Question: include calculations please a 2. (23 points) DDD Co. leased equipment from EEE on January 1, 2018. EEE purchased the equipment at a cost of

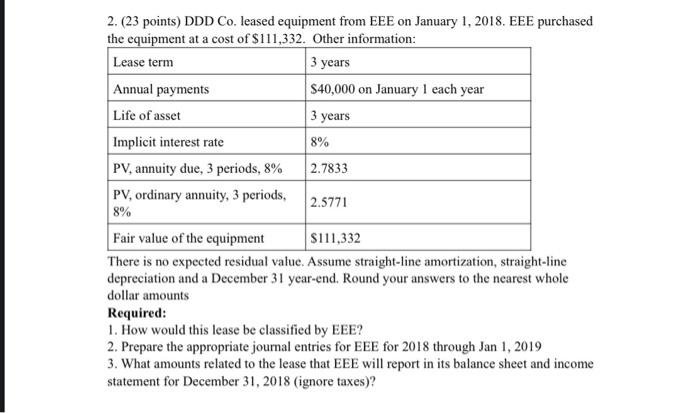

a 2. (23 points) DDD Co. leased equipment from EEE on January 1, 2018. EEE purchased the equipment at a cost of $111,332. Other information: Lease term 3 years Annual payments $40,000 on January 1 each year Life of asset 3 years Implicit interest rate 8% PV, annuity due, 3 periods, 8% 2.7833 PV, ordinary annuity, 3 periods, 2.5771 8% Fair value of the equipment $111,332 There is no expected residual value. Assume straight-line amortization, straight-line depreciation and a December 31 year-end. Round your answers to the nearest whole dollar amounts Required: 1. How would this lease be classified by EEE? 2. Prepare the appropriate journal entries for EEE for 2018 through Jan 1, 2019 3. What amounts related to the lease that EEE will report in its balance sheet and income statement for December 31, 2018 (ignore taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts