06678 0.04603 0.03184 0.02209 001538 0.01075 0.00753 0.00529 0.00373 0.00264 0.12285 0.10067 0,08264 0.06796 0.05599 0.04620 0.03819 0.11168 0.09069 0.07379 0.06014 0.04911 0.04017 0.03292 753 0.00329 0.00373 0.00264 Present Value of Ordinary Annuity of $1 4% 11% 13% 12% 14% 15% 16% 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 1,69005 1.66810 1.64666 1.62571 1.60523 2.40183 2.36115 2.32163 228323 224589 3.03735 2.97447 2.91371 2.85498 2.79818 3.60478 351723 3.43308 3.35216 3.27429 4.11141 3.99755 3.88867 3.78448 3.68474 4.56376 442261 4.28830 4.16042 4.03857 4.21236 5% 6% 7% 8% 9% 1 10% 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 2 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 3 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710 2.53129 2.48685 2.44371 4 3.71710 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16987 3.10245 5 4.57971 4.45182 4.32948 4.10020 3.99271 3.88965 3.79079 3.69590 6 541719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 7 4,23054 6.23028 6.00205 5.78637 5.58238 5.38929 5.20637 5,03295 8 4.86842 4.71220 7,01969 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 9 7.78611 7.43533 7.10782 6.80169 5.14612 4.96764 479877 4.63886 4.48732 4.34359 6.51523 6.24689 5.99525 10 8 53020 8.11090 7.72173 5.75902 5.53705 5.32825 5.13166 4.94637 4.77158 4.60654 7.36009 7.02358 6.71008 6.41766 614457 5.88923 5.65022 542624 521612 5,01877 4.83323 11 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 12 9.95400 9.38507 8.86325 6.49506 6.20652 5.93770 5.68694 5.45273 5.23371 5.02864 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 591765 566029 542062 519711 13 10.63496 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6,74987 6,42355 6,12181 5.84236 5.58315 5.34233 14 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 15 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 6,98187 6.62817 630249 600207 5.72448 546753 8.06069 7.60608 7.19087 681086 646238 6.14217 5.84737 5.57546 16 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 6.60388 17 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 6.26506 5.95423 5.66850 8.54363 8.02155 18 13.75351 12.65930 11.68959 10.82760 10.05909 7.54879 7.11963 6.72909 637286 604716 5.74870 9.37189 8.75563 8.20141 7.70162 7.24967 6X3991 646742 6.12797 5.81785 19 14 32380 13.13394 12.08532 11.15812 10.33560 9.60360 8.95011 8.36492 7,83929 7.36578 693797 6.55037 6.19823 5.87746 20 14.87747 13.59033 12.46221 11 46992 10.59401 9.81815 9.12855 8.51356 7.96333 7,46944 21 15.41502 14.02916 12.82115 11.76408 10.83553 10.01680 7.02475 6.62313 6.25933 5.92884 9.29224 8.64869 8.07507 22 15.93692 14.45112 13.16300 12.04158 11.06124 10.20074 9.44243 7.56200 7,10155 6.68696 6.31246 5.97314 8.77154 8.17574 7.64465 7.16951 6.74294 6.35866 601133 23 1644361 14.85684 13.48857 12.30338 11.27219 10.37106 9.58021 888322 8.26643 7.71843 7.22966 6.79206 6.39884 6.04425 24 16.93554 15.24696 13.79864 12.55036 11.46933 10.52876 9.70661 8.98474 8.34814 7.78432 728288 6.83514 6.43377 607263 25 1741315 15.62208 14.09394 12:78336 11.65358 10.67478 9.82258 907704 30 19.60044 17,29203 15.37245 13.76483 12.40904 11.25778 10.27365 8.42174 7,84314 7.32998 6.87293 6.46415 6.09709 942691 8.69379 8.05518 7.49565 7,00266 35 21.48722 18.66461 16.37419 14.49825 12.94767 11.65457 10,566821 6.56598 6.17720 964416 8.85524 8.17550 7.58557 707005 6.61661 6.21534 40 23.11477 19.79277 17.15909 15.04630 13 33171 11.92461 10.75736 977905 8.95105 8.24378 763438 7.10504 6.64178 6.23350 Present Value Tables Present Value of $1 5% 6% 7% 8% 9% 12% 13% 14% 15% 16% 3% 4% 10% 11% 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 2 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.78315 0.76947 0.75614 0.74316 3 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 0.69305 0,67497 0.65752 0.64066 4 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.61332 0.59208 0.57175 0.55229 5 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.54276 0.51937 0.49718 0.47611 6 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0 50663 0.48032 0.45559 0.43233 041044 7 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.42506 0.39964 0.37594 0.35383 8 0.78941 0.73069 067684 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.37616 0.35056 0.32690 0.30503 9 0.76642 0.702.59 0,64461 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.33288 0.30751 0.28426 0.26295 10 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.42241 0.38554 035218 0.32197 0.29459 0.26974 0.24718 0.22668 11 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.26070 0.23662 0.21494 0.19542 12 0.70138 0.62460 0.55684 0.49697 044401 0.39711 0.35553 031863 028584 0.25668 0.23071 0.20756 0.18691 0.16846 13 0.68095 0.60057 0.53032 0.46884 041496 0.36770 0.32618 0.28966 0.25751 0.22917 0.20416 0.18207 0.16253 0.14523 14 0.66112 0.57748 0.50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0,20462 0.18068 0.15971 0.14133 0.12520 15 0.64186 0.55526 0.48102 041727 0.36245 031524 0.27454 0.23939 020900 0.18270 0.15989 0.14010 0.12289 0 10793 16 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0,18829 0.16312 0.14150 0.12289 0.10686 0.09304 17 0.60502 0.51337 043630 037136 031657 0.27027 023107 0.19784 0.16963 0.14564 0.12522 0.10780 0.09293 0.08021 18 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.11081 0.09456 0.08081 0.06914 19 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.09806 0.08295 0.07027 0.05961 20 0.55368 0.45639 0.37689 0.31180 0.25842 021455 0.17843 0.14864 0.12403 0.10367 0.08678 0.07276 0.06110 0.05139 21 0.53755 0.43883 0.35894 0.29416 0.24151 0.19866 0.16370 0.13513 0.11174 0.09256 0.07680 0.06383 0.05313 0.04430 22 052189 042196 0.34185 0.27751 0.22571 0.18394 0.15018 012285 0.10067 0.08264 0.06796 0.05599 0.04620 0,03819 23 0.50669 0.40573 0.32557 0.26180 0.21095 0.17032 0.13778 0.11168 0.09069 0.07379 0.06014 0.04911 0.04017 0.03292 24 0.49193 0.39012 0.31007 0.24698 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 0.05323 0.04308 0.03493 0.02838 25 047761 0.37512 0.29530 0.23300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 0.03038 0.02447 30 0.41199 030832 0.23138 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 0.02557 0.01963 0.01510 001165 35 0.35538 025342 0.18129 0.13011 0.09366 0.06763 0.04899 0.03558 0.02592 0.01894 0.01388 0.01019 0.00751 0.00555 40 0.30656 020829 0.14205 0.09722 0.06678 0.04603 0.03184 0.02209 0.01538 0.01075 0.00753 0.00529 0.00373 0.00264 Present Value of Ordinary Annuity of S1 3% 4% 5% 6% 10% 13% T 0.97087 7% 8% 9% 11% 12% 15% 16% 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.88496 0.87719 0.86957 0.86207 2 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.66810 1.64666 1.62571 1.60523 3 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710 2.53129 2.48685 2.44371 2.40183 2.36115 2.32163 2.28323 224589 4 3,71710 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16987 3.10245 3.03735 2.97447 2.91371 2,85498 2.79818 5 4.57971 4.45182 4.32948 4.21236 4,10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.51723 3.43308 3.35216 3.27429 6 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.99755 3.88867 3.78448 3.68474 7 6.23028 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.42261 4.28830 4.16042 4.03857 8 7.01969 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.79877 4.63886 4.48732 4.34359 9 7,78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 5.13166 4.94637 4.77158 4.60654 10 8.53020 8.11090 7.72173 7.36009 7,02358 6.71008 6.41766 6.14457 5.88923 5.65022 542624 5.21612 5.01877 4.83323 11 9.25262 8,76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.68694 5.45273 5.23371 5.02864 12 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.91765 5.66029 5.42062 5.19711 13 10.63496 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 642355 6.12181 5.84236 5.58315 5.34233 14 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 6.30249 6.00207 5.72448 5.46753 15 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 6,46238 6.14217 5.84737 5.57546 16 12 56110 11.65230 10.83777 10 10590 9,44665 8.85137 8.31256 7.82371 7.37916 6.97399 6.60388 6.26506 5.95423 5.66850 17 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7,54879 7.11963 6.72909 6.37286 6.04716 5,74870 18 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.83991 6.46742 6.12797 5.81785 19 14.32380 13.13394 12.08532 11.15812 10.33560 9.60360 8.95011 8.36492 7,83929 7.36578 6.93797 6.55037 6.19823 5.87746 9.81815 20 14.87747 13.59033 12.46221 11.46992 10.59401 9.12855 8.51356 6.25933 5.92884 7.96333 7.46944 7.02475 6.62313 8.64869 8.07507 7-56200 7.10155 6.68696 6.31246 5.97314 21 15.41502 14,02916 12.82115 11.76408 10.83553 10.01680 9.29224 9.44243 22 15.93692 14.45112 13.16300 12.04158 11.06124 10.20074 8.77154 8.17574 6.74294 7.64465 7.16951 6.35866 601133 9.58021 8.88322 8.26643 7.71843 7.22966 6.79206 23 16.44361 14.85684 13.48857 12.30338 11.27219 10.37106 6.39884 6.04425 9.70661 24 16.93554 15.24696 13.79864 12.55036 11.46933 10.52876 8.98474 8.34814 7.78432 7.28288 6.83514 6.43377 6.07263 9.82258 9.07704 25 17.41315 15.62208 14.09394 12.78336 11.65358 10.67478 8.42174 7.84314 7.32998 6.87293 6.46415 6.09709 9.42691 8,69379 8.05518 7.49565 7.00266 656598 6.17720 30 19.60044 17.29203 15.37245 13.76483 12.40904 11.25778 10.27365 9.64416 8.85524 8.17550 7.58557 7.07005 6.61661 6.21534 35 21 48722 18.66461 16.37419 14.49825 12.94767 11.65457 10 56682 40 23,11477 19.79277 17.15909 15.04630 13,33171 11.92461 10.75736 9.77905 8.95105 8.24378 7.63438 7.10504 6.64178 623350 Question 2 (25 points) On January 1, 2022, Bunk Corporation issued $160,000,00 of 8-year, 9% bonds at a market (effective) interest rate of 12%. Interest on the bonds is payable on April 30, August 31", and December 31", Bunk's fiscal year is the calendar year. Any discount or premium is amortized using the straight-line method. Required: 1. Prepare a detailed calculation of the present value of the bond using the present value tables on the next page. Do not round the table factors. 2. Prepare a detailed calculation of the price of the bond. Round answer to nearest whole dollar. 3. Prepare the journal entry to record the issuance of the bond. Journal entry description is not required. 4. Prepare the balance sheet presentation of the bond on December 31, 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts