Question: include excel formulas Dog Up! Franks is looking at a new sausage system with an installed cost of $385,000. This cost will be depreciated straight-line

include excel formulas

include excel formulas

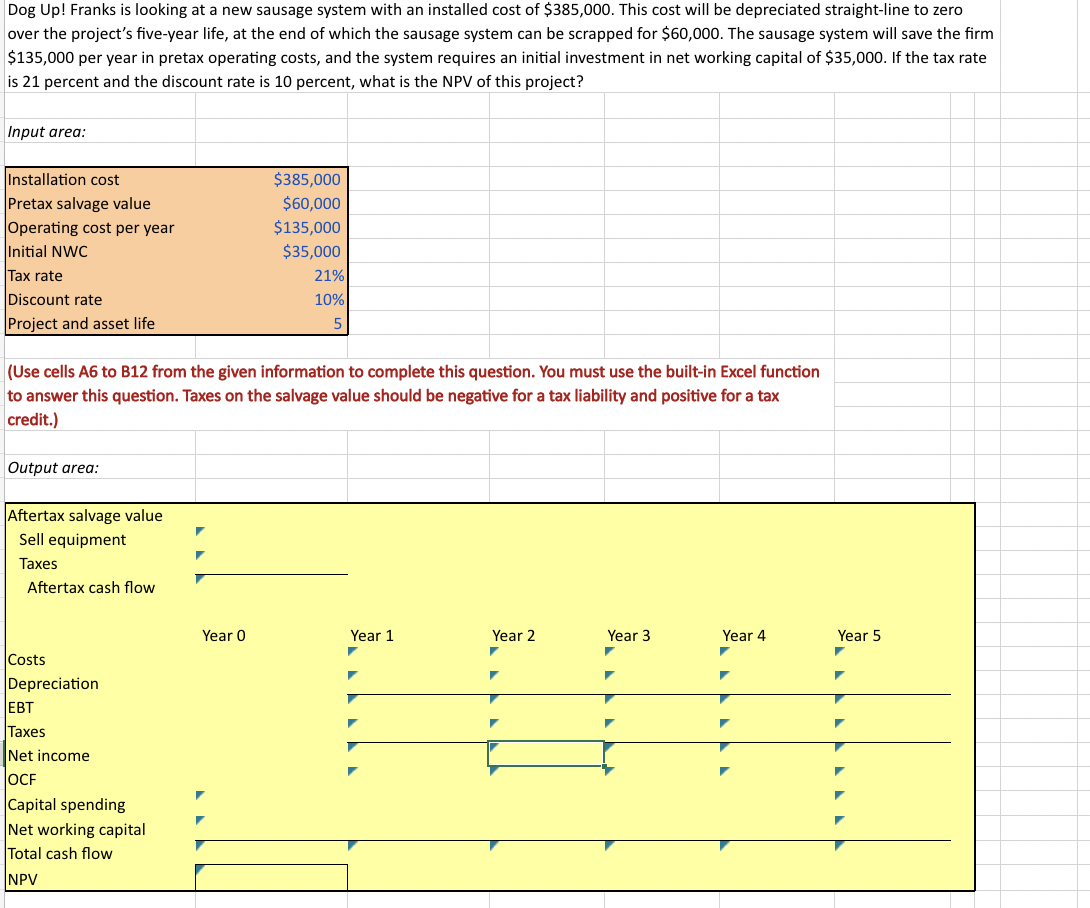

Dog Up! Franks is looking at a new sausage system with an installed cost of $385,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $60,000. The sausage system will save the firm $135,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $35,000. If the tax rate is 21 percent and the discount rate is 10 percent, what is the NPV of this project? Input area: \begin{tabular}{|lr|} \hline Installation cost & $385,000 \\ Pretax salvage value & $60,000 \\ Operating cost per year & $135,000 \\ Initial NWC & $35,000 \\ Tax rate & 21% \\ Discount rate & 10% \\ Project and asset life & 5 \\ \hline \end{tabular} (Use cells A6 to B12 from the given information to complete this question. You must use the built-in Excel function to answer this question. Taxes on the salvage value should be negative for a tax liability and positive for a tax credit.) Output area

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts