Question: Include all work and logic/steps for this question. Thank you for your help! Problem 5. Consider a three-step binomial model with risk-free return of r--

Include all work and logic/steps for this question. Thank you for your help!

Include all work and logic/steps for this question. Thank you for your help!

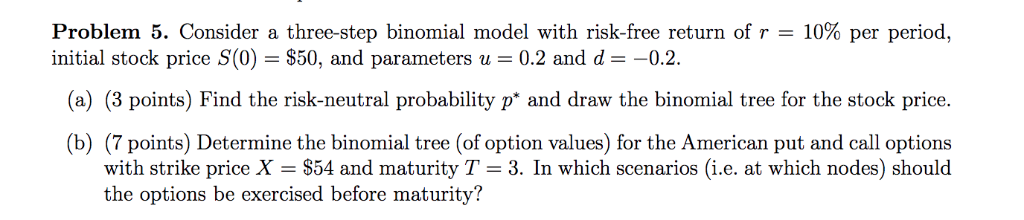

Problem 5. Consider a three-step binomial model with risk-free return of r-- 10% per period, initial stock price S(0) S50, and parameters u 0.2 and d (a) (3 points) Find the risk-neutral probability p' and draw the binomial tree for the stock price. (b) (7 points) Determine the binomial tree (of option values) for the American put and call options with strike price X = $54 and maturity T = 3, In which scenarios (ie, at which nodes) should the options be exercised before maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts