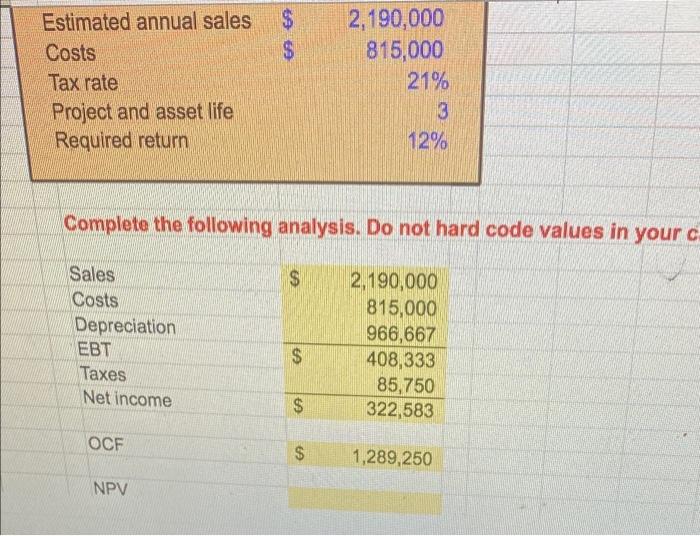

Question: include excel formulas for the missing answers please $ $ Estimated annual sales Costs Tax rate Project and asset life Required return 2,190,000 815,000 21%

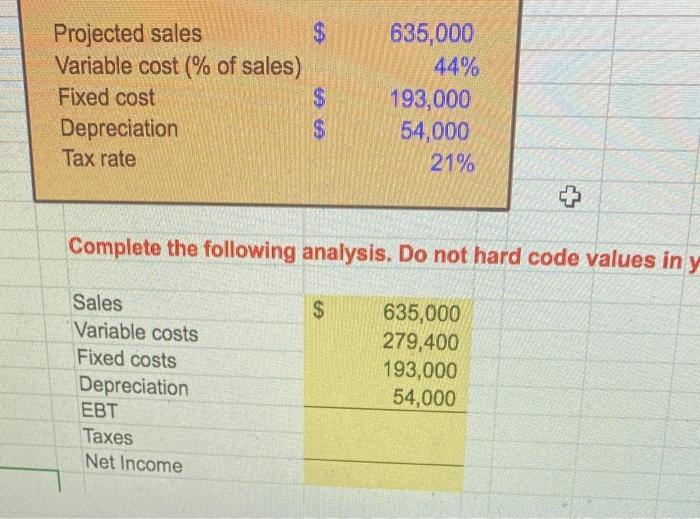

$ $ Estimated annual sales Costs Tax rate Project and asset life Required return 2,190,000 815,000 21% 3 12% Complete the following analysis. Do not hard code values in your c $ CA Sales Costs Depreciation EBT Taxes Net income 2,190,000 815,000 966,667 408,333 85,750 322,583 $ $ OCF $ 1,289,250 NPV $ Projected sales Variable cost (% of sales) Fixed cost $ Depreciation $ Tax rate 635,000 44% 193,000 54,000 21% Complete the following analysis. Do not hard code values in y $ Sales Variable costs Fixed costs Depreciation EBT Taxes Net Income 635,000 279,400 193,000 54,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts